In Singapore, we hear endless complaints about how expensive everything is. Especially property. Thanks to HDB flats, most Singaporeans are actually able to afford living in this expensive city. Recently, lowering the HDB eligibility rate has been the talk of the town. We have previously discussed what might happen if such a policy were to be put in place.

Having a place to call your own is a deeply personal matter. It is a major aspiration and milestone for youths who are adulting. In Singapore, we joke about how BTO applications are substituting romantic proposals. It is no longer a secret nor unconventional for people to plan their property journeys on the assumption of marriage. In other places, it is usually the other way around. Cohabitation before marriage is the norm in most western contexts.

The truth of the matter is that there are social groups falling through the cracks. Not everyone can afford to buy property in Singapore. In this article, we focus on singles and couples who do not intend or plan to get married. We hope that this article will give you a better perspective on the possible decisions you could make on your housing situation.

1. Assessing Income Situation & Eligibility for Public Housing

Image courtesy Dreamstime

The first step in exploring your housing options is to take a look at your eligibility for public housing and your income situation. As of now, the eligible age to buy a HDB (BTO/Resale) as a single is 35. However, in certain circumstances where your parents (Singaporeans) do not own any property, you may apply for public housing options. We will focus the discussion on singles and couples who do not plan to get married from ages 21-34. We then dedicate a final section to whether public housing is a good choice after turning 35.

