Good Class Bungalows (GCBs) represent the pinnacle of Singapore’s real estate market. With only about 2,600 GCBs in the entire country, they account for just 0.6% of Singapore’s private residential inventory (excluding Executive Condominiums). To clarify, not all detached homes qualify as GCBs—specific criteria set by the Urban Redevelopment Authority (URA) determine whether a detached house meets the standards to be classified as a GCB.

Among all pure landed homes in Singapore, GCBs comprise only 3.5%, and they make up 24.2% of all detached houses nationwide. These figures underscore GCBs’ exclusive status as the crown jewel of Singapore’s property market.

In this article, we’ll delve into what makes GCBs so desirable, examine their wealth preservation and growth potential, and explore how their rising value aligns with the increasing affluence of Singaporeans.

What Qualifies As A ‘Good Class Bungalow (GCB)’?

To qualify as a Good Class Bungalow (GCB), a property must first meet two key criteria:

If a detached home meets the land size requirement but is not located within a GCBA, it cannot be classified as a GCB. All 39 GCBAs are located within districts 10, 11, 20, 21, and 23. The Urban Redevelopment Authority (URA) gazetted these areas to preserve the exclusivity, prestige, and environmental quality of GCBAs, protecting them from more intensive forms of landed housing.

Building Regulations:

GCBs are also subject to strict building guidelines. They cannot exceed two storeys in height (excluding the basement and attic), and only 40% of the land plot can be developed for built-up living space. The remaining 60% must be dedicated to greenery and landscaping, which can include gardens, swimming pools, or even tennis courts. Additionally, owners must ensure sufficient greenery surrounds the property to maintain its aesthetic appeal and environmental quality.

Limited Growth in Inventory:

While it is technically possible to increase the number of GCBs, this is highly unlikely. For instance, a single GCB plot can be subdivided into two, but each new plot must still adhere to URA’s stringent regulations, including the minimum land size and location within a GCBA.

With their unparalleled exclusivity, scarcity, and strict criteria, it’s no surprise that GCBs remain the ultimate status symbol in Singapore’s real estate market.

Demand And Price Trends Of GCBs

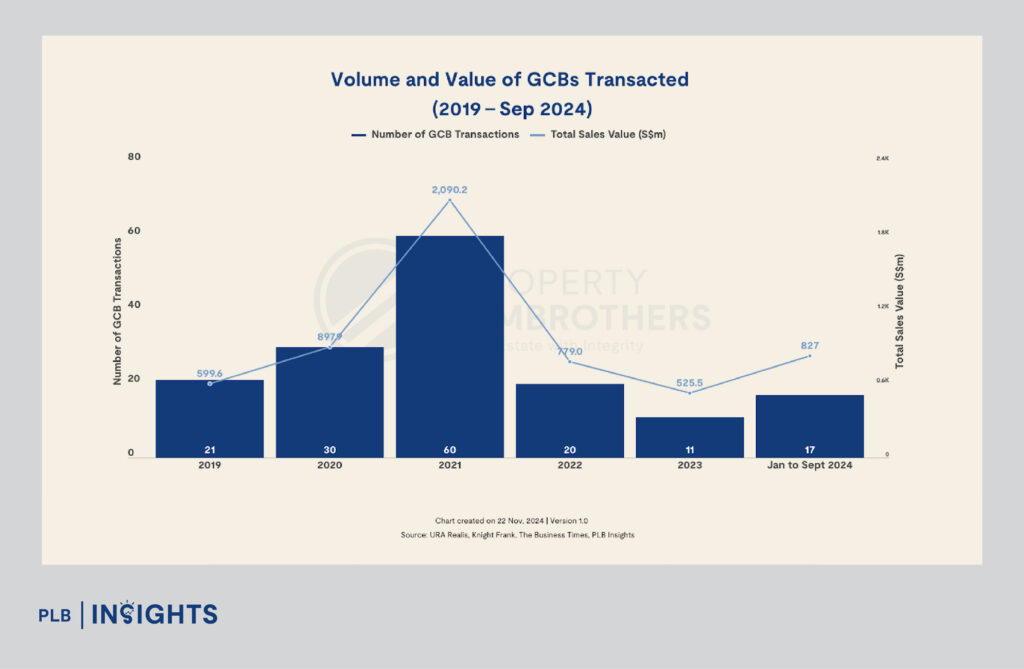

From January to September 2024, 17 Good Class Bungalows (GCBs) were sold, totalling $827 million in transaction value. Sale prices during this period ranged from $15.5 million to $93.9 million, or $1,067 PSF to $6,198 PSF.

