The last quarter has been an exciting period for Singapore’s Real Estate Industry. Several developments in the market further portray the enthusiasm around the properties in Singapore. If you have been keeping up with the latest updates, you will know what we are talking about. In this article, we will cover some of the notable developments in Singapore’s Real Estate Market, which include some of the more noteworthy En-blocs and Government Land Sales (GLS), the confidence in Singapore’s properties by some reputable individuals, not forgetting the challenges the property might face in the near future due to some happenings locally and globally. This is PLB’s Q3 Update.

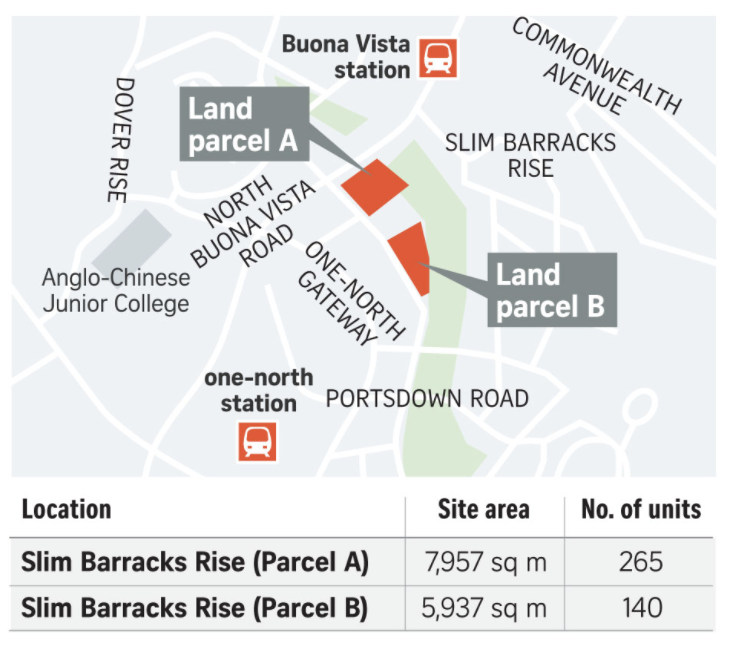

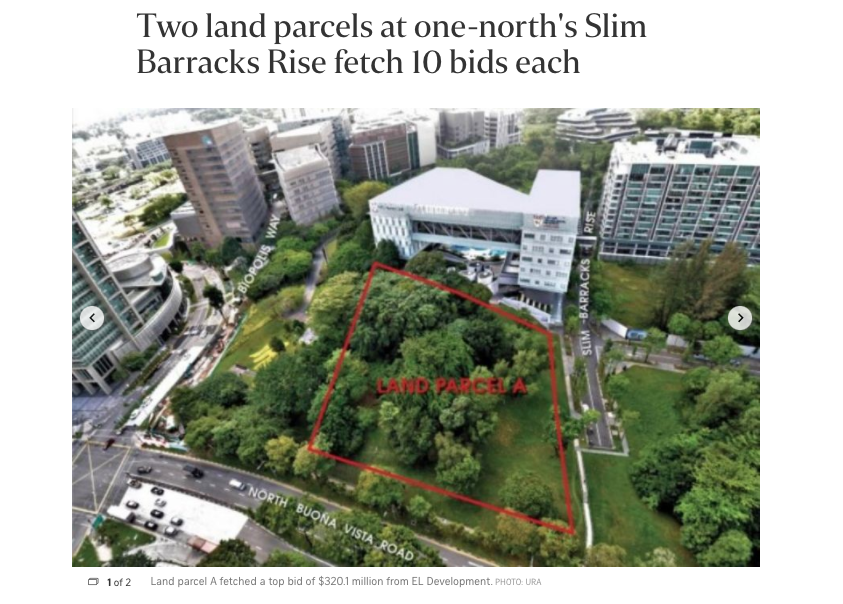

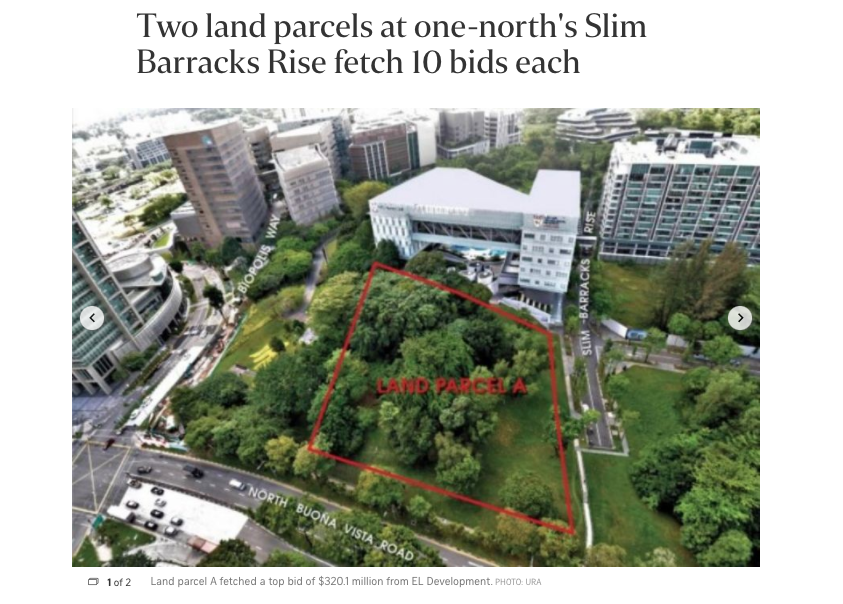

Slim Barracks Rise GLS

Courtesy of ST

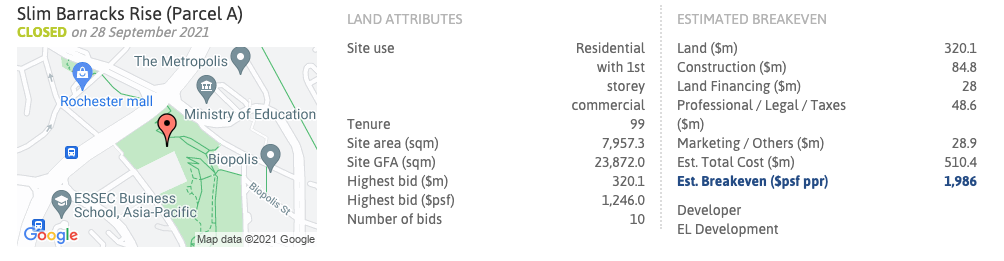

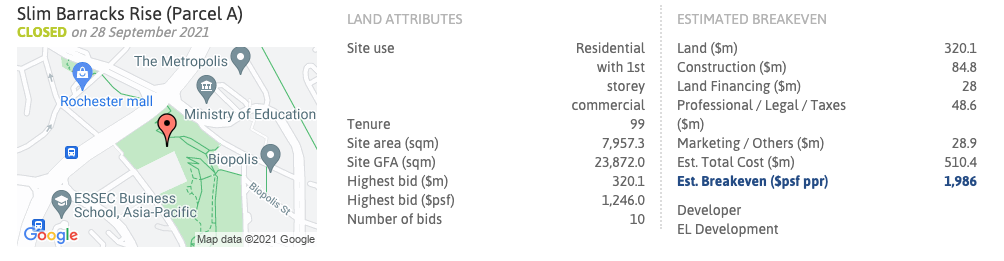

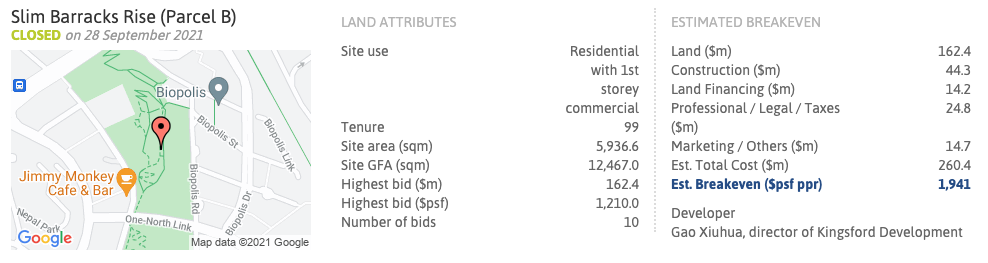

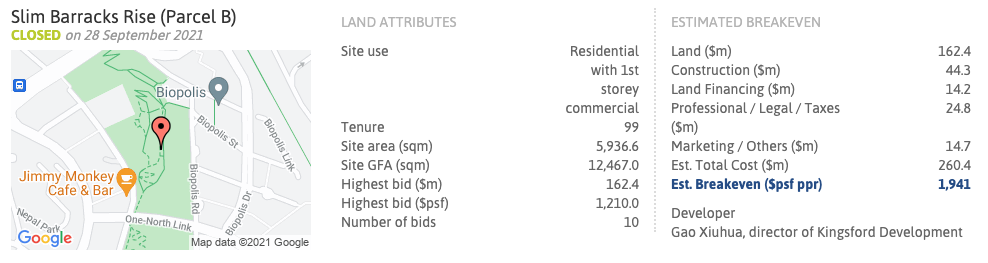

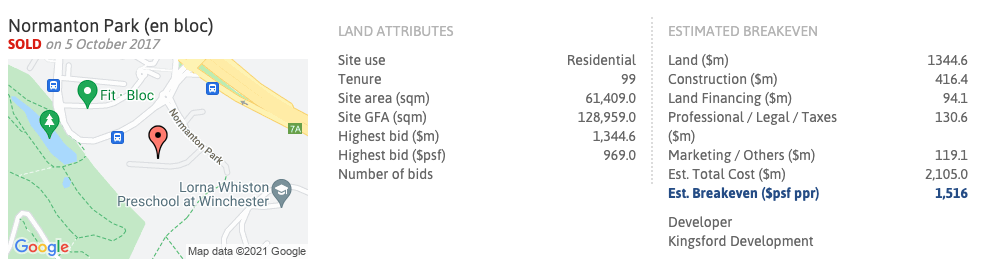

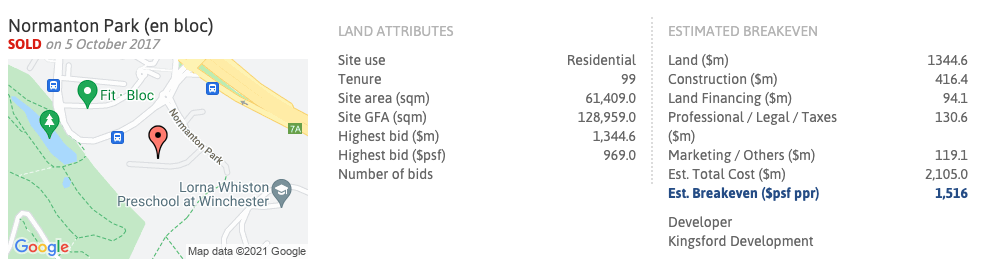

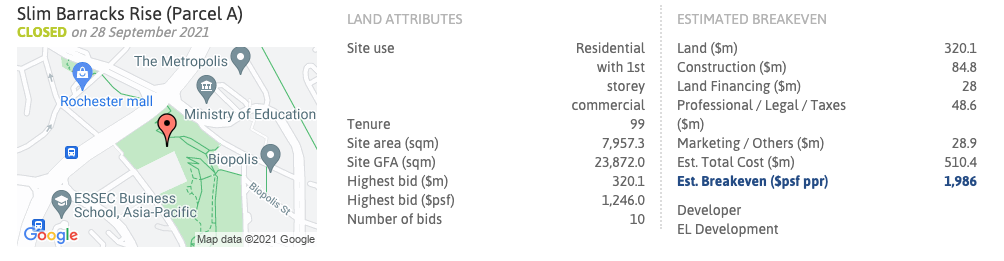

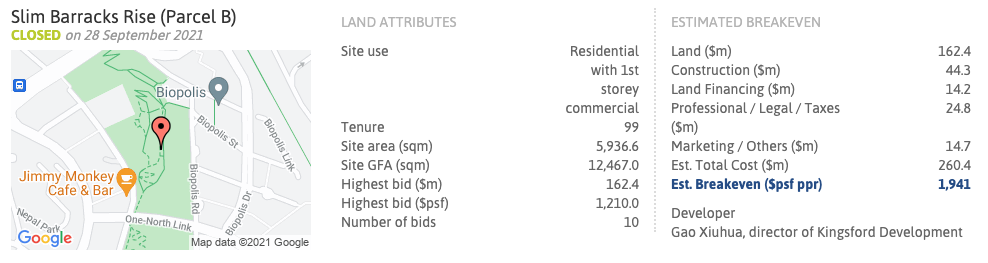

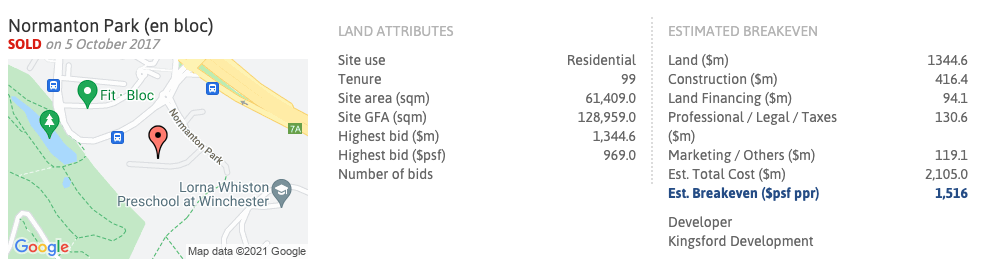

The latest GLS tender concluded was for two parcels of land in one-North, Slim Barracks. Both are 99-year leasehold sites. Land Parcel A, about 7,957 sqm/85,648 sqft, was successfully bidded by EL Development at $320.1Mil or about $1,245.6 psf ppr. Land Parcel B, which is about 5,936 sqm/63,901 sqft, was successfully bidded by Gao Xiuhua for $162.4Mil or about $1,210 psf ppr. Gao Xiuhua happens to be one of the owners of Kingsford Development, which bidded for the highly acclaimed Normanton Park project. To put things in perspective, Normanton Park was successfully en-bloc for $830.1Mil or about $969 psf ppr for the 61,408 sqm/660,999 sqft site. That is a difference of about $300 psf ppr accounting for land cost only.