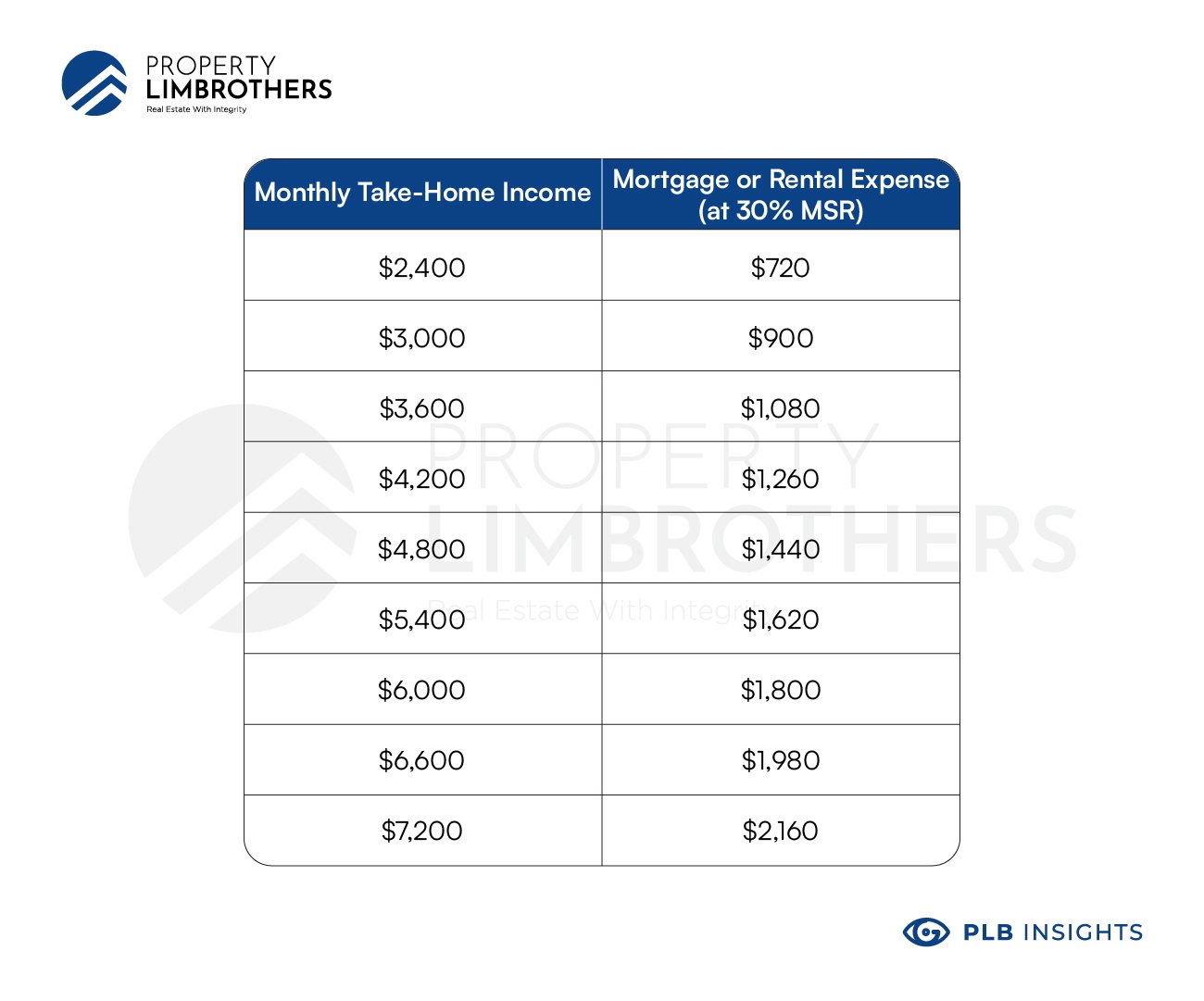

If you are 21-34 years old and looking to get your own place, first consider the options that are affordable for you. This would help to ensure that your housing decisions do not jeopardise your future finances. What is ideally “affordable” would be to keep your mortgage or rental payments within the 30% Mortgage Servicing Ratio (MSR). For your personal finances, your fixed expenses (including rent, mortgage, credit card bills, insurance, family contribution, utilities, phone bills and subscriptions, etc) should not exceed 55% of your income.

This would give you breathing space to plan for your future options and eventual retirement but also leave some of your income for you to enjoy. Housing is a huge decision in personal finances. It can easily take up 30-50% of your income. You should really ask yourself if the decisions you are making are in your best interest for your present and future self.

Here is a rough guideline on what you could comfortably afford based on these income levels:

2. Renting as a Long Term Solution?

In Singapore, renting is often frowned upon. It is commonly viewed as an unnecessary expense or money that could have been better off invested. Perhaps this is because most Singaporeans often live with their parents until they are married. Or that parents could not bear to see their children leave their household on a whim. Nonetheless, we have to acknowledge that there’s more to it than meets the eye.

The pandemic only made what was already present more obvious. Many start to realise that they do not have an ideal environment for work or their personal lives. Renting is a legitimate solution if you plan it in the larger context of the entire property journey. Rent makes housing affordable. Especially for people who are still saving up to own a place. It takes time to build up capital for the property down payment. We shouldn’t be too extreme in hoarding cash solely for this purpose at the expense of other aspects of our lives. That being said, your rent and expenses shouldn’t be so high as to jeopardise your future property plans.

When deciding to rent, the trade-off is primarily between having your own space and capital accumulation. Understandably, when people move out they like to experience an increase in the standard of living and quality of life. Not the reverse. Unfortunately, such an improvement in lifestyle will be expensive. Renting out the entire unit of a decently located property will not be cheap. The reality of renting sometimes includes less-than-ideal housemates, rundown apartments, and terrible landlords. But it doesn’t have to be that way.

