Singapore is known for its well-developed capital markets. With the reputation as the Switzerland of Southeast Asia, there are plenty of investment opportunities for locals and foreigners alike. Stocks, bonds, REITs, and real estate are all standard features of an investment portfolio in Singapore. But do you know that Shophouses can be a great form of real estate investment as well?

In the minds of Singaporeans, real estate usually comes in the form of HDB flats, Executive Condominiums, Private Condominiums, Terraces, Semi-Detached, Good Class Bungalows and the like. On the commercial end, people think of industrial buildings or modern offices. Shophouses might catch the fancy of bystanders and foot traffic, but it seldom comes into investors’ minds when one thinks of real estate. This article will cover 10 main reasons why Shophouses are attractive investment opportunities.

1. The Choice between Residential and Commercial Use

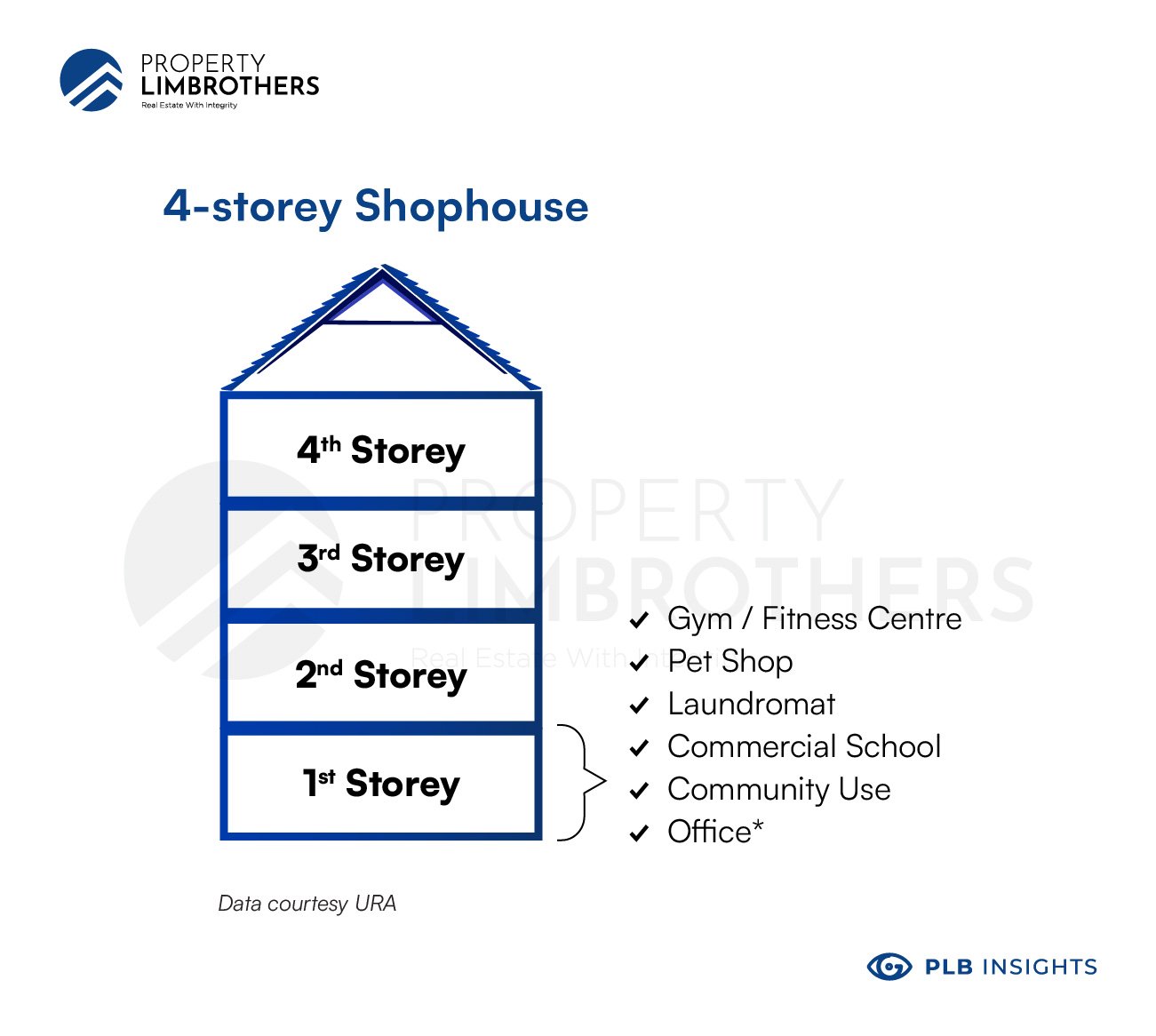

Shophouses are a great form of real estate investment because it gives investors a choice between residential and commercial use. Based on the Shophouses’ colour-coded zoning system, investors can select Shophouses solely for commercial purposes (dark blue) or mixed-use (pink).

