Most of our articles take a strong focus on the local property market for what it is. To broaden this view, we have put out articles comparing Singapore’s real estate market with those of other countries. We have laid out an overview of the real estate market in Asia, how the rental market in Singapore compares to the rest of the world, the Evergrande crisis and Singapore as an investment destination, and how to buy real estate in Singapore as a foreigner. These articles set the stage for a deeper look at Singapore as an investment destination for luxury properties.

In this article, we look at how Singapore has performed consistently as a preferred destination for real estate investors. We look at some of the takeaways from corporate reports and translate them down to what it means for Singapore’s Luxury Property Segment.

Leaderboards for Real Estate Investing

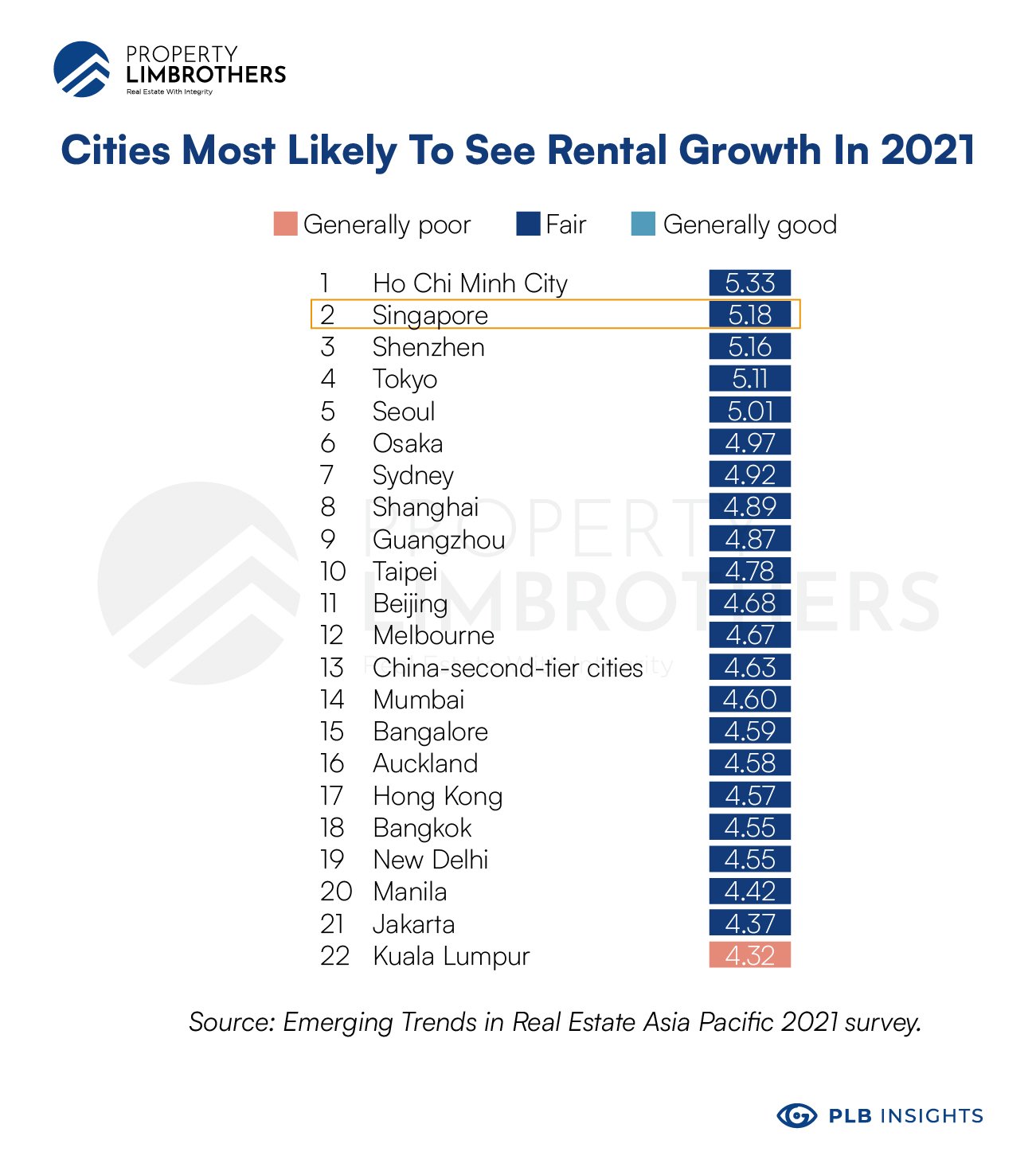

In real estate, choosing the right location has been the singular focus. According to the PWC – Urban Land Institute’s 2021 report on the emerging trends in Asia-Pacific Real Estate, Singapore is the foremost choice in HNW investors minds. Singapore is ranked number 1 as an investment prospect and has the best city development prospects. Singapore also ranks number 2 on the likelihood of rental growth.