The peak year for GCB transactions was 2021, with 60 sales amounting to $2.1 billion. The last time the total transaction value approached $2 billion was in 2010, at $1.8 billion. The 2021 surge was driven by low interest rates and pandemic-related lifestyle shifts, as buyers sought larger indoor and outdoor spaces amidst movement restrictions.

However, transaction volumes declined after 2021, with 20 GCBs sold for $779 million in 2022, and 11 sales totalling $525.5 million in 2023. This dip is unsurprising, given GCBs’ high price points and their status as personal trophies—purchased for long-term enjoyment rather than quick resale.

GCB transactions have seen a resurgence in 2024, with the total transaction value by September already 57.4% higher than the entirety of 2023. This reflects a possible renewed demand for these exclusive properties.

Top 5 Record-Breaking GCB Sales of 2024: A Testament to Singapore’s Property Market Resurgence

In July, a 15,150 sqft GCB in Ridley Park achieved the highest recorded price of $93.9 million. Earlier in April, a 28,111 sqft property in Bin Tong Park transacted for $84 million. Belmont Park saw two significant sales in July: a 24,566 sqft bungalow sold for $73.7 million, while a smaller 19,223 sqft plot fetched $57.5 million. In May, a 15,094 sqft GCB in Chatsworth Park was sold for $58 million. These transactions reflect the resurgent demand for prestigious GCB properties across Singapore.

Is The Resurgence In GCB Sales A Sign Of Growing Affluence Amongst Singaporeans?

The rise in GCB transactions in 2024 highlights the growing affluence of Singaporeans and their ability to sustain demand for these exclusive properties. According to the Allianz Global Wealth Report 2024, Singapore ranks as the fourth wealthiest nation globally, with net financial assets per capita at €171,930 ($246,000 SGD). This places Singapore ahead of other regional leaders like Taiwan and Japan, underscoring the nation’s strong financial foundation. Singapore’s robust income growth, prudent borrowing habits, and strategic investments in stocks and bank deposits have contributed to this wealth accumulation, enabling more individuals to afford high-value assets like GCBs.

GCBs represent more than just homes—they are symbols of exclusivity, prestige, and wealth preservation. Even with rising prices, the demand for GCBs remains evident, demonstrating the financial capacity of affluent Singaporeans. Without buyers able to sustain this market, the value of GCBs would falter. However, transactions such as the record-breaking $93.9 million sale in Ridley Park affirm the resilience of this asset class. These properties continue to attract wealthy individuals who view them as stable, long-term investments amidst economic uncertainty.

The Knight Frank Wealth Report further supports this trend, highlighting Singapore’s position as Asia’s fastest-growing wealth hub and the increasing number of Ultra-High-Net-Worth Individuals (UHNWIs). With a rising UHNWI population and strong economic performance, the pool of potential GCB buyers is expanding. Additionally, Singaporeans’ cautious approach to debt and focus on wealth diversification create a favourable environment for sustained demand for these limited, highly desirable properties.

In Summary

The growing affluence of Singaporeans ties directly to the enduring value and demand for Good Class Bungalows (GCBs). As Singapore secures its position as one of the world’s wealth leaders, with strong income growth and prudent financial management, the pool of affluent individuals capable of sustaining the GCB market continues to expand. These exclusive properties, with their limited supply and prestigious status, remain highly sought after as both a symbol of success and a vehicle for wealth preservation.

The resurgence in GCB sales in 2024 underscores the increasing purchasing power of Singaporeans, as evidenced by record-breaking transactions and a robust market performance. With the nation’s economic trajectory remaining strong and an ever-growing number of Ultra-High-Net-Worth Individuals, GCBs are set to retain their position at the pinnacle of Singapore’s real estate market. As wealth continues to rise, these iconic properties will likely see sustained demand, ensuring their relevance and value for years to come.

Navigating the exclusive world of Good Class Bungalows (GCBs) can be complex, but our expert consultants are here to help. Whether you’re exploring your first GCB purchase or adding to your portfolio, we provide insights into regulations, market trends, and opportunities tailored to your goals. Contact us today to make your GCB journey seamless and rewarding.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.