With the worst of the pandemic behind us (fingers crossed), is it finally blue skies from here onwards? Some fear that the worst is yet to come. First, crazy high inflation, next war in Ukraine, then Fed rug-pulling the stock markets, and cryptos crashing down. It seems that 2022 is full of surprises in itself. And not the good kind.

In investment speak, “black swans” are unexpected events that have negative effects on investment outlook. Usually, they are used to refer to big-scale events that spook investors. Covid-19 is a typical example now. Investors are now increasingly worried that 2022 is going to be a repeat of 2020, with a wave of bad news bombarding the first quarter alone.

In this article, we will cover how black swans in 2022 might or might not affect Singapore’s real estate market. More importantly, we will talk about steps you can take to safeguard your capital and considerations you need to have before making any big investment decisions.

Potential Black Swans of 2022

Image courtesy Encyclopedia Britannica

No news is good news. But this year has been full of it. We will first give a list of potential black swan events in 2022, and then proceed to discuss the probability and severity of impact on Singapore’s real estate market. No one likes bad news; we are psychologically designed to avoid bad news. This is reason enough to discuss potential black swans in detail, so that we do not get completely blindsided if they really manifest.

-

Prolonged war in Ukraine & spillover conflicts

-

Famine & global food crisis

-

Energy crisis

-

New strains of Coronavirus & further lockdowns

-

Raging hyperinflation or stagflation

-

U.S. Fed Quantitative Tightening (raising interest rates, reducing balance sheets)

-

Crypto crash & rug pull on Metaverse

-

Stock market bubble

-

Evergrande debt crisis

-

Singapore’s new property cooling measures Dec, 2021

-

Coinciding Timing of Black Swans

Image courtesy The Guardian

These are a lot of events. Let us slowly unpack them. The biggest headline of the year so far is the war in Ukraine. The slew of sanctions against Russia that ensued had created huge macro implications for a few different markets. In general, the European populace are terrified of spillover conflict into the Baltic region or into central and western Europe. That is why de-escalation has been a priority in the west to make sure that the war does not spillover to their lands. If the war does spread, memes of World War 3 would not be so funny after all.

A potential famine is also along the way. Russia and Ukraine are major exporters of wheat which is a basic food product. Together they supply more than a quarter of the world’s wheat. With the conflict along with sanctions, the price of wheat has shot up by approximately 40% since. In addition to this, fertiliser prices have also risen because of sanctions on Russia (as they are a major exporter of fertilisers). This would push farmers to ration out fertiliser usage, resulting in lower crop yields. All together, these factors might lead to famine in some countries and at best, much higher food prices.

The energy crisis is also a problem due to sanctions on oil exports from Russia (again a major producer). Crude oil prices are very much elevated. If this energy crisis persists, high gas prices for your car will be the least of your worries. High energy prices will hurt the economy badly. Every single business uses energy in one form or another. From data centres, hospitals, restaurants, you name it. It will drive prices up and contribute to cost-push inflation (the bad kind).

Image courtesy The Japan Times

While most of us believe that the worst of the Covid pandemic is over, new Variants of Concern continue to make markets skip a beat every now and then. However, most countries are now better equipped (infrastructurally and mentally) to deal with a resurgence of Covid. Vaccines and other treatment technologies are also catching up. This makes a new variant less of a big deal but what investors fear more is the chance of a lockdown happening. Shutting down the economy or a city is a traumatic experience for the local economy. In most recent news, Shanghai has faced a 2-stage lockdown despite being an economic centre. This is bound to spook investors.

Inflation has also been the big talk of the town in 2022. It is the primary reason why the U.S. Fed is putting in place all its quantitative tightening measures. If inflation spirals out of control into hyperinflation, the purchasing power of the everyday person would be greatly diminished. It could lead to the collapse of currencies (unlikely) and also social instability. If the Fed decides to take the feet of the brakes, stagflation becomes another concern (higher prices, no growth). In general, the Fed faces a challenging dilemma: stop inflation and stunt the economy, or let inflation run rampant and the economy continue recovering from the pandemic.

