In the land of condominiums, the first-hand owner is king. But between Executive Condominiums (ECs) and Private Condominiums (condos), who is the winner? ECs are typically found in the Outside Central Region (OCR), as an option for aspiring homeowners with income levels that sandwich them between buying a HDB or a Condo. The location for ECs might be less than ideal when compared to condos which are able to get more accessible and prime land plots.

Some of you might already have an intuitive answer in mind. “Of course, ECs will win.” You might be right. But we won’t know for sure why, and how right you are before looking at some numbers. Technically speaking, even though they are both termed as “condominiums”, they are considerably different property classes. You can say it’s like comparing green and red apples. They have the same shape but taste completely different.

ECs are subsidised housing that fall under the policy guidance of HDB. While EC owners enjoy subsidies and grants, they are subjected to a 5 year Minimum Occupancy Period (MOP) where they are not allowed to sell the property. On the other hand, condos are private property with no income limit restrictions, no subsidies and grants, and only the Temporary Occupation Permit (TOP) and Seller Stamp Duty (SSD) as limitations to owners.

We take a deep dive into ECs and why they plateau in this other article: https://www.propertylimbrothers.com/insights-posts/why-are-shophouses-a-good-investment

In this article, we will instead be laser-focused on the comparison between ECs and condos in the OCR. We will cover who actually benefits the most between ECs and condos, and why that may be the case.

Capital Gains for Whom?

Who Makes More Capital Gains in OCR? This question can be interpreted two ways. A good answer to the question of whether ECs or condos make more capital gains have to take into consideration the types of owners we are talking about. Talking about the capital appreciation of property itself is limited in its usefulness. Capital appreciation for whom? Who is the literal person that benefits from this? We believe that is also an important question.

For the sake of brevity, we consider 2 waves of buyers. For ECs, the first home owner will typically hold it for 9 years: 4 years for TOP and another 5 years for MOP. The second wave of buyers for resale ECs may vary in terms of holding period because some might be investing while others are staying for good. We can consider the minimum holding period to be 3 years in order to avoid SSD, but we will compare the first and second wave by assuming they both hold the property for an average of 9 years.

For condos on the other hand, MOP does not apply. The first owner of a condo might look to sell the condo after TOP, around 4 years of waiting. By then, SSD would no longer apply since the 3 year period is over. Again, we will have a variety of different kinds of investors. Some that intend to keep the property for rental yield and some for a short-term investment. Theoretically, holding property as an asset class around 5-10 years is considered normal. This is to ride out market crises or property cycles. We compare the first and second wave for condo buyers by assuming they both hold the property for an average of 9 years. This will make for an easier comparison with the above EC groups.

Here the time period we chose, 2015 to 2022, is used as a fixed reference point such that all the ECs and condos in the pool experience the same market conditions. The trade-off and caveat here is that our first and second wave samples consist of different properties. Averaged out across all the 9 year period, we assume that there is no groundbreaking difference between the properties developed in two different time frames. This is an important step to take because market conditions play a huge role in affecting the price, more so than the differences between the two samples. In our previous article on ECs, we explain how market conditions can lead us to jumping to the wrong conclusions. This comparison is designed to prevent that.