Dark blue zoned Shophouses are designated only for commercial use. We may compare these Shophouses to commercial real estate investments such as industrial or office building units. One might even compare REITs to this option. In this aspect, Shophouses are unique. They have character, style, and heritage. We will cover more on these points in the rest of the article.

Pink zones are designated for mixed-use. The commercial areas must not be located above residential areas. You may only use the first floor for commercial purposes. However, if you wish to use pink zoned Shophouses solely for residential use, you will have to get permission from the URA or HDB. Who you get the permission from will depend on whether it is a HDB Shophouse. An important caveat here is that the pink zoned Shophouses have the same limitations to that of a landed property, where foreigners are restricted from purchasing these reserved properties. Foreigners who wish to purchase a Shophouse that consists of a residential component will require an approval from the Land Dealings Approval Unit (LDAU) in order to own these types of Shophouses.

Why is this flexibility in Shophouse usage important? For investors, this is critical. You can choose which group of tenants or future buyers you want to appeal to. From boutique businesses, cafes and restaurants to law firms and family businesses. The commercial demand for Shophouses is there. The same can be said for residential purposes. Shophouse living has graduated from bohemian to a more acceptable choice of home. We cover this in the later section of the New Singaporean Dream House.

This flexibility is most salient to the immediate investor. Real estate is unique in that it provides you with space, a workplace and a home. In the case of Shophouses, investors have the perk to own and use their integrated property. This will be especially true for investors who want to run their own business and keep it close to their personal space, just like the good old days (only now with air conditioning).

We have an article here highlighting the perks of real estate investing in detail. Check it out. https://www.propertylimbrothers.com/insights-posts/7-unique-traits-real-estate-investment

2. Flexibility for Foreigners & Local Property Owners

The flexibility does not just end with the designated usage of Shophouses. It provides financial flexibility for Foreign and Local Investors alike. This section will talk about Additional Buyer’s Stamp Duty (ABSD), Total Debt Servicing Ratio (TDSR), and selling options.