The Crypto and Stock market crash is related to the Fed’s quantitative tightening policies but also because of their highly speculative nature now. It has reached the point where there are talks of it being similar to the dot com bubble (2000s crash). This is not entirely out of the question. Crypto performance has been closely correlated to the performance of the stock market. Both of them are risk-on assets; assets which investors are likely to purchase when they are more willing to take financial risk. These factors coupled with the U.S. treasury bonds yields inverting (10year minus 2year) signal poor investor confidence and uncertainty.

Image courtesy Flickr

A big scare we had in 2021 was the Evergrande default. Although this black swan did not really manifest in a “Lehman Brothers” style, it was enough to spook investors out of China’s property market. Generally, the Chinese government didn’t bail Evergrande out per se. What they did to avoid a $300 billion catastrophe from unveiling all at once was to give public assurance on the stability of the property market by cutting reserve requirements and releasing money into the economy to cushion the blow. However, if businesses continue to be overleveraged and can’t make good on their debts, it will take a toll on the Chinese economy. Banks will be more vulnerable to black swans that cause widespread panic due to the lower reserves that they have.

Last but not least, we have the 2021 new cooling measures in Singapore. In comparison to the other potential black swans, this might seem less significant in terms of scale and macroeconomic impact. Nonetheless, it has the most direct effect on Singapore’s real estate market out of all of these events. Generally, it puts a lid on the prices of private property and prevents it from ballooning. While economists think of it as a good thing (avoiding a property bubble), returns on real estate investments are going to be stunted for investors. Coupled with the current macroeconomic environment, growth might be muted.

That’s a whole lot of bad news that might potentially happen. It is a wall of worry that investors would have to climb over to stay in the market. Institutional investors and fund houses are holding larger amounts of money in cash. Perhaps, signalling in some sense, their confidence in the current market. The coalescence of all these potential black swans will be uncanny and deeply unfortunate. We definitely have our fingers crossed in 2022.

What does this mean for Singapore’s Property Market?