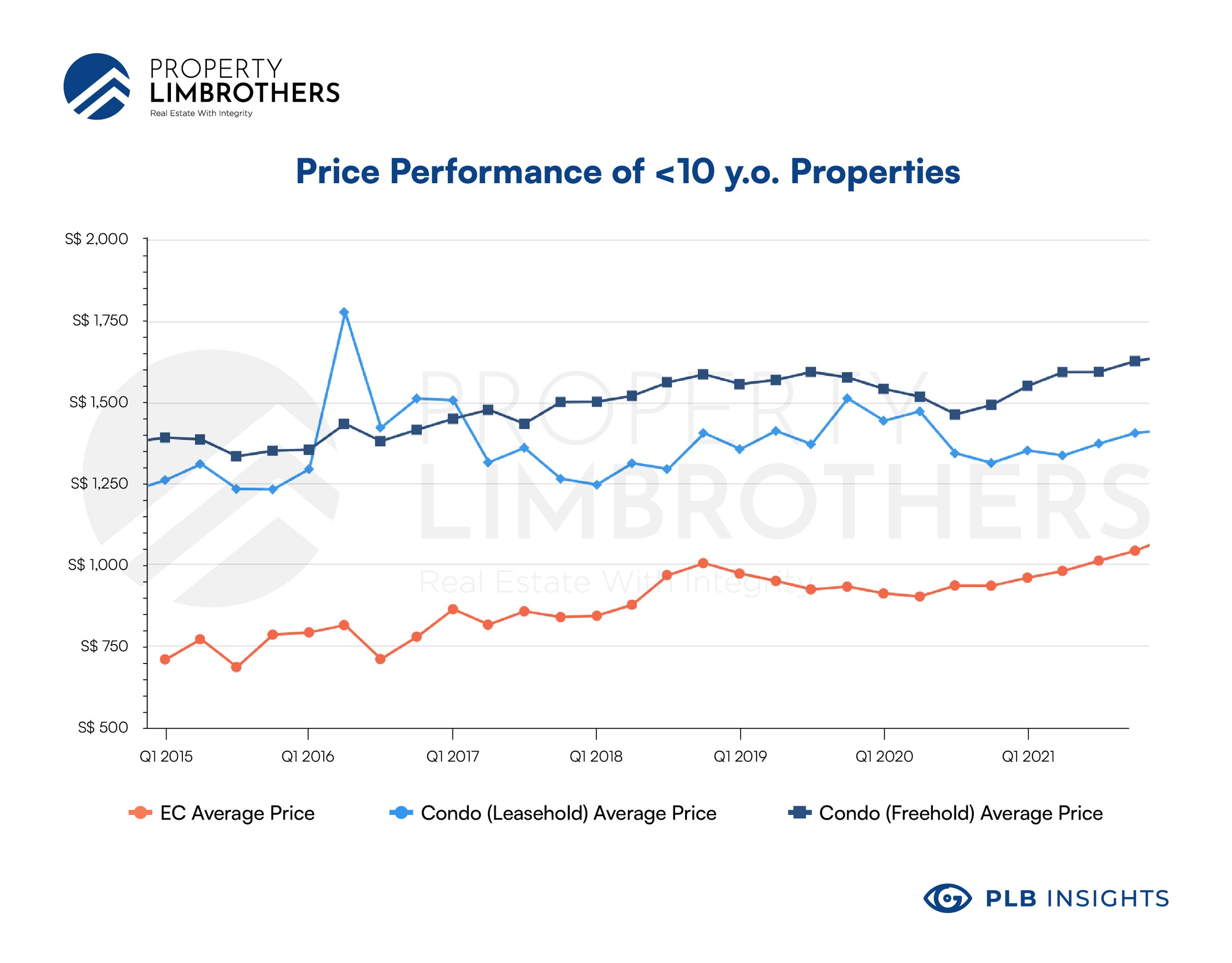

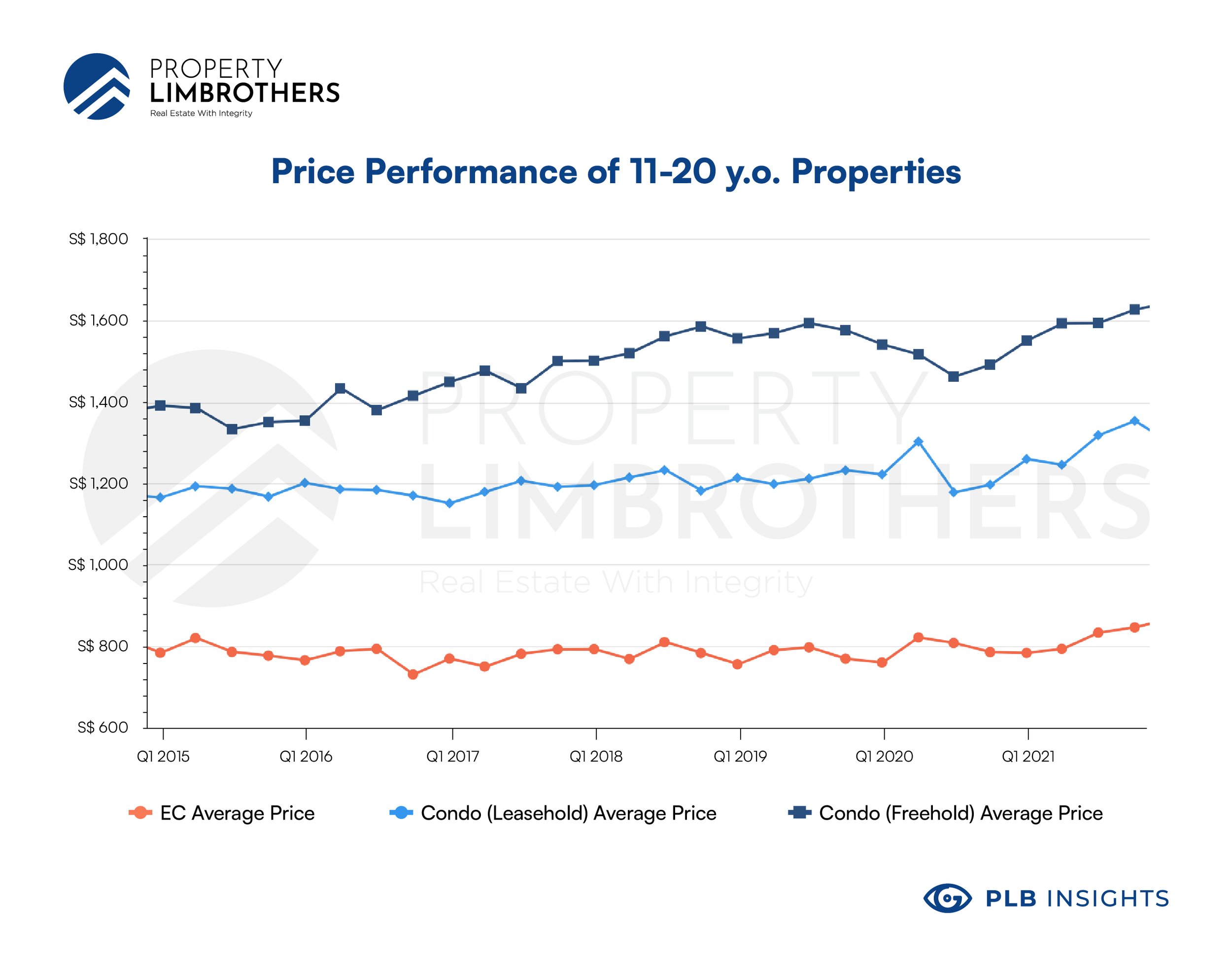

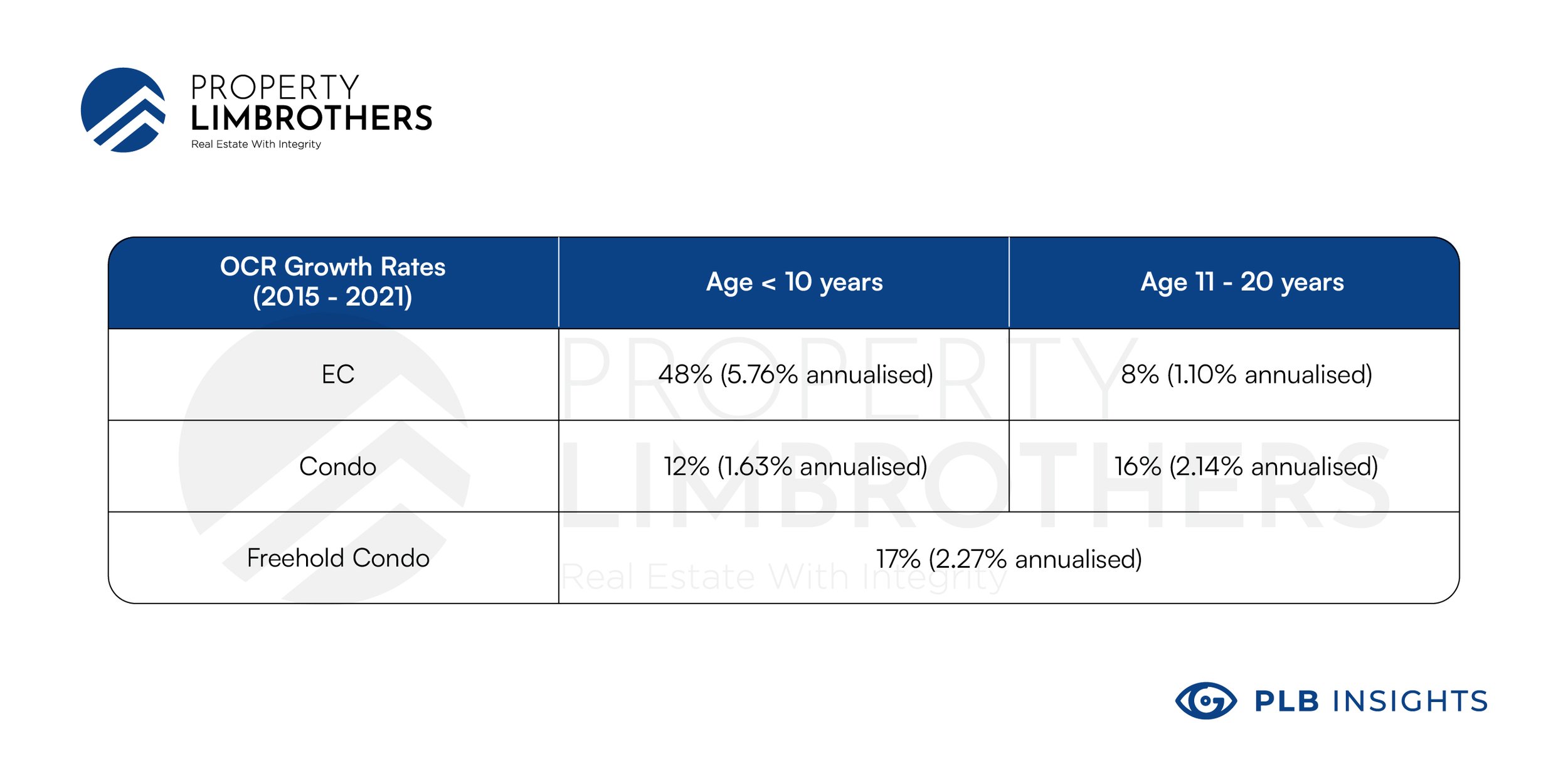

From this summary table, we can clearly see how the pie is sliced. Freehold Condos are included as a reference point because they have no lease, the different buyer groups are not that disadvantaged. We use freehold condos of all ages to get the average effect.

In the land of condominiums, the first-hand owner is king (at least for ECs). Going back to this starting line, we can see why this is the case. For ECs, sales for properties aged younger than 10 years enjoy substantially higher growth rates (5.76%) than their older counterparts (1.10%). A bigger piece of the pie is taken by the first owner, or for owners who sell before 10 years. This is especially true for ECs. For Condos, however, it