After accounting for all the costs of development, such as construction and taxes, the estimated breakeven $psf ppr is about $1,9xx for both the Parcel A and B Slim Barracks Rise site. At the time of writing, the average PSF price of Normanton Park stands at $1,784 PSF. The estimated breakeven price in 2017 for Normanton Park was $1,516 PSF. If we were to utilise the same differential to account for the developer’s profit margin of roughly 20%, that would bring the estimated sale price of the potential developments for the Slim Barrack Rise sites to about $2,3xx. A whopping $500 psf difference from the existing $1,7xx psf of Normanton Park.

Normanton Park is a mega project with over 1,800 residential units, including a spread from 1-Bedroom types to 5-Bedroom types and even 2000+ sqft Strata Terrace Houses. While the development costs of the 61,409 sqm site will far exceed that of the two Slim Barrack Rise sites due to the difference in land size, Normanton Park has the benefit of many more residential units to share the costs of development. This has been translated into cost savings for potential buyers of Normanton Park. Consider it in a group buy context, almost. On the other hand, the two Slim Barracks Rise Sites, potentially yield about 265 units and 140 units, respectively, will not benefit. Couple that with the rising construction costs due to the pandemic, which has raised material and manpower costs, the projected PSF could very well exceed the $23xx mark, which is currently projected. While the rising land and other miscellaneous costs are not within our control, what is within our control is entering into a development like Normanton Park, at the current PSF, which might potentially see a good capital gain in the future when the other two developments have been completed. The price disparity will benefit Normanton Park and those looking to exit, perhaps five years down the road.

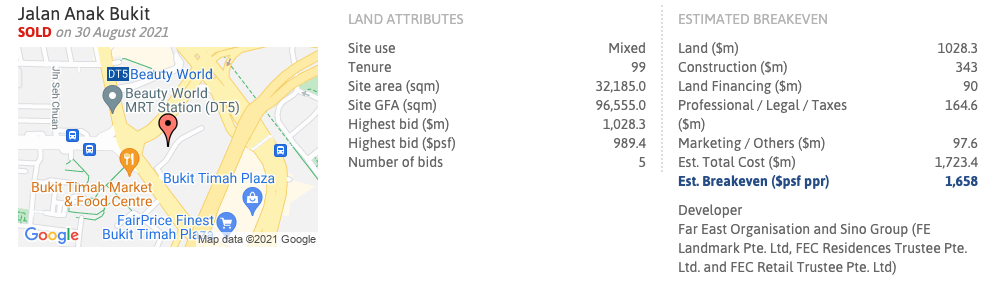

Jalan Anak Bukit GLS

Another noteworthy GLS site that concluded recently is Jalan Anak Bukit, which Far East Organisation and Sino Group successfully tendered. The 99-year leasehold site is 32,185 sqm / 346,436 sqft and was tendered for $1.03 Billion, which translates to about $989 psf. The land parcel is zoned as Mixed Use, which would require it to follow URA use quantum guidelines of 60:40 residential and commercial components, respectively.

