As the U.S. reintroduces sweeping tariffs under President Donald Trump’s administration, the global trade ecosystem finds itself once again under pressure. With blanket 10% import tariffs and higher duties for specific nations—including China (54%), Vietnam (46%), and the EU (25% on steel and cars)—a new era of economic fragmentation may be taking root.

The question is, what does this mean for Singapore’s real estate—particularly one of its most inelastic, prestigious segments: pure landed homes?

Trade Tensions, Uncertain Capital: A Global Reality Check

Tariffs disrupt not just pricing but capital flow, supply chains, and investor sentiment. As manufacturing shifts and trade routes evolve, multinational companies may rethink regional HQs or expansion plans, triggering knock-on effects on local office, logistics, and housing demand.

For global investors, volatility fuels a flight to safety. Political risk, inflation, and currency devaluation push them toward stable, rule-of-law jurisdictions—where wealth can be preserved even if not dramatically grown.

Why Singapore’s Pure Landed Market Remains Steady

Singapore isn’t immune to global economic winds, but it stands uniquely resilient. The pure landed housing segment, in particular, is unlikely to overheat or collapse, thanks to a combination of fundamentals:

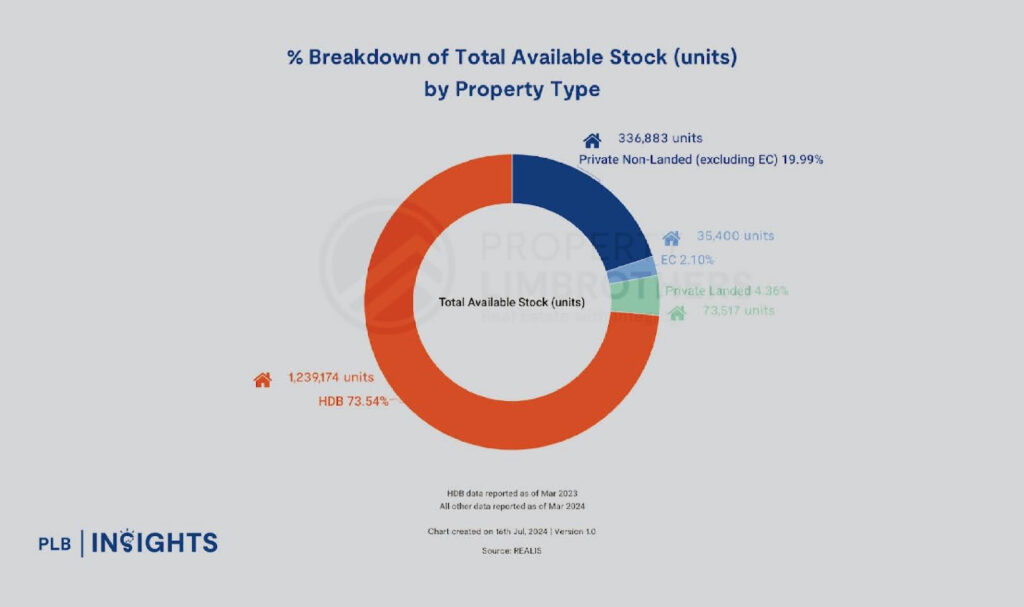

Inelastic Supply

Only about 73,000 pure landed homes exist—less than 5% of total housing stock—and this figure has remained largely unchanged for years due to zoning restrictions and long-term planning. There is no meaningful new supply pipeline, making this an ultra-rare asset class.

Strong Local Demand

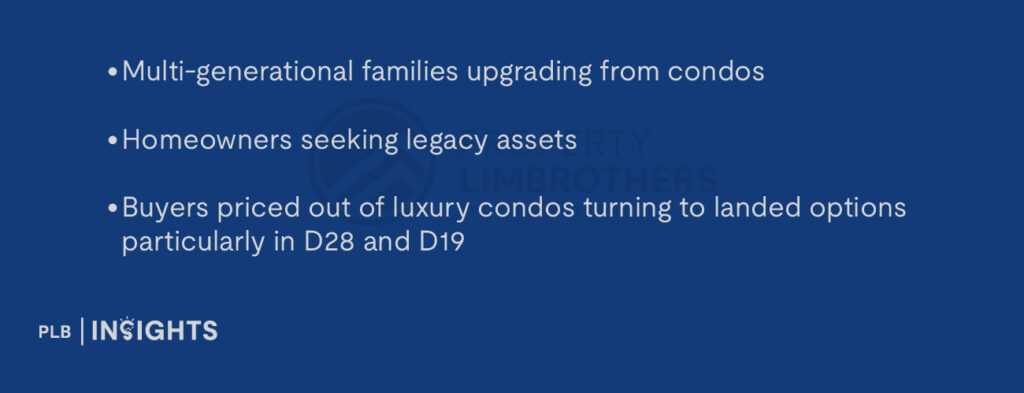

Foreigners face a 60% ABSD on landed homes, while PRs require special approval, effectively limiting demand to Singaporean citizens. But that demand remains healthy—driven by:

High Holding Power

Landowners in Singapore, especially those in Districts 10, 11, 15, 19, and 28, are typically high-net-worth individuals with no urgency to sell. Most are long-term occupiers, not speculators. This ensures price resilience, even during downturns.