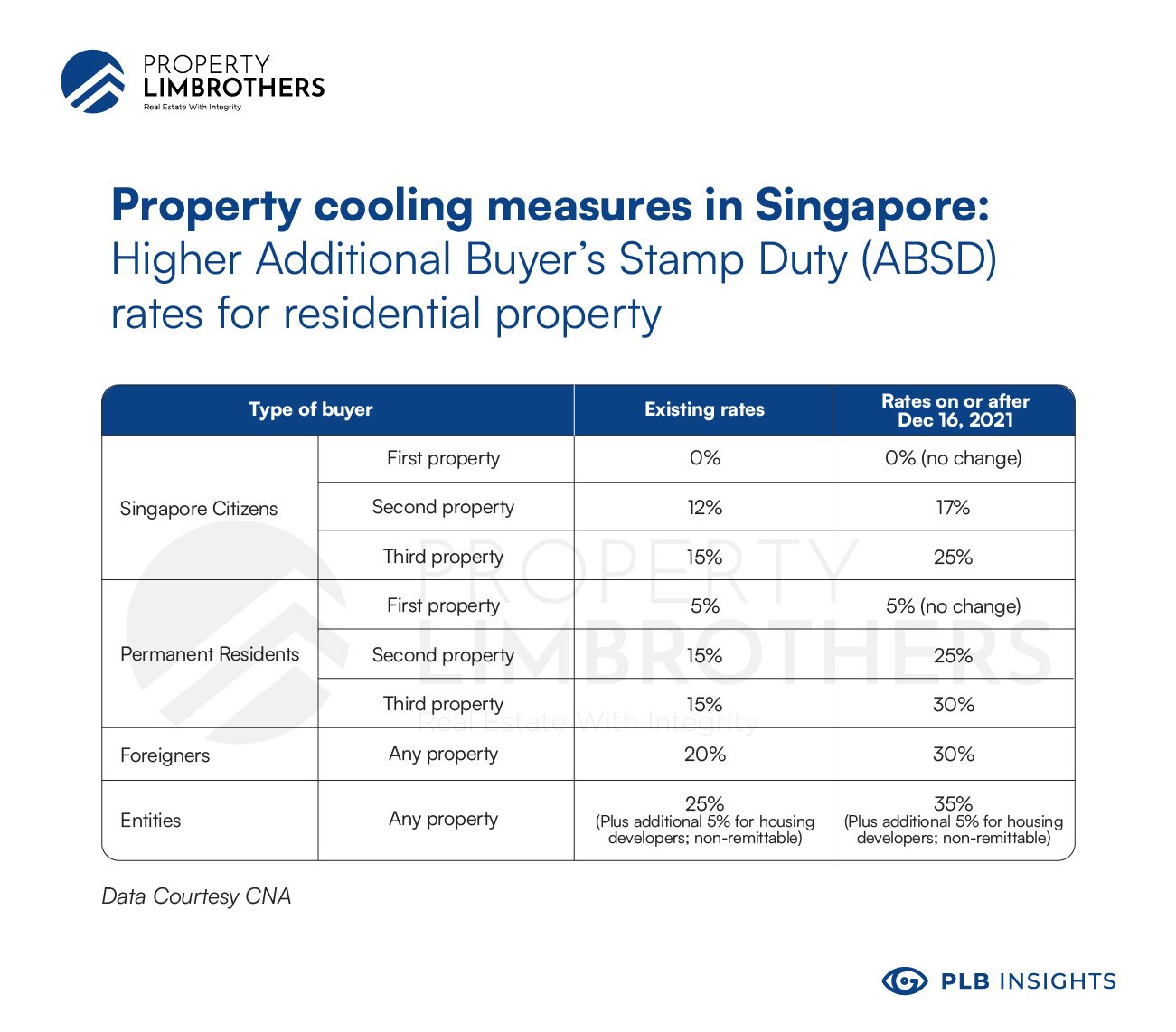

Here is the great news. If you are investing in a full commercial shophouse, ABSD does not apply. ABSD only applies if you are purchasing a Shophouse that is zoned Residential or Residential with Commercial on the 1st Storey. In the case of mixed-use Shophouses, ABSD will be pro-rated based on the area used for residential purposes. This is a huge boon for foreign investors and Locals who are already property owners. With the recent property cooling measures (and any future changes to ABSD, as a matter of fact), this point becomes even more salient. Paying less stamp duty means that you get to keep a larger slice of the pie and enjoy the higher potential for profit upon price appreciation. The difference in ABSD is non-trivial, amounting to S$1.7 million for a property quantum of S$10 million.

Of course, we are comparing commercial Shophouses to residential properties. If Shophouses are mixed-used, the difference in ABSD payable would be slightly mitigated by the commercial component. Again, one important caveat is that pink zoned Shophouses are restrictive for Foreign investors. Only dark blue zoned Shophouses are available as a non-restrictive option for Foreign investors.