This development is noteworthy because in the tender proposal submitted, the 50-50 joint venture submitted three different bids and concept proposals. The final one successfully selected is a proposed mixed-use development with an integrated transport hub with a bus interchange on the second storey. When it comes to mixed-use developments along the Beauty World Station stretch of Upper Bukit Timah Road, there is no shortage with Bukit View Condominium and Sherwood Towers. Both are 99-year leaseholds that start from the 1970s. The attached malls, Beauty World and Bukit Timah Plaza, serve as the main nodes for residents to procure their daily amenities. However, these malls also have a long-running reputation for the array of domestic helper agencies that are unmissable when walking around each level. With the new integrated development, Far East Organisation and Sino Group have the opportunity to capitalise on the shortage of a diversified tenant that is notably missing around the area. The inclusion of the bus interchange will enhance an already well-connected area and attract even more traffic to the new integrated development. We are excited for the revelation of plans for this integrated development, and you should keep a lookout for updates on this plot of prime land.

Is En-Bloc Fever Back?

#block-yui_3_17_2_1_1634010692677_32495 .sqs-gallery-block-grid .sqs-gallery-design-grid { margin-right: -10px; }

#block-yui_3_17_2_1_1634010692677_32495 .sqs-gallery-block-grid .sqs-gallery-design-grid-slide .margin-wrapper { margin-right: 10px; margin-bottom: 10px; }

In August and September alone, we have had five reported en-bloc incidents in the market across the island. Flynn Park is the only en-bloc sale concluded, while the others are waiting for tenders to close. To summarise some of the notable developments before accounting for development costs:

Flynn Park

Tenure: Freehold

Estimated PSF PPR: $1,355

Flynn Park is located on the edge of District 05, which benefits from the Greater Southern Waterfront. The most notable New Launch development in the region is The Reef at King’s Dock, which averages about $2,3xx psf. If we were to account for the estimated development cost to redevelop Flynn Park, the breakeven psf price would come to about $2,0xx psf before accounting for the developer’s profit margin. The potential psf prices for the relaunch of Flynn Park could very well be relatively higher than the current average psf price in The Reef at King’s Dock. The Reef at King’s Dock is a 99-year leasehold development but is also located in a more prime District 04 and by the waterfront. If you would like to find out more about District 05 or The Reef at King’s Dock, we have reviewed both of them recently and could satisfy your curiosity on the potential of these two areas.

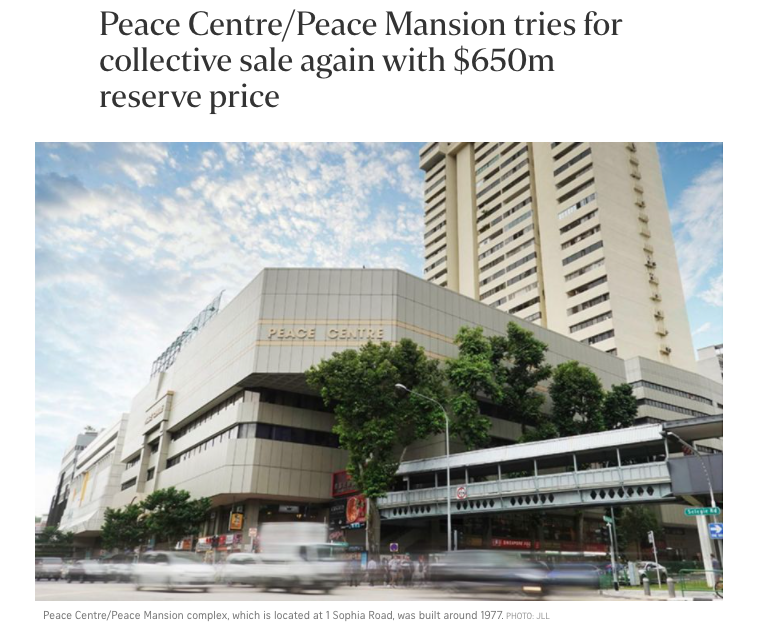

Peace Centre/Peace Mansion

Tenure: 99-Year Leasehold (In-principle approval from SLA for lease top-up)

Estimated PSF PPR: $1,474

While the collective sale has not been concluded, we are a little torn on the potential of this area. Peace Centre/Peace Mansion is located in a relatively quiet area of the Bugis precinct. If a developer successfully concludes the collective sale, they will have to compete with current integrated developments in the area like Midtown Modern and Midtown Bay by Guoccoland. However, the land that Peace Centre/Mansions sits on has a gross plot ratio of 7.89 and could be redeveloped to a height of 55M Singapore height datum, with a part of it potentially as high as 67M. The new high rise will benefit from being located closer to Orchard Road, where URA has plans to enhance the central shopping belt as a Lifestyle Destination.

International Plaza

Tenure: 99-Year Leasehold

Estimated PSF PPR: $2,170

International Plaza will potentially be Singapore’s largest en-bloc deal regarding the number of units and value. The 50-Storey leasehold building has been launched for sale by public tender at a record reserve price of $2.7 Billion, which works out to about $2,170 after accounting for land intensification. The land is a commercially zoned site, so developers need not pay Additional Buyer’s Stamp Duty, and foreign buyers could keep the land. If successful in the en-bloc sale, the potential competition for this prime development is the white site at Marina View. The Marina View site has recently been awarded to Malaysia’s IOI Properties Group for $1,508,000,101, which is $101 above the $1.508 Billion minimum price. Both these developments reflect the enthusiastic plans to rejuvenate the Downtown Core into a Live, Work and Play district. In an area with very limited residential housing options, these two mega-developments will likely add enhanced vibrancy in line with the current plans and complement the existing developments.

Evergrande

Even if you have not been keeping up with the Real Estate Market, you would undoubtedly have heard of the word Evergrande floating around as of late. For the benefit of those that do not know the full story, here is an explainer by The Straits Team, which covers the gist of the situation. Evergrande’s problems sum up to one word, debt. China’s housing giant has failed to meet the obligations on its financial liabilities. At the time of writing, Evergrande’s total liabilities stand at 1.97 Trillion Yuan or $305 Billion.

We know what you are thinking, “does this affect us in any way?”. Well, yes and no.

There is no direct impact on Singapore’s Real Estate market or our economy, for that matter. Most local banks have released statements to address the issue and reassurance that they have little to no exposure to Evergrande, which means your money is still safe in your banks.

Coincidentally, the Chinese government also introduced new cooling measures to curb home price growth, stabilising an over-performing market, and reining in property bubbles. Since introducing the new cooling measures, China’s property market has seen a dramatic slowdown to 0.2% in August and 0.3% in July. New home prices rose 4.2% in August and 4.6% a year earlier. This result is also likely attributed to the Evergrande debacle that coincided with the new cooling measures.

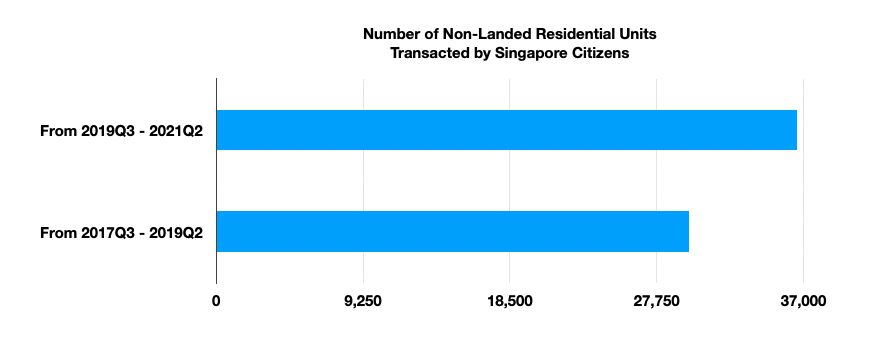

Bringing it back to Singapore, as far as our real estate market is concerned, we do not have a direct relation to the debt issues of the China Housing Giant, thanks to well-structured and rigid housing regulations. The number of units transacted for residential non-landed properties by our Singaporean residents increased by 23% from 29,780 in 2017Q2 – 2019Q2 to 36,573 units in 2019Q3 – 2021Q2. This increase could be attributed to our local properties’ growing interest and confidence, accredited to a well-regulated market.