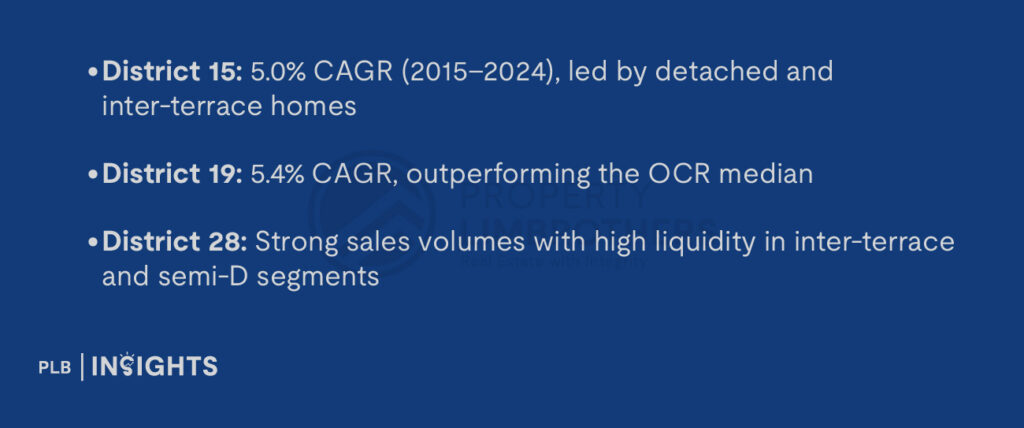

Historic Growth Patterns

Since 2015, pure landed home prices have seen consistent growth:

Even during the global pandemic and interest rate hikes, prices in most districts held steady or rose modestly, demonstrating exceptional durability.

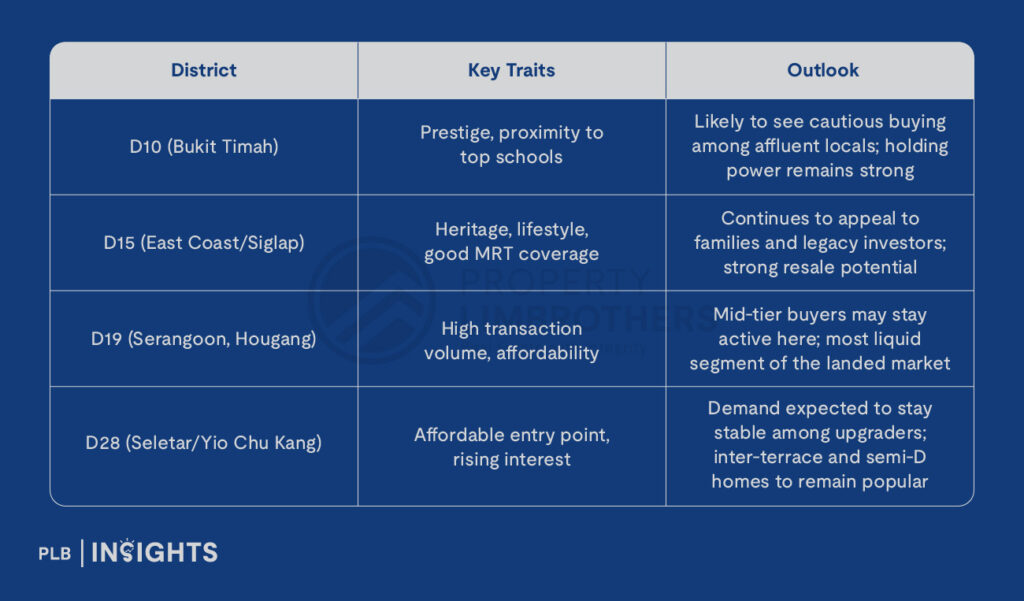

How Will Different Landed Districts Respond?

Let’s explore how the market outlook varies across key landed enclaves:

What Buyers and Investors Should Expect

Short-Term: Flat to Gradual Price Movement

Mid-Term: Selective Recovery

Long-Term: Solid Wealth Preservation

Final Thoughts: Not a Market That Roars—But One That Endures

In an age where markets can surge or sink on geopolitical whim, the Singapore pure landed home market isn’t about hype—it’s about its staying power.

It won’t skyrocket overnight. But it won’t collapse either.

If Trump’s tariffs do lead to economic realignment, Singapore’s clear governance, inelastic supply, and citizen-driven demand will continue to anchor its landed housing segment. For those who can afford the entry, landed homes remain one of the most stable places to park long-term capital—not just in Singapore, but globally.

Navigating Singapore’s landed property market doesn’t have to be daunting. Our experienced consultants are here to provide personalised guidance and expert insights, ensuring a smooth journey to finding your ideal home. Whether you’re seeking a legacy investment or a dream property for your family, we’re ready to help you make the right choice. Contact us today to turn your aspirations of owning a landed home into a seamless and rewarding reality.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.