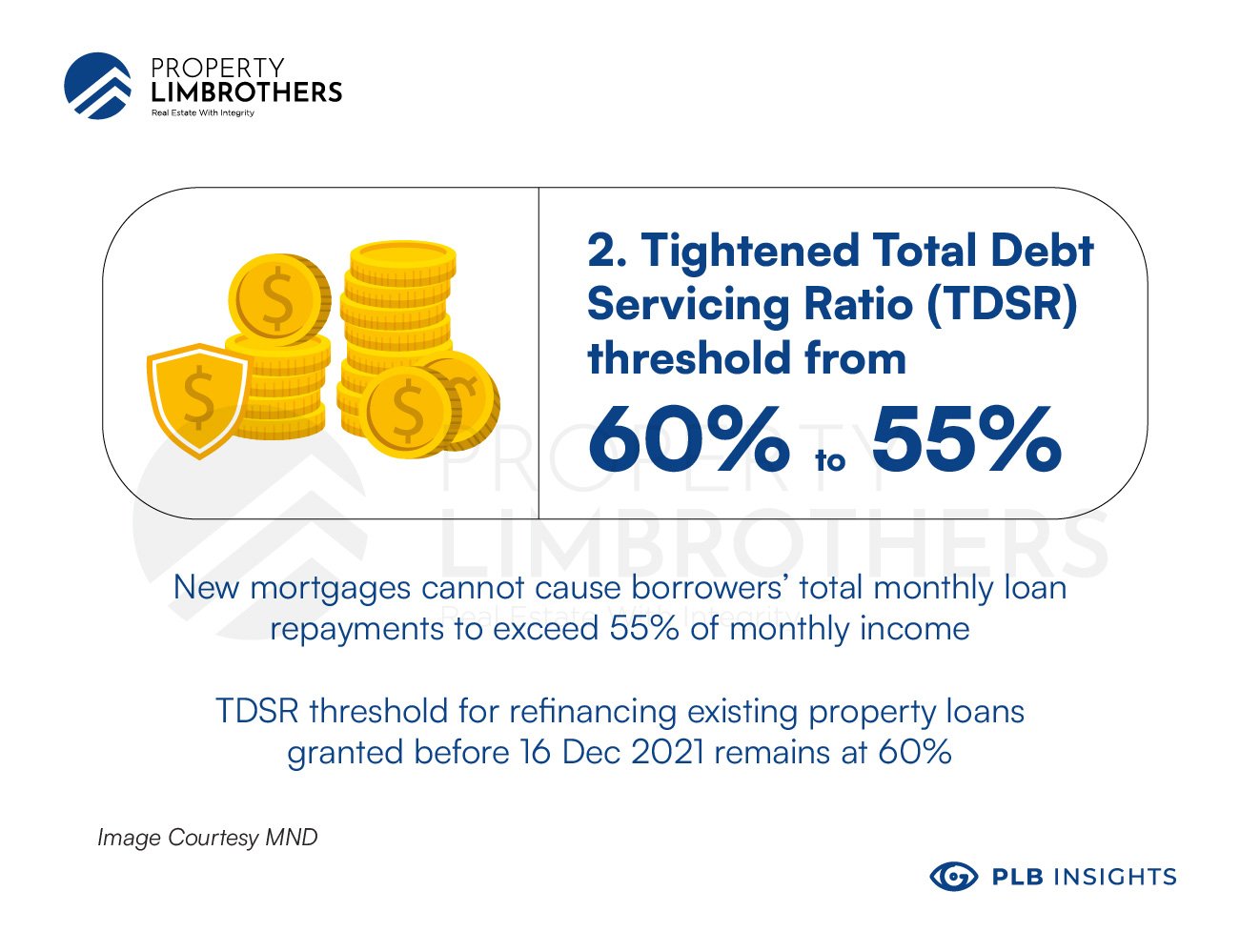

TDSR is another big issue that most investors will face. According to the most recent property cooling measures (Dec 2021), the TDSR is reduced from 60% to 55%. This limits the maximum amount of loan one can take from the bank to finance the property purchase. Unfortunately, this applies to Shophouses whether or not it is used for residential or commercial purposes. This requirement is also slapped on locals and foreigners alike. Even business vehicles set up to hold property are affected by the TDSR.

It is important to understand how TDSR works to best navigate its limitations. Any individual applying for a loan to purchase a property or a loan secured by a property is subject to TDSR rules. It does not apply to loans for companies, as they are subject to a different set of credit assessment criteria. However, if the borrower is a sole proprietor or an individual setting up a company solely to purchase property, Financial Institutions are required to apply the TDSR rules to the individual.

If you already own Singaporean real estate and have not repaid the home loan in full, TDSR guidelines might prevent you from a big home loan for your second property purchase. Back to business ownership, these vehicles can assist in the TDSR calculations if they have large income streams to support the mortgage. Therefore, business owners can leverage what they have built to afford taking up loans for Shophouse purchases. Of course, a proper accountant and financial advice need to be sought if you are seriously considering this route.

Shophouses are Foreigner-friendly. Again, as we have mentioned, dark blue zoned Shophouses are exempt from ABSD when used for commercial purposes. This is juicy news for foreign investors, but it also benefits anyone planning to purchase Shophouses. There is a larger pool of prospective investors when you intend to cash in on capital gains. Because of the appeal to foreign investors, demand is not limited to our people on this small island. Exit opportunities in the form of buyers are plenty.

We cover more on the latest set of cooling measures in December 2021 here:

https://www.propertylimbrothers.com/insights-posts/cooling-measures-comprehensive-guide

3. Relative Scarcity

Our third reason why Shophouses are a good investment is the cornerstone of economic theory. Scarcity. There are only around 6500 conserved Shophouses in Singapore. Unless some time travelling is involved, this number will not increase. Conserved Shophouses are a piece of history as much as it is a piece of real estate. This puts the conserved category of Shophouses into relative scarcity when we compare them to other commercial or residential properties. With occasional new launches, the numbers will keep increasing for conventional real estate. While the growth of the real estate market now is substantial enough to support the growing number of commercial and residential properties, even more so would the static limited number of Shophouses enjoy growth. There will not be any additional conserved Shophouses being built, but there will be plenty of growth opportunities for this class of real estate.

Image Courtesy Home & Decor

Pit against other commercial and residential properties, Shophouses make a unique choice. Even non-conserved Shophouses can hold a candle to conventional real estate choices. Non-conserved Shophouses are still relatively scarce and offer a more down-to-earth, heartland vibe present even today. I hesitate to use the term “Kampong Spirit”. Instead, these Shophouses are “comfort food”. They represent the relatable, the everyday, the mundane but ever-present fixtures to old markets and HDB estates.