For starters, developers of any projects in Singapore are required to open a Project Account, which facilitates the payments from potential buyers and to their vendors. This segregates the money received from the developer’s accounts and ensures that it will only be used for reasons pertaining to the project that has been paid for. Other requirements include submitting the latest audited accounts for URA’s perusal and a minimum sum of paid-up capital in order to start selling the units developed. All these regulations in Singapore are meant to avoid critical situations like the one happening in China right now, which also helps to add further confidence to the property market in Singapore.

The largest population decrease since 1950

The sharp decline in Singapore’s population stemmed largely from the 10.7% decrease in the non-resident population, which is mostly attributed to falling foreign employment amid travel restrictions. This comes as a further decline from the 2.1% decrease last year for the same reasons. Additionally, the Singapore Citizen and permanent resident (PR) population has also decreased 0.7% to 3.5 million and 0.6% to 0.49 million, respectively. This could likely be attributed to the safe management measures and other operational restrictions that limit the number of slots to complete the PR and citizenship registration process, which require in-person attendance.

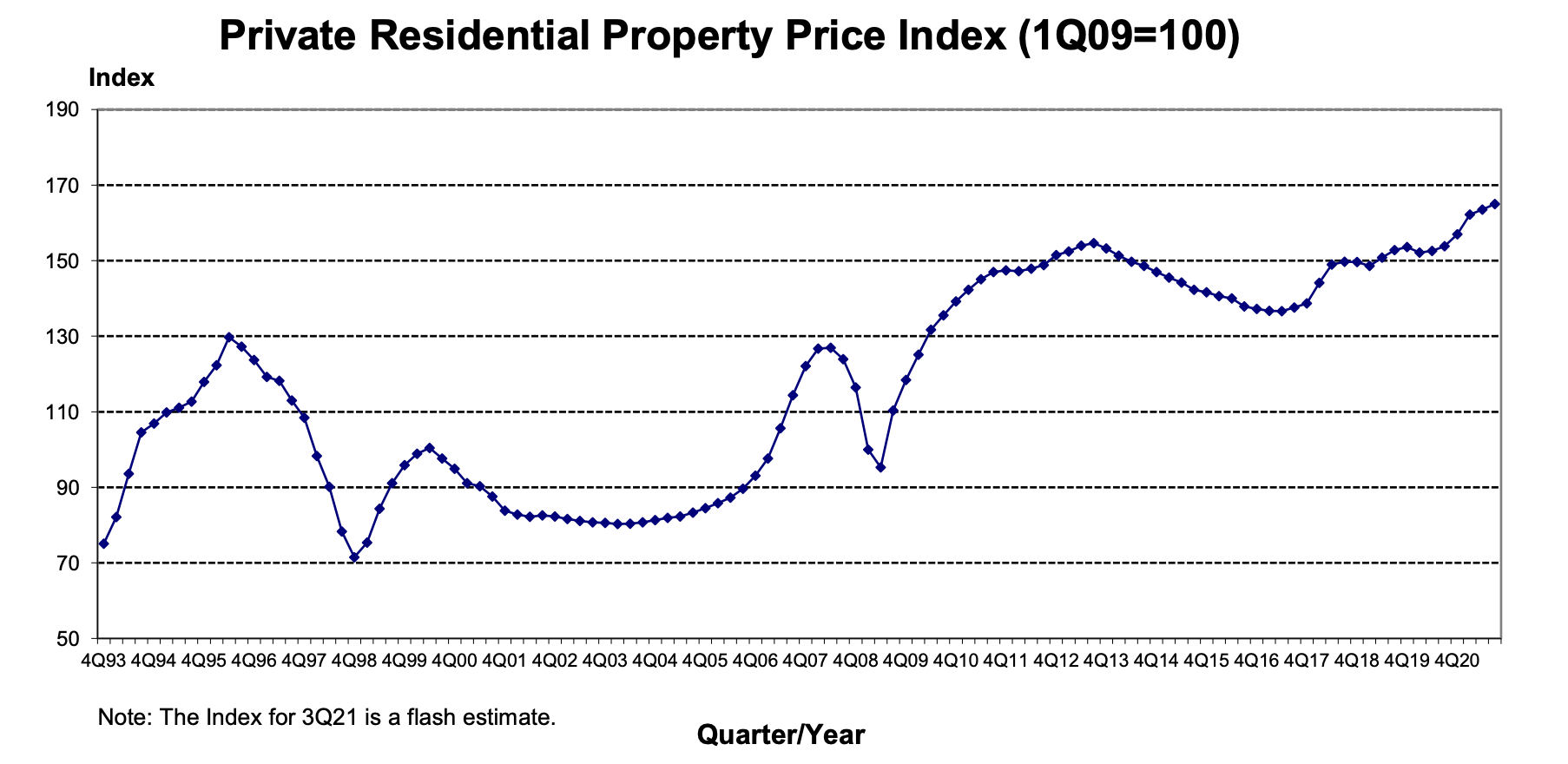

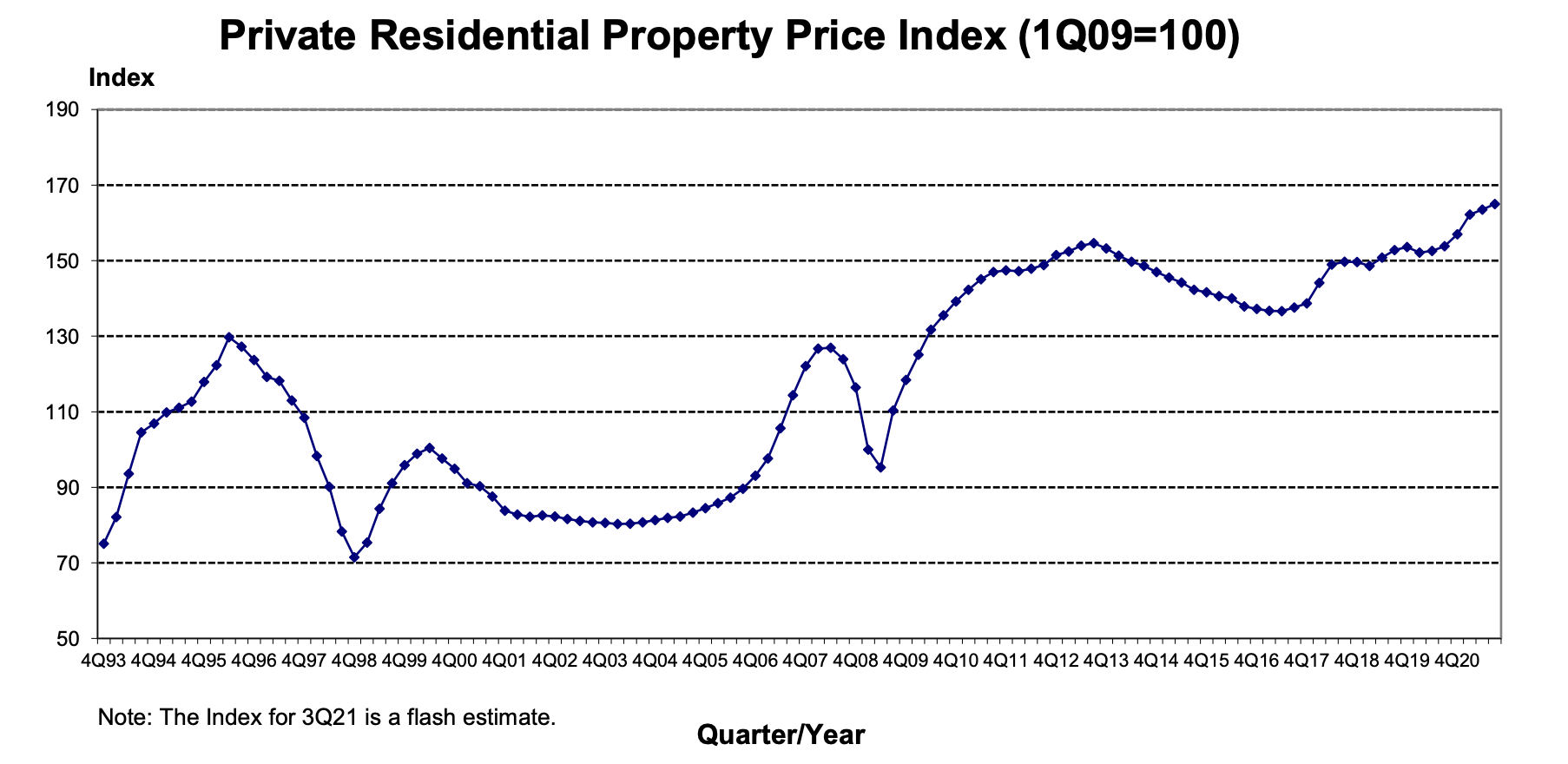

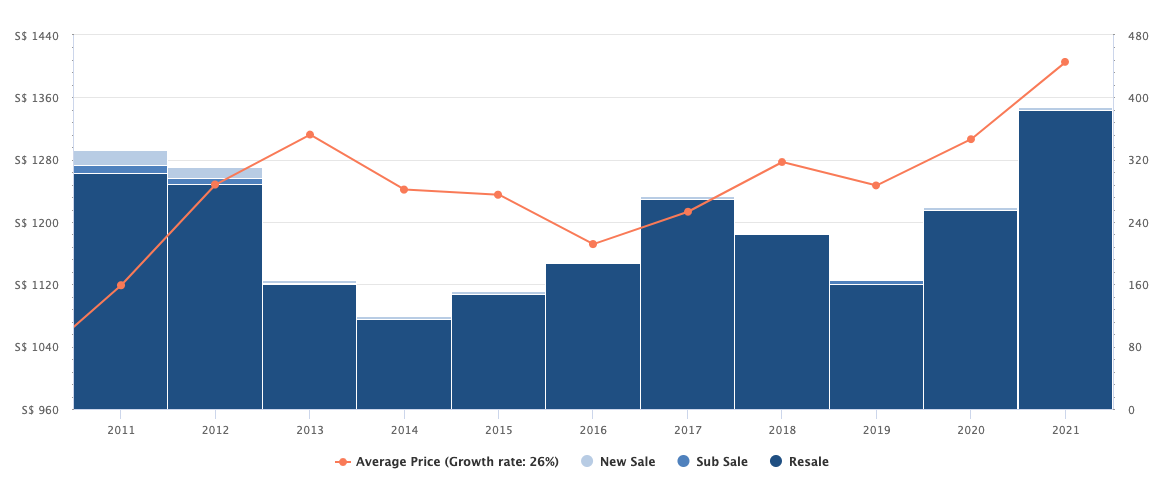

Conversely, if we look at the property price index (PPI), based on the flash estimates by URA for Q3 of 2021, the real estate market has seen another increase of 0.9% compared to the previous quarter. This increase comes amidst an already performing market that has seen a 7.2% growth in the PPI year-on-year. So one thing is for certain, the decrease in population did not directly affect our property market or the prices to be more accurate. But why is that so?