Image courtesy InvestAsian

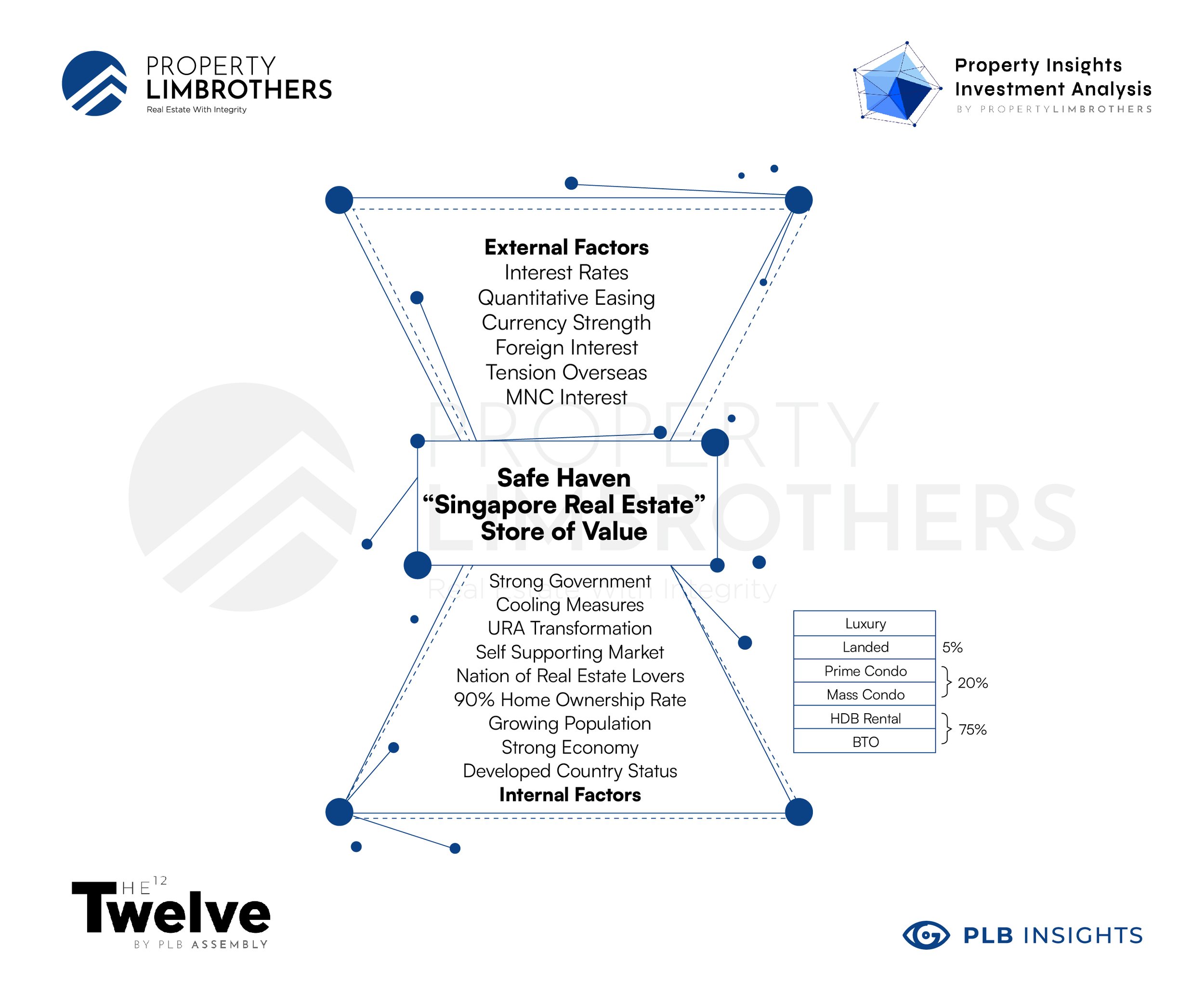

That being said, not all of these black swans directly impact the property market. By the time the ripple hits Singapore’s real estate market, its effects might be muted. Historically, Singapore’s real estate is driven highly by domestic demand and responds most strongly to cooling measures and new regulations. While it might be correlated to cycles of monetary tightening and easing, along with stock markets, it stores value well and has much less volatility (especially to the downside).

To sum up how those 11 black swans would impact Singapore’s property market, we draw a few generalisations. The global macro-outlook is poor. There are headwinds from geopolitical instability, rising commodity prices, and quantitative tightening. Overall, it suggests a down-cycle (recession) in the global economy. In this scenario, capital will usually sit in cash or in risk-off assets. However, bonds and fixed income options are looking to be less attractive with the recent sell-off triggered by the Fed. This leaves a lot of cash sitting in anxiety of what is to happen in 2022.

Usually, people might go to real estate as a store of value and hedge against inflation. However, the cooling measures coupled with rising mortgage rates might be too much for some investors to park their money in Singaporean property. The capital will also be locked up for a minimum of 3 years if they do not wish to pay the Seller Stamp Duty (SSD). All these factors put a cap on returns from real estate investment. In exchange for less volatility, the capital gets locked up with some uncertainty on the eventual return. Which is more attractive — Sitting in cash and wondering if the inflation situation will be kept under control? Or investing in Singaporean real estate with the risk of uncertain returns? To be honest, the decision is not as clear cut as we wish.

Thankfully, Singapore does have a safety net based on some internal and external factors. Singapore’s external outlook is still not terrible despite interest rates, quantitative tightening, and tension overseas looking to be very rough. The Singapore dollar remains strong. Singapore is also privileged enough to enjoy relative geopolitical stability. This might spark foreign interest and MNC interest in spite of the cooling measures.