4. Benefits of Shophouse Clusters

Speaking of “Kampong Spirit”, the identity of Shophouse clusters matters. Is that area known for nightlife, good food, instagrammable murals? Shophouses across Singapore usually exist in clusters. Each cluster typically has an identity tied to the location and previous businesses in that region. Take for example, Clarke Quay. Shophouses in this area are known for their nightlife, bars and restaurants. Here, foot traffic is more scarce in the day than at night. This is just one example. Other Shophouse clusters could have more activity in the day than at night.

Image Courtesy CapitaLand

This identity tells us the types of businesses the cluster is known for. People and foot traffic would predominantly frequent the area for those reasons. Should you be a savvy and prospective investor, you would know that those kinds of businesses are likely your future tenants. On the other hand, if you plan on using the Shophouse investment for your own business, do pick an area that synergises with it. Understanding this would give you more awareness and potentially the kind of tenants and customers that you want.

Identity aside, another benefit of Shophouse clusters is the agglomeration effect. Businesses that complement each other cluster together. The close proximity of these complementary businesses leads to economies of scale. Even if the businesses are competing, there might still be an overall positive impact because agglomerating or clustering together attracts more customers and suppliers than one business can achieve on its own. Therefore, if you intend to invest in Shophouses for your own business, pick your clusters wisely and ensure they are in a related industry or complement each other.

Image Courtesy The Ordinary Patrons

The last important benefit of Shophouse clusters is the superstar effect. A superstar business within a Shophouse cluster can bring many customers and businesses into the area. There would be a positive spillover onto nearby businesses as they get to enjoy more foot traffic and media attention. While this may not be beneficial for businesses who compete with the superstar, other complements or even unrelated businesses may benefit from the spillover fame.

5. Accessibility & Attention

An obvious benefit that some investors might miss is the difference in foot traffic between Shophouses and conventional commercial rental sites. Let us compare a rental site within a shopping mall and a Shophouse. While both sites have a storefront, Shophouses have more eyes, foot, and street traffic. Storefronts enclosed within a shopping mall or office building have restricted views. For Shophouses, their storefronts also act as a billboard for people driving by or crossing the street. Moreover, Shophouses are usually found in clusters that are not built-up areas. Shophouse storefronts are more prominent, accessible, and attract more attention than conventional peers.

What’s more, Shophouses have access to direct foot traffic that is not limited to an enclosed space. Even if the walking area or street is not an air-conditioned space, people still travel. This, coupled with the benefits of clusters, makes Shophouses attractive to bystanders’ eyes. Furthermore, most Shophouse clusters are centrally located, making them highly accessible to Singaporeans all over the island.