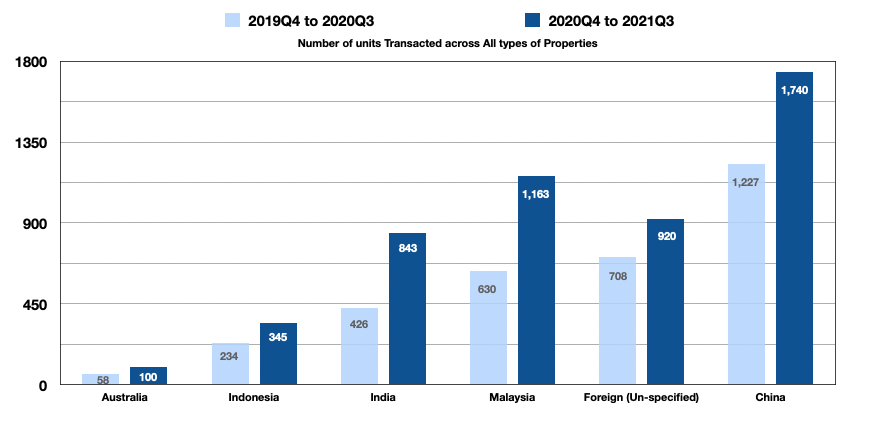

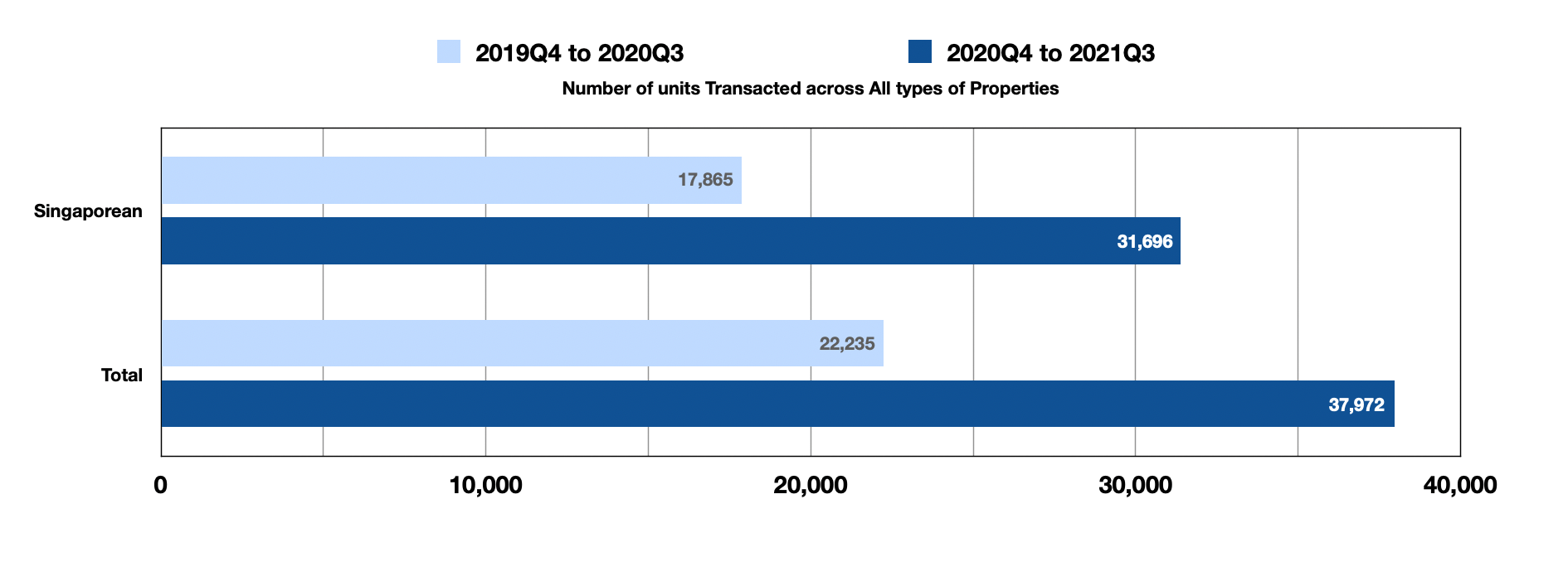

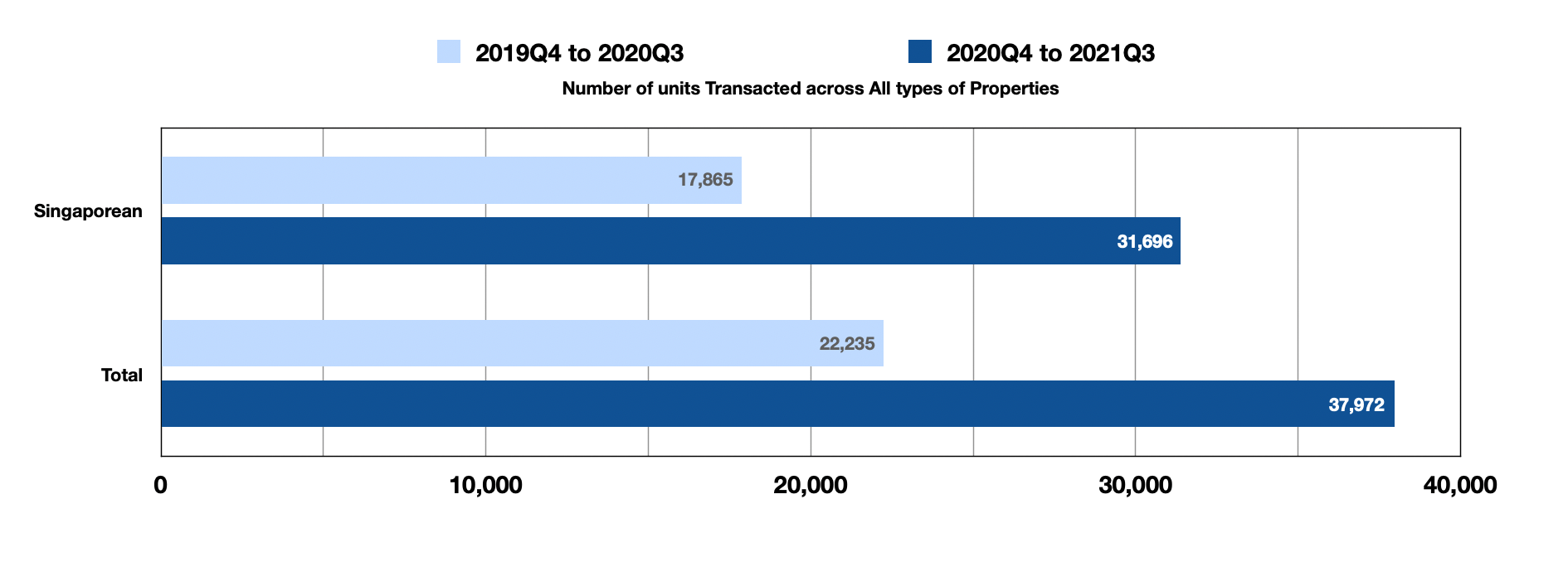

Even though there has been a decrease in our population numbers, the number of transactions across all types of properties have increased. The above data, adapted from URA, shows the number of property transactions performed between the two time periods of 2019Q4 to 2020Q3 and 2020Q4 to 2021Q3. The biggest contributors to the increased number of transactions by nationality are made by those closest to our country. Transactions made by Indian nationals doubled from 426 to 843 transactions, with Malaysian nationals as the other substantial contributor.

The increase in transactions by foreigners could likely be due to the pandemic and the increasing realisation that there is no short-term solution to the situation. Thus, prompting more foreigners to move away from the rental model and store their money using a property. The other contributing factor could also be the political unrest around the Asia region and, as mentioned earlier, China’s housing situation, which could have brought in more interest and enthusiasm to our shores.

The truth is, the most enthusiastic group of people in our properties are Singaporeans ourselves! Property transactions made by Singaporeans have grown almost twice, from 17,865 to 31,696. Singaporeans also made up 83% of the total transactions made. The pandemic has not only limited foreigners to travel into our country, but it has also restricted Singaporeans travel overseas. Overseas Singaporeans who typically reside overseas, as defined by our population guidelines, have decreased from 203,000 in 2020 to 179,500 in 2021, the lowest since 2011. More Singaporeans have returned home over the pandemic, perhaps citing the advantage of our pristine healthcare system where Singaporean Citizens get privileged treatment. This has also increased the need for housing, which is evident from the increase in the number of transactions. Those in search of larger houses further amplify the increased volume due to work-from-home restrictions, which accelerated the need for larger spaces to accommodate the extra time and family members at home at the same time.

The Singaporean Spirit