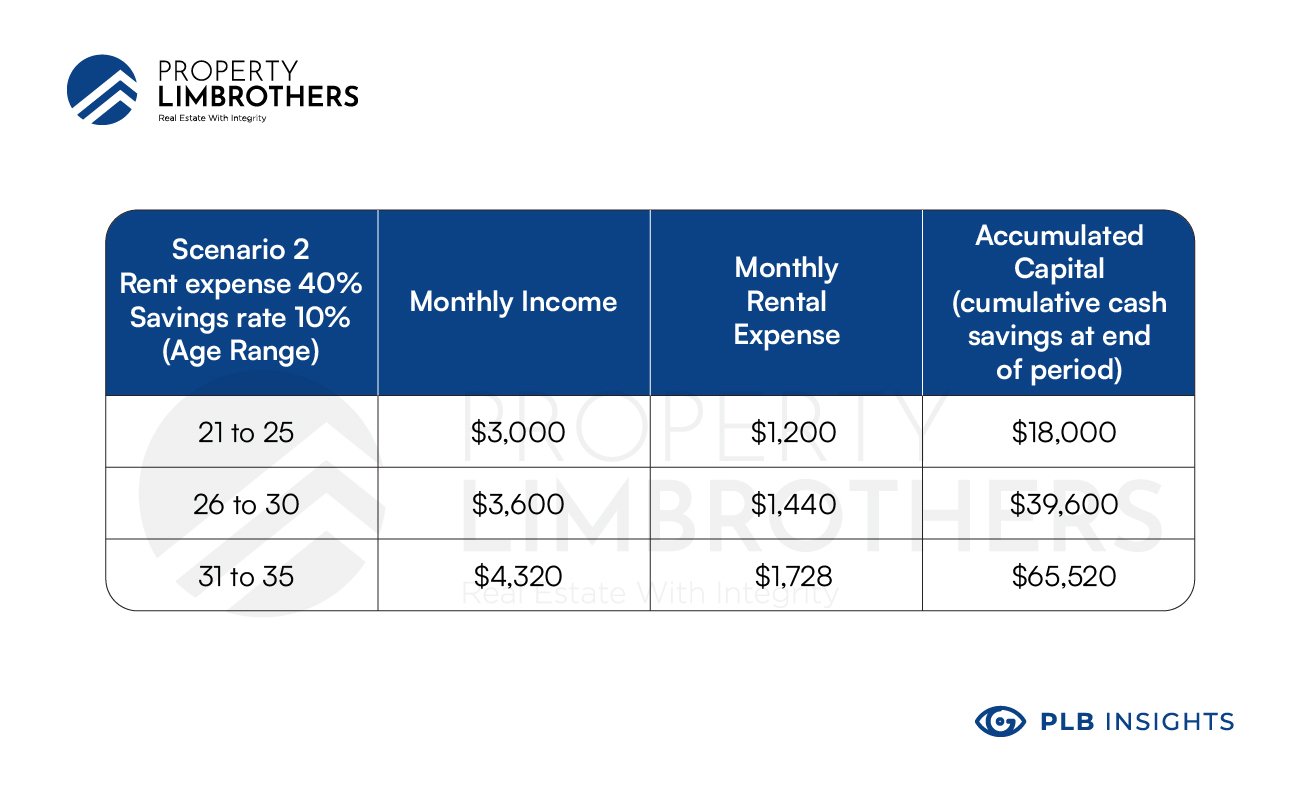

Renting as a long term solution is valid, but only with careful financial planning. We use two scenarios to demonstrate. The first scenario, we will have a rental expense of 25% of total income. A prudent amount expended for rent and a savings rate of 25% (The Singaporean average is 40%). In the second scenario, we will have a rental expense of 40% of total income and a savings rate of 10%. We assume that the other 50% of income in both scenarios are used to pay the bills and personal daily expenses. In both scenarios, we assume that the person earns the Singaporean median income of ~S$3,000 and has a pay raise of 20% every 5 years (simple inflation). The rent and savings also increase in their respective proportions.

Do note that with rental expenses, your savings rate will fall below the Singaporean national average of 40%. This is the reason why most Singaporean households are against renting. However, it is hard to put a price tag on the value and quality of life one would have when they have their own place. We leave this debate to the discretion of the reader’s wisdom. Looking at the two different scenarios, one can ask themselves if it is a financial situation they are comfortable with having. In both scenarios, the accumulated capital is assumed to be kept in cash with 0% interest returns. Of course, in reality it is ideal if you prudently invest this sum such that it is not idle capital sitting there getting eaten away by inflation.

Look at how much difference there is between the two scenarios over the course of 15 years. The difference between the two is 15% in rental expense and savings rate. The trade-off is clear. You get more space (depending on location, 1 additional room or the whole of a small apartment) but the amount that you save would be less than half (163K vs 65K). This is a super conservative estimate. The actual difference would be much larger due to the effects of inflation, investment returns on capital, and rising rental prices.