As we mentioned earlier, the property market in Singapore is mainly driven by domestic demand. Strong governance means stable prices and sustained growth, which improves investor confidence in real estate as a reliable store of value. Generally, the real estate market in Singapore has withstood plenty of macroeconomic instabilities and black swans. With a nation of homebuyers that trust property as an asset class, the demand for real estate still stays strong.

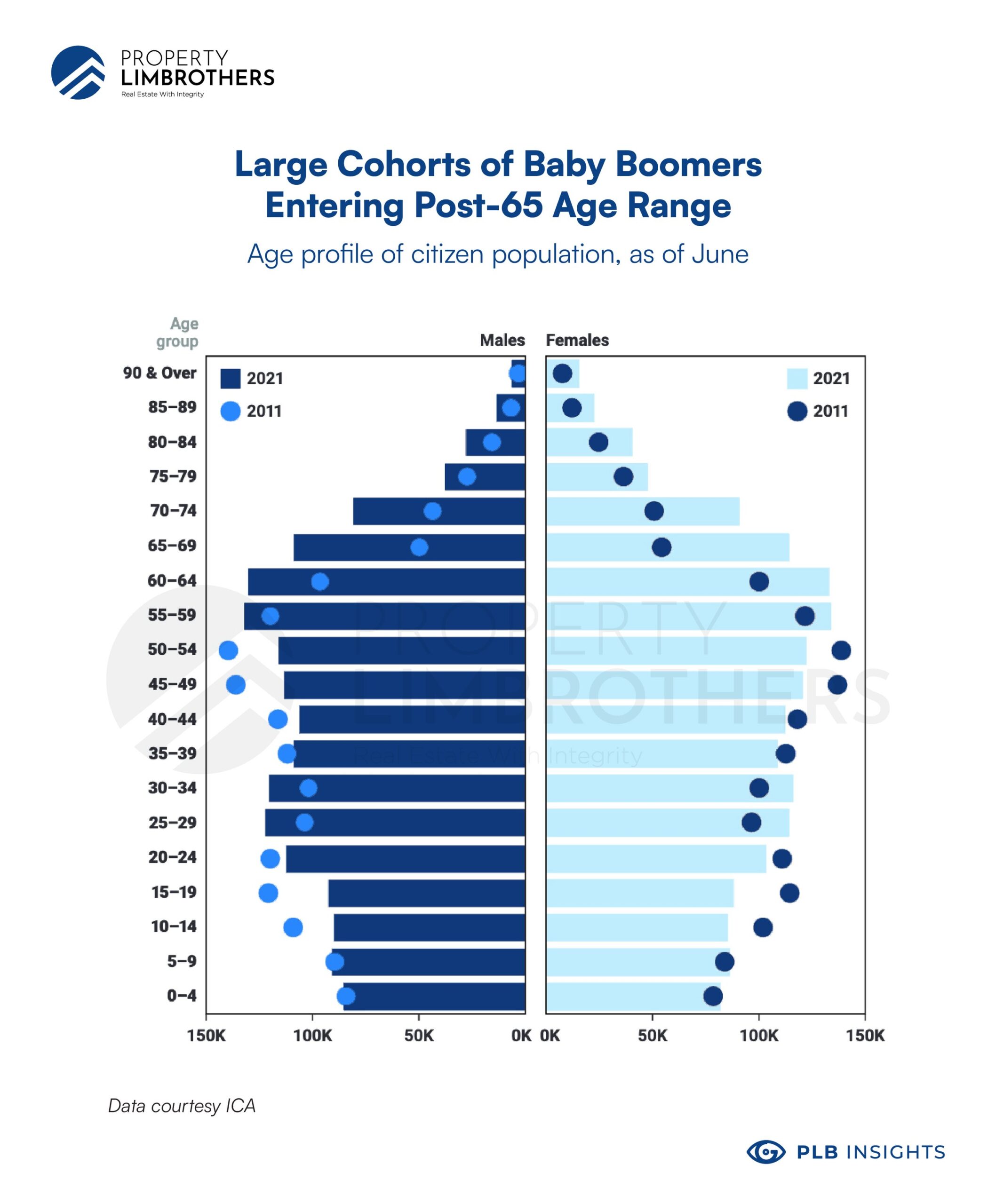

While Singapore’s population is ageing, there is still a case for a bull market over the next 5 to 10 years. Demographically, the millennial generation is what will hold up the economy (and the real estate market by extension). The bump in the population chart below (age group 20-39) serves as the key demographic that will continue to drive growth in the property market for the foreseeable future.

We expect Singapore’s real estate market to stay resilient despite these black swan events. Its resistance against global macro-headwinds can be attributed to the strong domestic demand for property. While this may be true for the next 10 years, it will be a growing concern moving into the next decade. With the ageing population, Singapore’s real estate market might open up more to foreign or corporate investors. This is to sustain and prop up prices. It is hard to predict what will happen exactly after 10 years but we suspect that global macroeconomic conditions will only step in as a major price determinant post 2030, when domestic demand is weaker and government regulations relax.

What does the price movement suggest?