#block-yui_3_17_2_1_1634010692677_126101 .sqs-gallery-block-grid .sqs-gallery-design-grid { margin-right: -20px; }

#block-yui_3_17_2_1_1634010692677_126101 .sqs-gallery-block-grid .sqs-gallery-design-grid-slide .margin-wrapper { margin-right: 20px; margin-bottom: 20px; }

Amongst the Singapore Property enthusiasts, there is a group of people who are especially supportive of the value in our Real Estate Market. Surely, you have seen some of these notable purchases that have been reported on most major media outlets. While these tech entrepreneurs have their differences and helm different operations, they have one thing in common, a Good Class Bungalow. Good Class Bungalows are considered an asset class of their own due to the very limited numbers, the quantum in which they transact, and the size of the land. These attributes collectively reinforce the iron fortresses as a good store of value, especially on a land-scarce island.

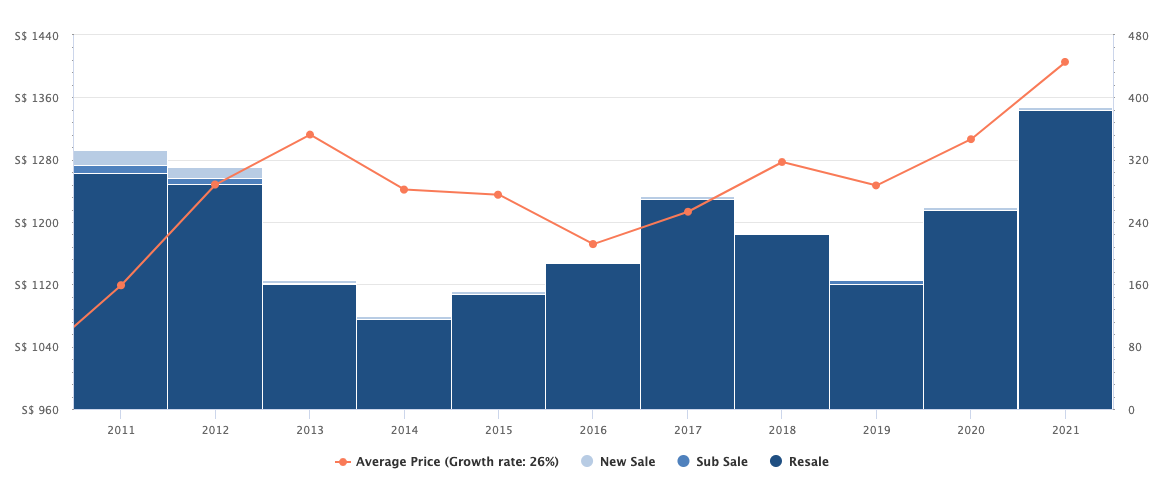

Detached Landed houses are currently averaging $1,381 psf across the island. In 2021, the highest recorded psf for a GCB transaction was $4,005 psf by the wife of Nanofilm Technologies head Shi Xu. Because GCBs are a different breed of an asset class with other non-intrinsic factors that contribute to the property’s value, prices fluctuate differently according to those same factors. Some may prefer the Feng Shui of a certain plot of land, and others may prefer the most prestigious addresses. Albeit most transactions are still made with the current market valuation in consideration. From 2016 onwards, average psf prices of Detached Landed houses have increased by 18%, which is in line with the growing land cost even for non-landed residential plots of land. However, because GCBs are so unique and limited, this asset class will likely see accelerated growth if the interest in our local properties continues to grow. Reopening our borders to allow for overseas travel will also help alleviate the current economic uncertainties and allow for a more booming economy. With that growth, more would likely turn to landed properties to store their keep since it has been proven to be one of the most trustworthy asset classes. Whatever the case may be, we foresee detached houses, or Good Class Bungalows to be more exact, to see even further growth from here on.