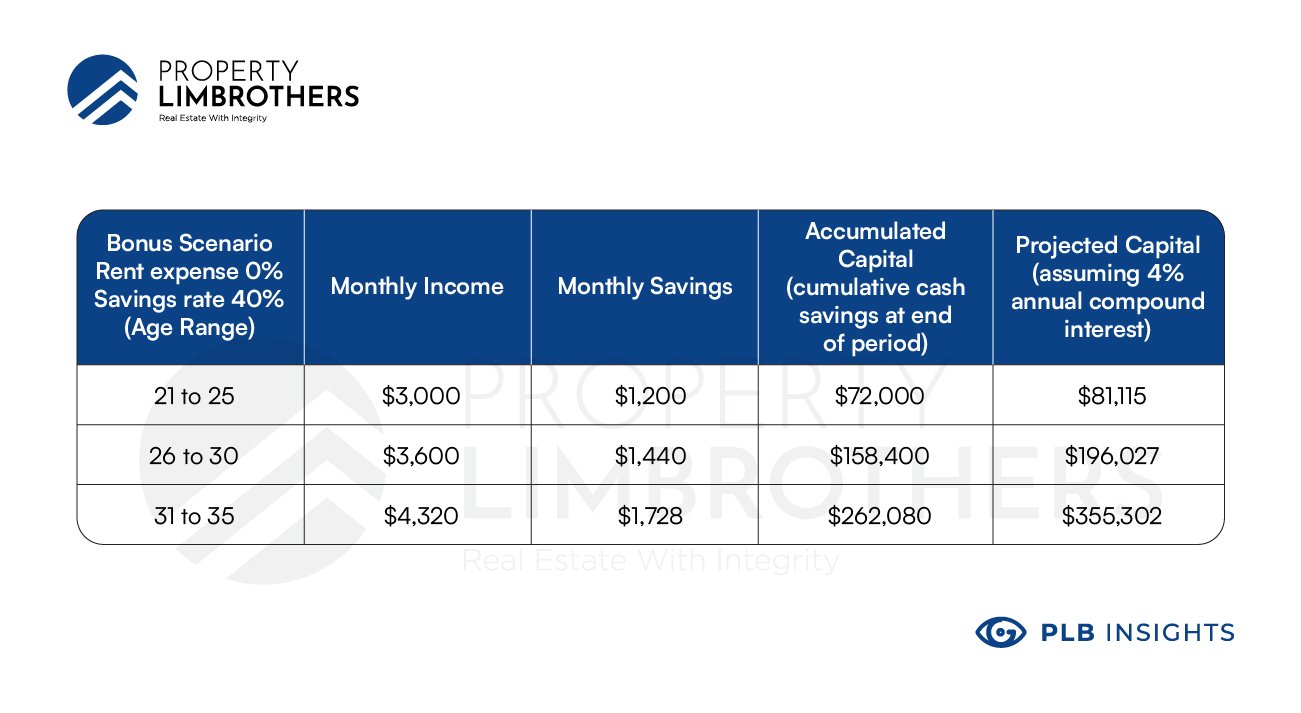

We present a bonus scenario, to show what would happen if you were the average Singaporean. With the same income but a savings rate of 40% and no expenditure on rent. This is the perk of living with your parents. Behold, the numbers that compel people not to move out. A single that stays in with parents can save more within 5 years (72K) than an avid renter would in 15 years (65K). In the last column, we calculate what would happen if you actually invest this money with a 4% annual compound interest. The difference is jarring. This should be motivation enough to invest.

To sum up our discussion on renting, we are not discouraging renting as an option per se. If you do intend on renting for lifestyle purposes or for a more conducive place for living and working, we just want you to make the choice with both eyes open. Keeping in mind the long term consequences it might have on your financial situation. Some people might choose to rent with friends or their partners to slightly reduce the load of renting alone. Our key reminder here is not to overspend on rent and remember to set aside savings for your future options.