would not hurt to hold. There is a slight growth in appreciation for older Condos (2.14%) than for younger ones (1.63%). All this is given similar market conditions.

So… Who Wins? ECs or Condos?

In the land of OCR, the EC is king. For those of you who thought the same, you’re right. EC wins. The reason being is the lower psf that ECs start with, this gives much more room for capital appreciation upwards. When a property bull market hits, and demand is high, we see the price gap between ECs and condos likely to close. Even though ECs are considered a different property class due to their subsidised nature, once they pass the MOP, they are close comparables to condos on the resale market.

Nonetheless, the advantage that ECs have over condos dwindles surprisingly fast. So don’t celebrate too early. If you intend to sell past the 10 year mark, the growth rate for ECs are likely to be muted and much closer to their condo counterparts. In this scenario, that is where freehold condos shine, with a much better performance than ECs (at 29% rather than a measly 4%).

Closing Thoughts

To sum up, ECs are better than condos if you intend to sell early. However, if you’re in it for the long game, freehold condos might be a better option to preserve and grow your capital. If you are not a seller but instead planning to buy a property in the OCR in the near future, consider buying new launches rather than resale if possible. This will allow you to have a larger slice of the capital gains from the property growth.

If you wish to have deeper insights into your own property situation, our experts would love to get in touch and help you out here.