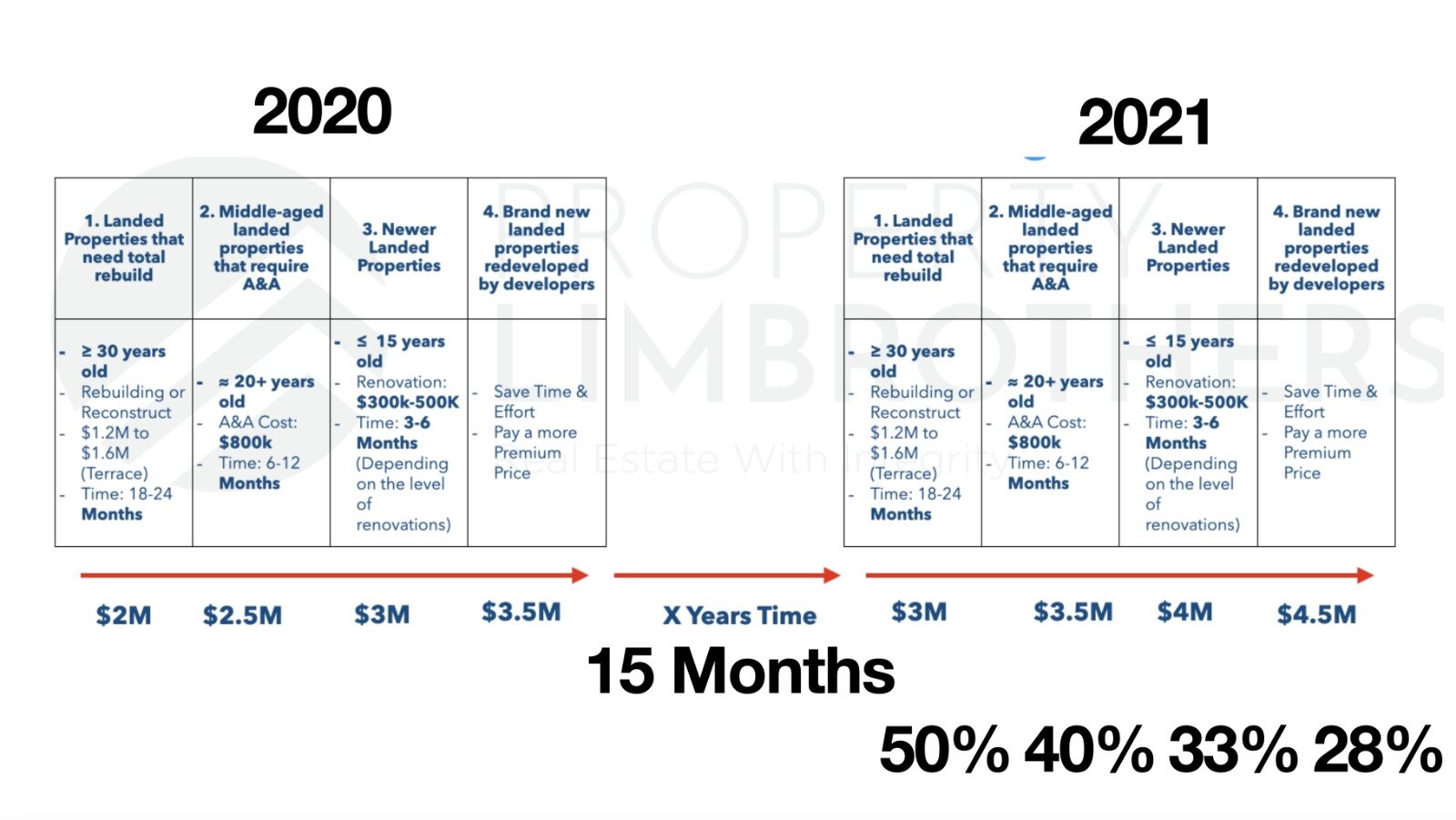

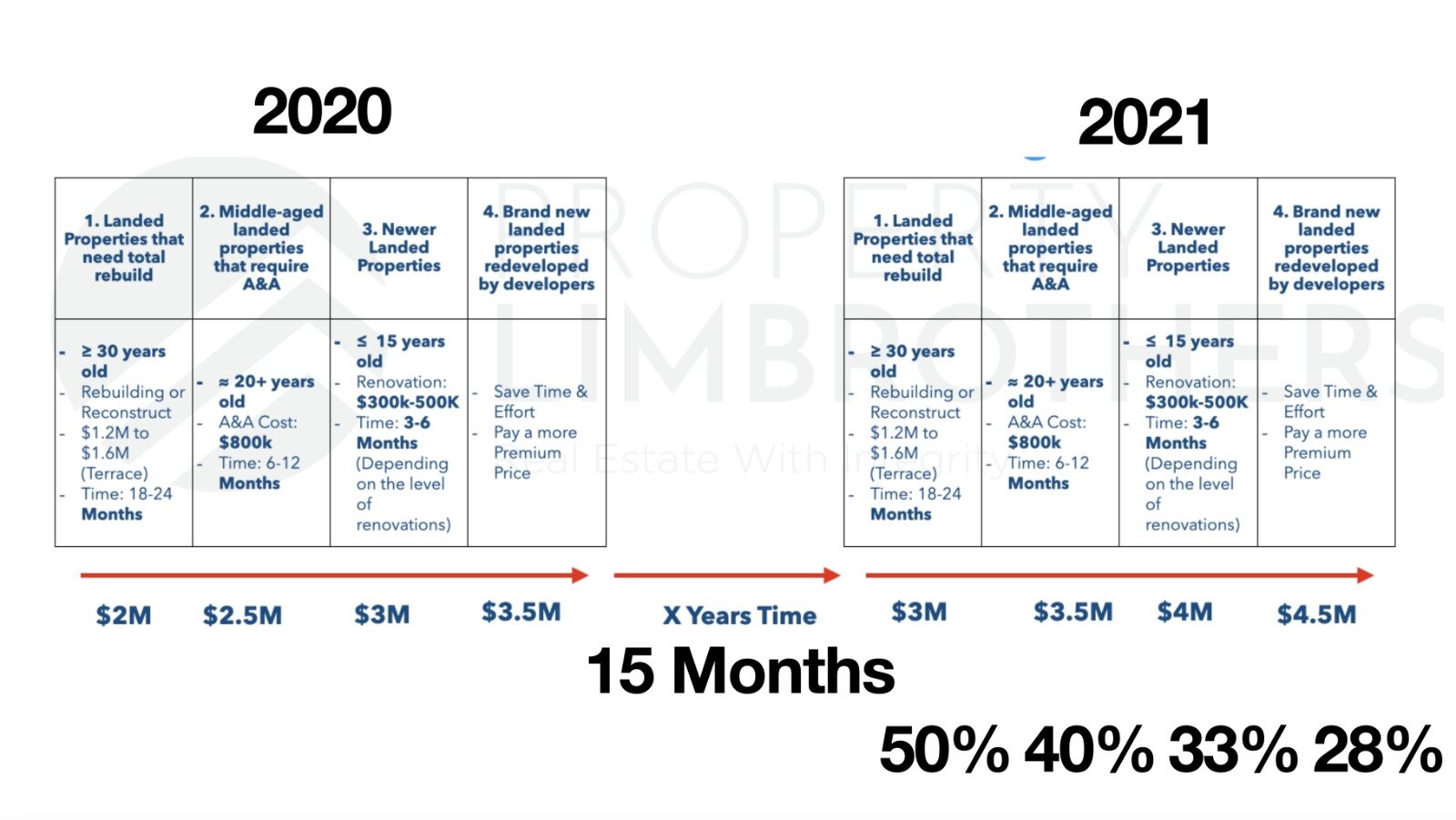

What about the landed housing that more can afford? Based on our observations from transacted landed properties and currently listed ones, we categorised them into four main types.

-

Landed Properties that need a total rebuild

-

Middle-aged Properties that require A&A

-

Newer Landed Properties

-

Brand New Landed Properties redeveloped by developers

Demand for landed properties has been overwhelming, to say the least, since the pandemic started. More homeowners have found it increasingly urgent to find a bigger home than the one they are currently staying in due to the rise of new requirements. Amongst the four types, we noticed the highest percentage increase by absolute quantum in Landed Properties that need a total rebuild. This just further justifies the movement of the landed properties market as more demand is seen. This type of landed property has the most attention because they are the lowest priced in the market currently, so potential homeowners who want to have a landed house that they can truly and uniquely call their own will likely go for these types. At the same time, developers who have been overwhelmed with the response on their new launch landed properties are also on the hunt for these types of landed properties. Thus, this type of landed property has garnered the highest percentage gain between 2020 to 2021.