3. Renting vs Buying

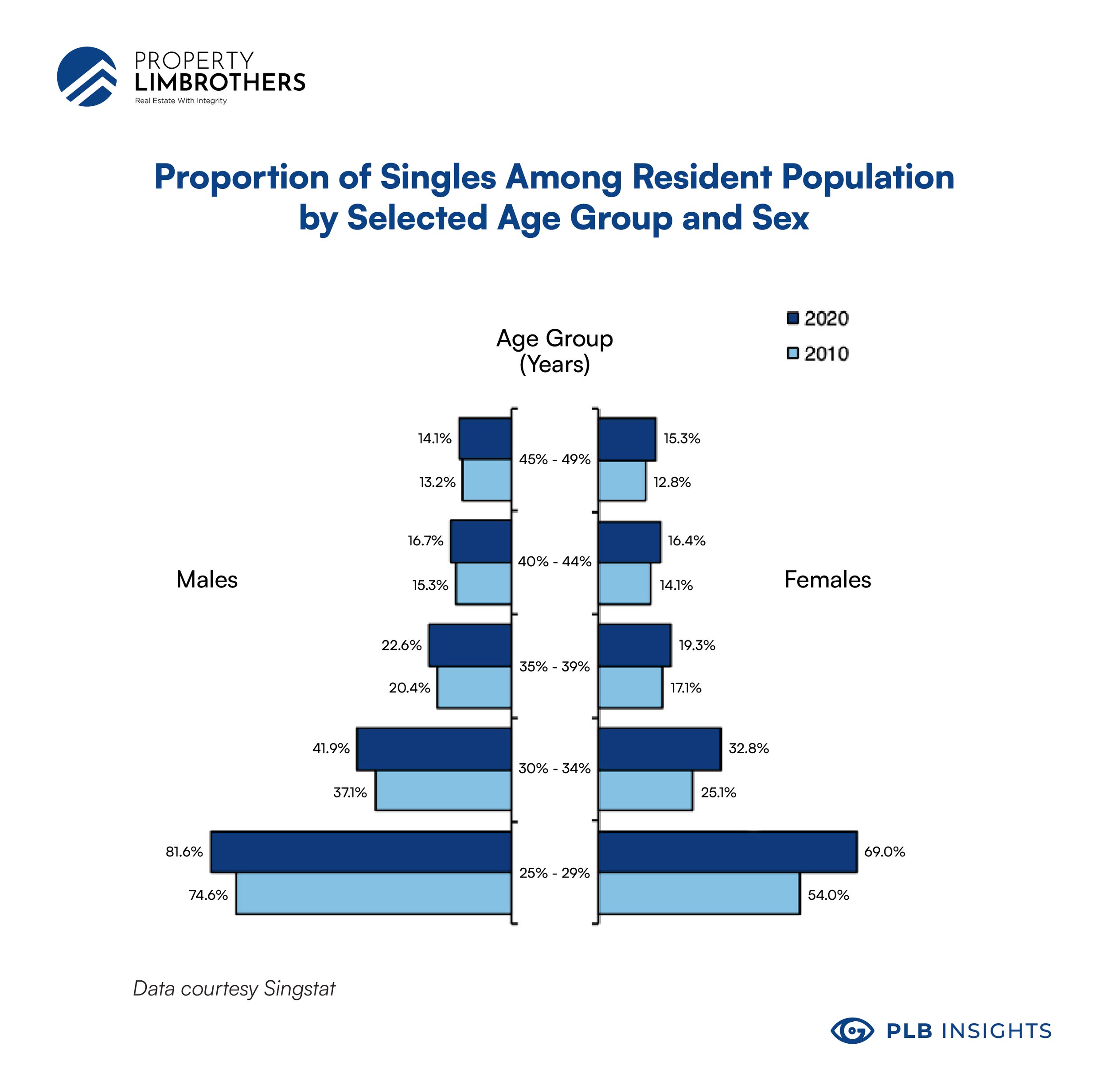

Renting versus buying a property is a huge choice a budding adult would eventually make. With a growing number of singles in the country, we would see more debate on this issue. More singles under 35 mean less BTO proposals. Buying a house will remain expensive, or get even more unaffordable. Renting might gradually be more appealing over time. There are 7% more male singles and 15% more female singles aged 25-29 comparing the 2020 and 2010 numbers. For individuals aged 30-34, the number of male singles increased by 3.2% and female singles by 7.7%. These numbers are not trivial and will translate to a higher demand for alternatives to public housing. Affordability will be a key factor.

If we were to extrapolate this trend, rent prices would consolidate over the next 5 to 10 years. The demand for affordable rentals would increase, putting pressure on the rental market to raise prices either across the board or closing the price gap between different districts. The number of singles increasing would also mean higher potential demand for smaller units. Despite the Work-From-Home (WFH) trends showing a demand for bigger units, the demographic trend for singles might mean that smaller units would not fall far behind. The aggregate demand for rentals and purchases of large and small sizes would still be strong.

Parting Words

We have discussed the rental situation and the capital that can be saved from different strategies. In Part 2 (next week), we will cover how the saved capital (whether you rent or not) can be used for your purchasing decisions. What property types can you afford? Which districts offer more affordable options without compromising on quality? Should you wait till you are 35 to buy HDB as a single? These are the questions we would like to tackle.

Here are the options we will cover next week:

-

Studios or 1-Bedders

-

2-Bedders

-

Public housing after 35?

We hope that this article has helped you in your decision on whether rent is for you. Considering long-term finances will be important to make sure you have your blind spots covered in planning. We got your back. Contact us here if you would like more customised advice to your situation.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.

PLB On Telegram

Home tours and property news — straight to your device.

Insights On Telegram

Fresh articles, market trends and news — right to your device.

Subscribe to our YouTube Channel

PLB Newsletter

Stay up to date with the latest property news and development

The PLB Seller Experience