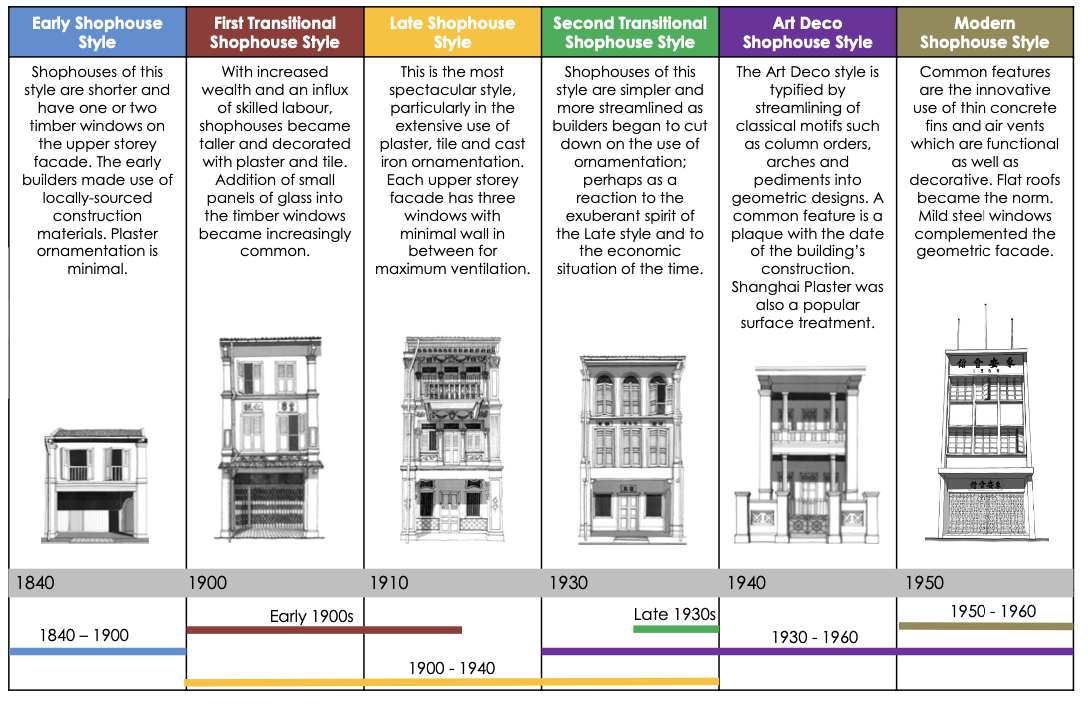

6. Architectural Heritage

When you invest in Shophouses, you also invest in Singapore’s architectural heritage. This factor should not be discounted. Would you invest in a commercial estate which has a dull and oppressive concrete face? Perhaps, if you are running a manufacturing line or intend to spend a huge sum of money on renovations. If you look at it from an economic point of view, the beauty of Shophouses is built-in. You need not go through the tedious process of finding designers and contractors to overhaul the place. This could easily save you a big sum, focusing on using the rest of your capital for better purposes.

Image Courtesy URA

In “The Architecture of Happiness”, the importance of beauty is discussed and demonstrated. Each architectural style has a “vibe”, in common speak, it affects the atmosphere as much as Christmas or Chinese New Year-themed songs. This vibe affects the experience and social psychology of us humans. From Simple Modern to Art Deco, each architectural form leaves its viewers with an impression that shapes their experiences and interactions within that space.

The age of Instagram ushers with it a renewed obsession with aesthetics. You might think that aesthetics is just a side point, but businesses can be built on the foundations of being “Instagrammable”. Architecture is the instagrammability of your storefront. It either catches the eyes of people, or it doesn’t. It has the potential to stop people in their tracks, double-take, and perhaps make a U-turn for a short visit.

We cover more on the architecture of Shophouses in another article here:

7. Relative Performance to Condominiums & Commercial Properties

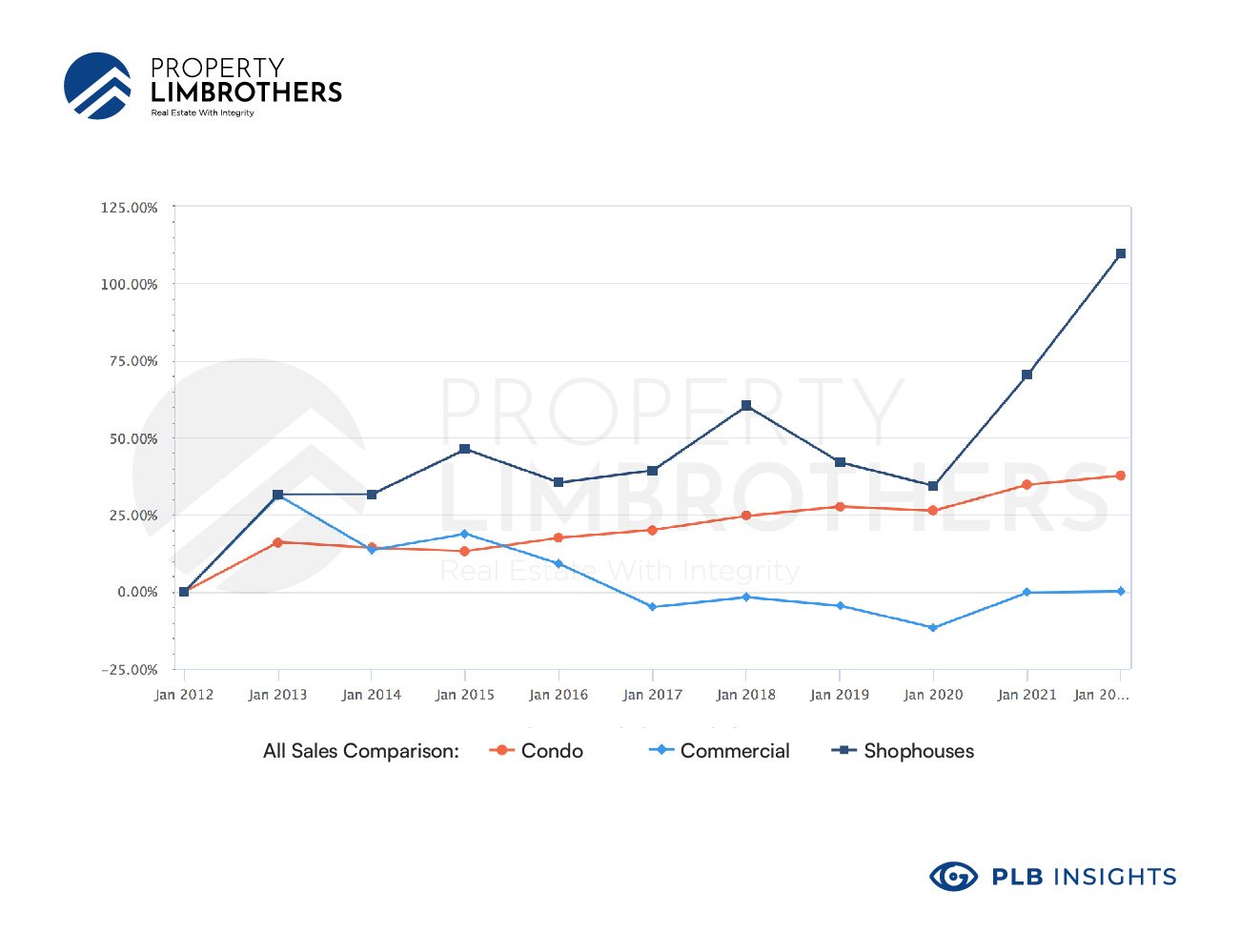

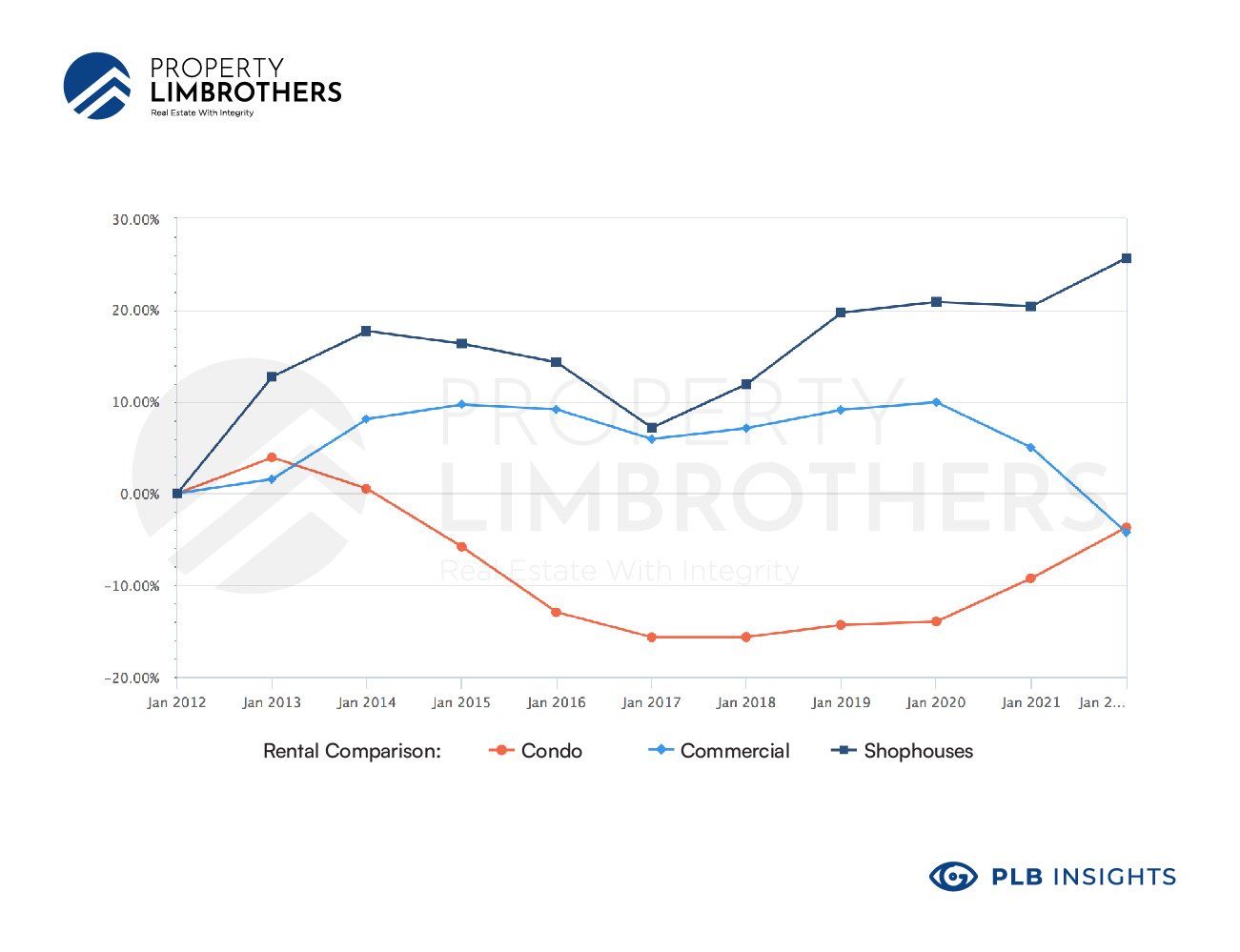

We now compare the relative performance between private condominiums (orange), commercial properties (blue) and Shophouses (black). Using the past decade’s data, from 2012 to 2021, we use 2012 as the starting point for yearly percentage difference. Looking at all sales and rental comparisons, Shophouses outperformed private condominiums and commercial properties in the past decade and by a significant margin.

Figure 1: All Sales comparison with 2012 as base.

Figure 2: Rental comparison with 2012 as base.

Shophouses have stood out and shown their resilience throughout the COVID-19 crisis, with sales and rentals soaring over the past 3 years. This is simple descriptive data on the sales and rental performance of Shophouses and is not indicative of future performance. Nonetheless, the past decade has shown that Shophouses are in a league of their own, maintaining a solid margin ahead of private condominiums and commercial properties.

8. The New Singaporean Dream House

Beyond being hip, Shophouses are fast becoming the new Singaporean Dream House, especially among younger millennials. Being tired of cookie-cutter homes and becoming more affluent gives rise to the demand for more unique homes. A trend is currently emerging in the co-living and rental space where living in Shophouses is becoming more popular.

Image Courtesy Robb Report Singapore

Shophouses also tend to be near central areas, cafes, restaurants, bars. Compared to cookie-cutter options, the gentrified Shophouse areas provide amenities and social life of a different form. Life will be different. The views, exiting the front door, daily routines, morning runs will all be different. It is this unique lifestyle that gives Shophouses its allure. Investors might want a taste of this before leaving it in the hands of tenants.

9. Living Landed in the Central

While we are on the topic of living and lifestyle, a natural comparison that comes to mind is landed property. After all, if you plan on using your Shophouse investment for residential purposes, landed properties are a close relative. A key difference when we make this comparison is that landed properties are typically in a residential area. Landed property locations are much less central than Shophouses, with fewer amenities and food options nearby.

Image Courtesy PropertyGuru