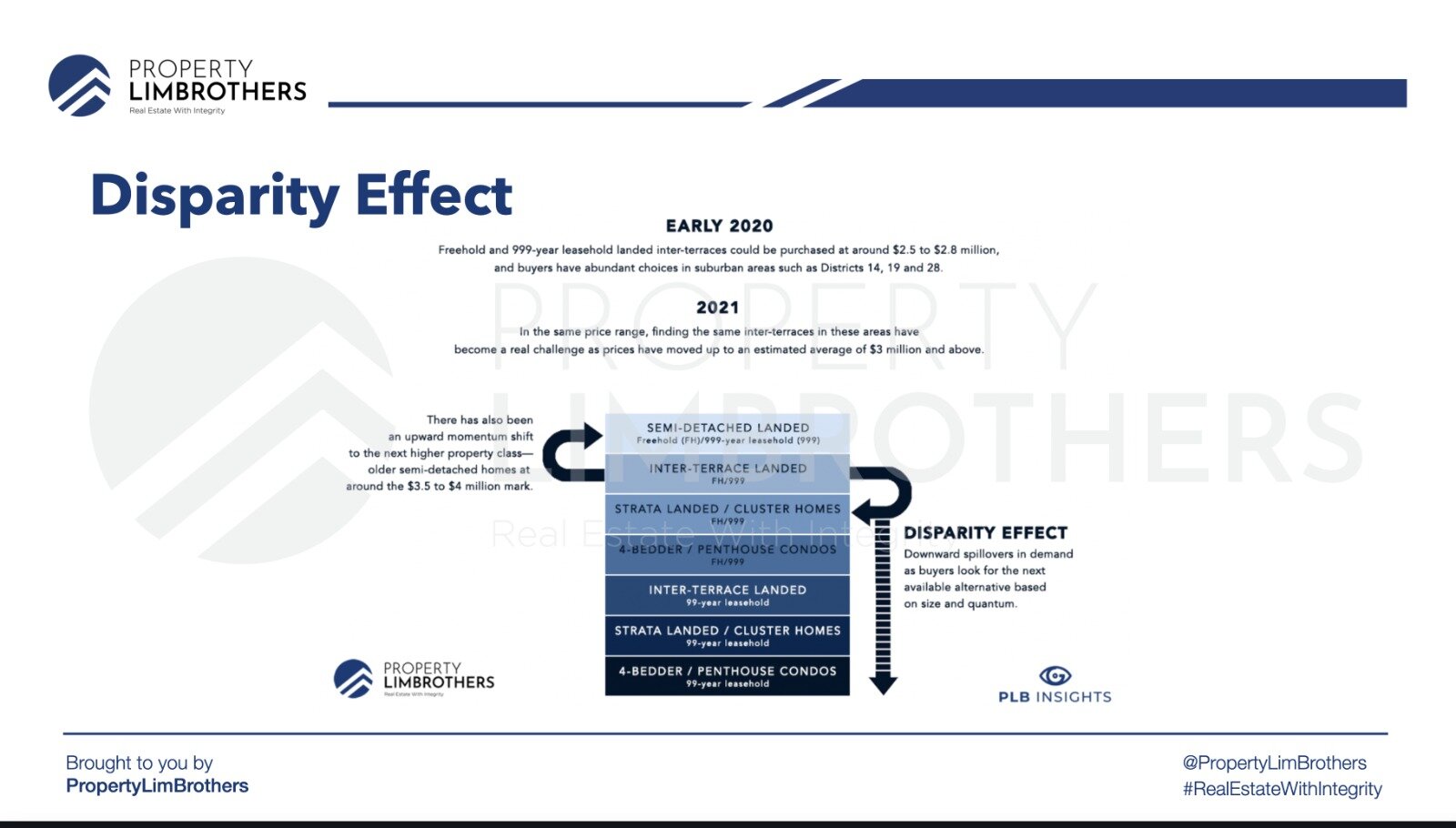

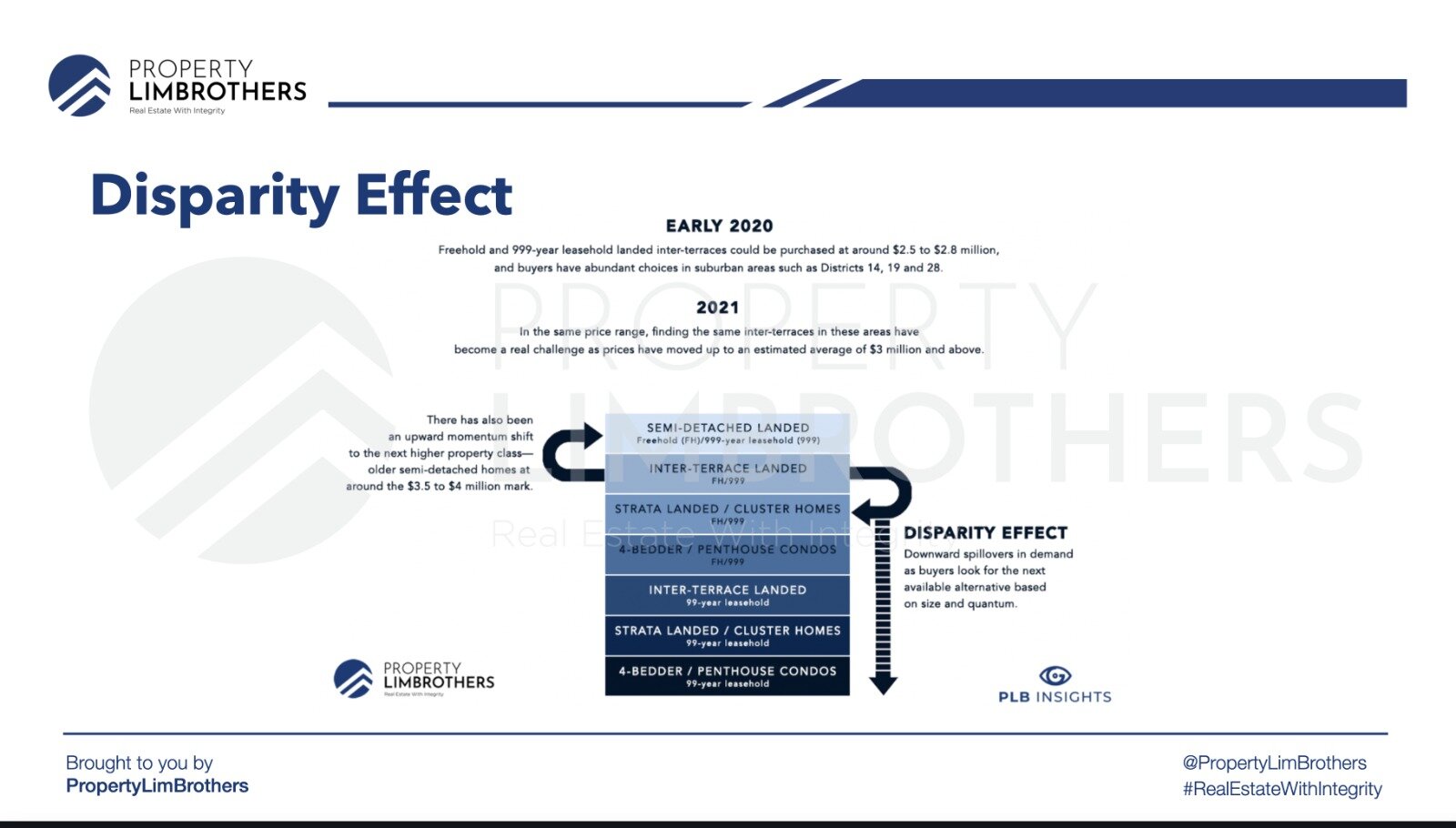

For those that have actively kept up with PLB and all our Insights, you would know we talk about this often, The Disparity Effect.

We can observe that the increase in prices across the four types over 2020 to 2021 have generally increased collectively. However, price movement does not magically jump from $2Mil to $3Mil overnight, and it happens gradually. In non-landed residential properties, price movement leading the disparity is typically by New Launches as they set new benchmarks in their respective markets. Contrary to that, the landed residential properties are sometimes led by the oldest types, which require rebuilding. Consider this, as cost increases for raw materials, prices for the final product would naturally increase to account for the cost of production. As we earlier explained, landed houses, which are a very scarce commodity in Singapore, are highly sought after. With the increased demand and low supply, the only reasonable outcome would be for prices to move upward to entice existing owners of these properties to sell their landed homes. As the prices for the most basic type of landed property increase, this will, in turn, push the prices of the next type upwards. To put things in perspective, as the lower type increases in prices, it would be a favourable environment for the next type to move up in prices because of its intrinsic attributes over the previous type. Otherwise, there will be a price disparity between a certain type and its adjacent counterparts. Hence, the Disparity Effect.

Final Words

In our latest episode of Nuggets On The Go, we summarise some of the current Micro Trends in Landed Properties that we have observed. If you would like to find out more, do tune in to the episode, or you could always drop us an email at Insights@plb.sg, and we would be happy to answer any queries. The key takeaway from this article is that the rising land cost in Singapore is inevitable due to the limited land available. Timing the market is never sensible, especially with the current happenings and developments across the market. With the rising land costs evident from the recent GLS and En-bloc sales, timing the market could easily put you in the position of being priced out of the market and may increase the cost of your property. The current market performance coupled with the confidence of our local Singaporeans has reinforced a very well structured and regulated property market in Singapore. As we inch closer to the reopening of our borders, our stumped population numbers could very well be accelerated upwards and drive the property market further. We await what is to come in Q4, and we hope we have provided you with some value through our PLB Q3 Updates. Till our next article, Take Care!