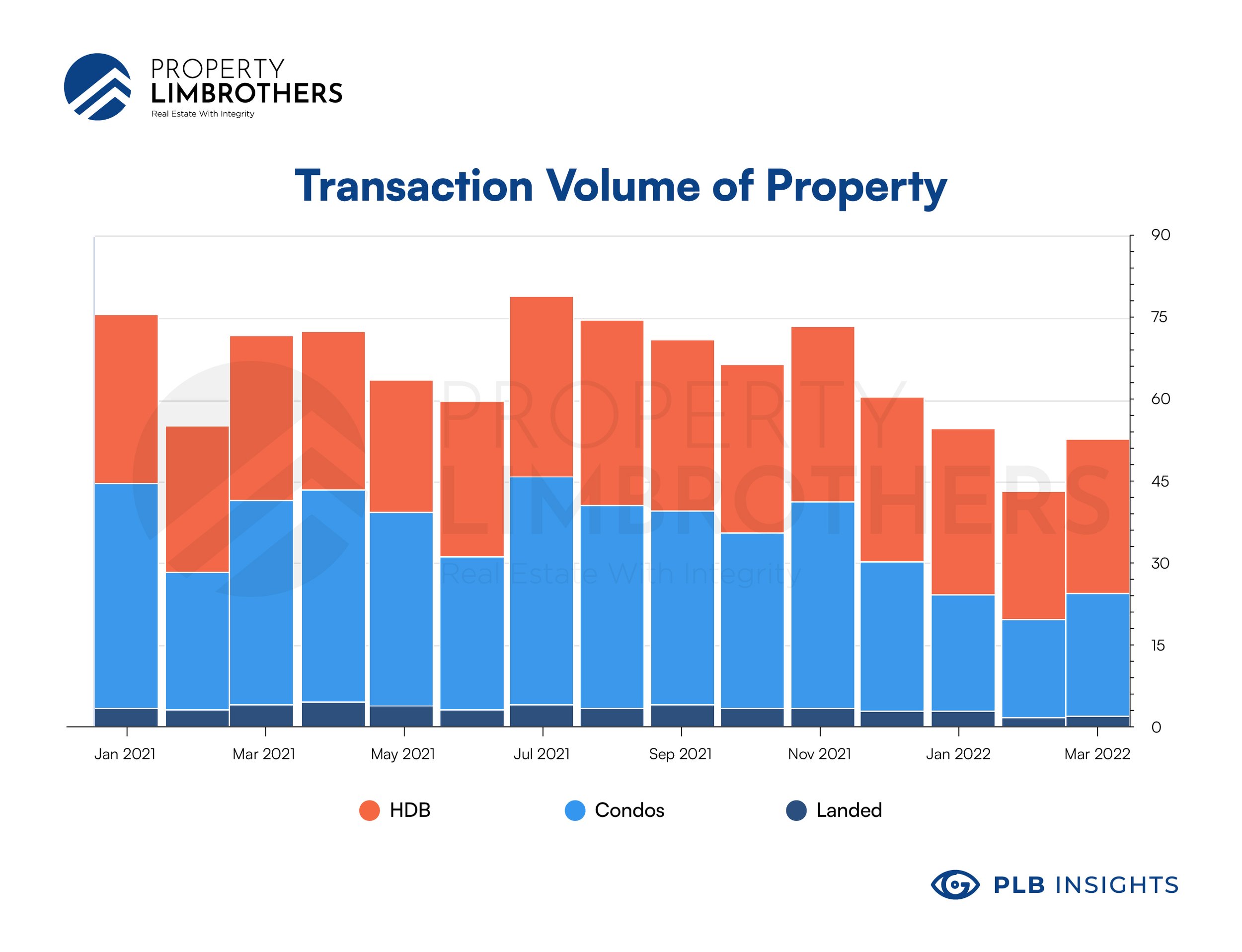

We now look at the price movement of various property classes over the past 15 months to see what they suggest (January 2021 to March 2022). Comparing three main groups of property (HDBs, Condos, Landed), we take a look at how the black swans have or have not impacted prices.

The general price trend suggests resilience against global macro headwinds. Prices have been steadily climbing with no significant drawdowns. Volatility is low, especially for HDBs. Among these three groups of properties, Condos experience the most price volatility and marginally less growth (4% less) over the past 5 quarters. To be fair, the performance of property has been modest and resilient. The cooling measure in Dec 2021 did not have much impact other than a slight dip in prices for Landed properties in Jan 2022. Overall, there are no strong suggestions that the property market is going south. At most, growth might be capped, but the general upward trend remains strong.

Transaction volume in the property market is slightly weaker than the previous year by an approximate margin of 20%. We do not pay much attention to the dip in February due to the seasonality factor of Chinese New Year. Despite a slowdown of transactions at the last two quarters of 2021, we see March 2022 close the quarter with some strength.

While prices do not reflect the complete picture of consumer sentiment, transaction volume tells us a different story. Even though prices are stable we can see that transactions have slowed. This suggests that buyers and sellers might be sitting tight to “wait and see” what ensues in the larger macroeconomic picture. This in itself should not pose a huge problem. In fact, it is better for individuals to be cautious and take decisions such as these seriously.

If anything, both price and volume suggest that holding power is not an issue for Singaporeans. There are few to no panic sellers. The government policies and stamp duties work its role of lengthening holding periods and stabilises the price movement in the real estate market. Due to this governance factor, we would truly have to wait and see before we see the macro impacts slowly unfold, if at all.

So… What should you do?

After all is said and done, what should you do? To be honest, you should still sit tight but not so much until you are waiting for the black swan to come to you. Be enterprising but cautious with your investment monies in 2022. Pay close attention to your own risk tolerance but also be brave enough to not sit on the sidelines while inflation eats away at your capital.

If you’re planning to time the market with your primary residence (your current home), we advise you to think twice before doing so. The timelines can be rather delicate and messy. You do not want to end up with a period being homeless, or paying more than what you should for your next place.

To ride out the uncertainties for 2022, you should do two things. First, know yourself better. What are your goals in your property journey? Do you have anything already planned this year? Next, you should have an impeccable game-plan if your answers to the past 2 questions is “yes”. What is your exit strategy? Can your finances take it if the market goes against you? These are important questions to ask yourself before starting the process.

If you like what we’ve discussed thus far and want to get in touch, reach out to us here.