Furthermore, landed properties do not possess the same mixed-use flexibility as Shophouses. Building on our previous points, landed properties with its restrictive nature to foreigners pose a higher barrier to entry. When looking for buyers for your property in the future, Shophouses would give you less of a hard time because of the wider range of buying audiences.

10. Singapore’s Push for a Cultural Renaissance

Singapore has long desired to be the art capital of Southeast Asia. Since 2000, the Renaissance City Plan was implemented to increase the appreciation of arts and culture in Singapore. Now, 22 years on, we have indeed seen greater appreciation for the arts in Singapore, with events and festivals garnering a strong support base. While much less tangible, this might translate to a better appreciation for heritage houses.

Image Courtesy Civil Service College

Conservation Shophouses in Singapore hold an important aspect of our colonial history. And this history cannot be removed from the property itself. Moving forward, these Shophouses aren’t getting younger. But with Singaporeans treasuring this history, we can expect Shophouses to continue to be special and enjoy good capital appreciation over time.

Concluding Thoughts

If you have made it this far by reading, kudos to you. Even if you haven’t, no matter, we will now give you a summary of what we have covered in this long article. Here are our 10 reasons why Shophouses are a good investment:

-

The Choice between Residential and Commercial Use

-

Flexibility for Foreigners & Local Property Owners

-

Relative Scarcity

-

Benefits of Shophouse Clusters

-

Accessibility & Attention

-

Architectural Heritage

-

Relative Performance to Condominiums & Commercial Properties

-

The New Singaporean Dream House

-

Living Landed in the Central

-

Singapore’s Push for a Cultural Renaissance

We surmise that Shophouses remain a unique class of real estate in Singapore that offers investors a high degree of flexibility. It is a great investment for capital preservation with one of the best performing real estate assets in terms of capital appreciation. Our points on scarcity, accessibility, clusters and heritage support this conclusion. We also expect modestly better performance compared to comparable conventional properties. Last but not least, the living experience and lifestyle is something that an investor should have a taste of before handing over the keys.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.

PLB On Telegram

Home tours and property news — straight to your device.

Insights On Telegram

Fresh articles, market trends and news — right to your device.

Subscribe to our YouTube Channel

PLB Newsletter

Stay up to date with the latest property news and development

The PLB Seller Experience