This is in no small part due to excellent city planning by URA and cooling measures that keep real estate investment sustainable by preventing bubbles from forming. Strong stability factors on geopolitics and natural disasters further add to Singapore’s appeal to investors both abroad and at home.

Overall, Singapore has a great track record among property investors across the world. In the past 4 years, Singapore has come in consistently at top 3 in terms of its investment prospect ranking. This consistency in terms of being a quality prospect means that Singapore is much better positioned to have a resilient property market, with its geopolitical stability and sound statecraft.

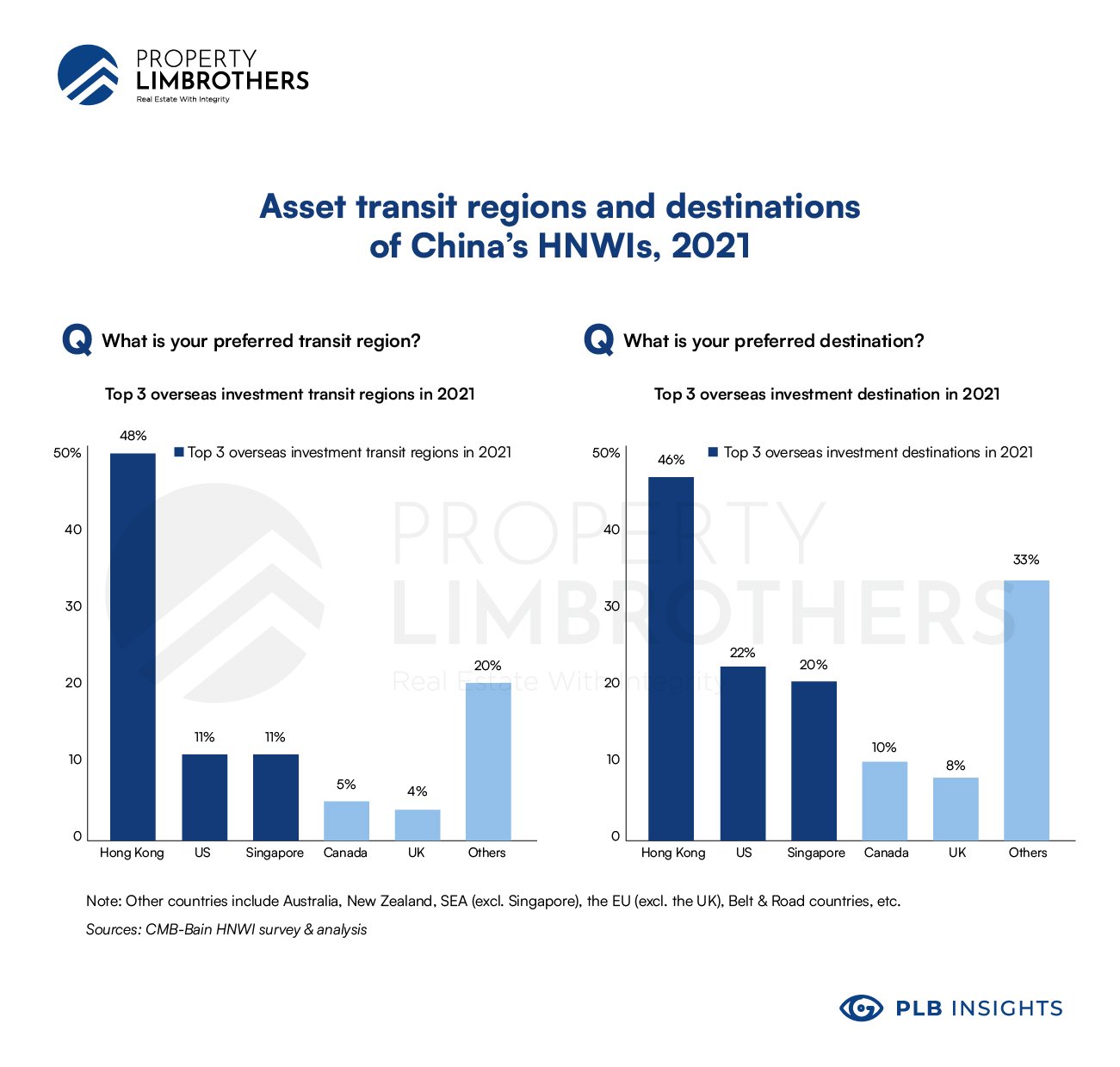

On top of being ranked as a quality investment, Singapore also has a geographical advantage. As an investment transit location and an investment decision itself (chart below), Singapore ranks top 3 for China’s HNWIs. With Hong Kong dropping in the ranks as an investment prospect in the table above, we expect that Singapore will soon surpass the U.S. and potentially Hong Kong as an investment decision for Chinese investors. We expect the foreign demand for Singaporean real estate to be strong despite government cooling measures due to its appeal as a safe haven for taxes and global-regional instability. In fact, active regulatory action at planned intervals that ensures the sustainability of long-term growth is a benefit not to be understated. It is a rare policy stance that we do not see in other destinations.

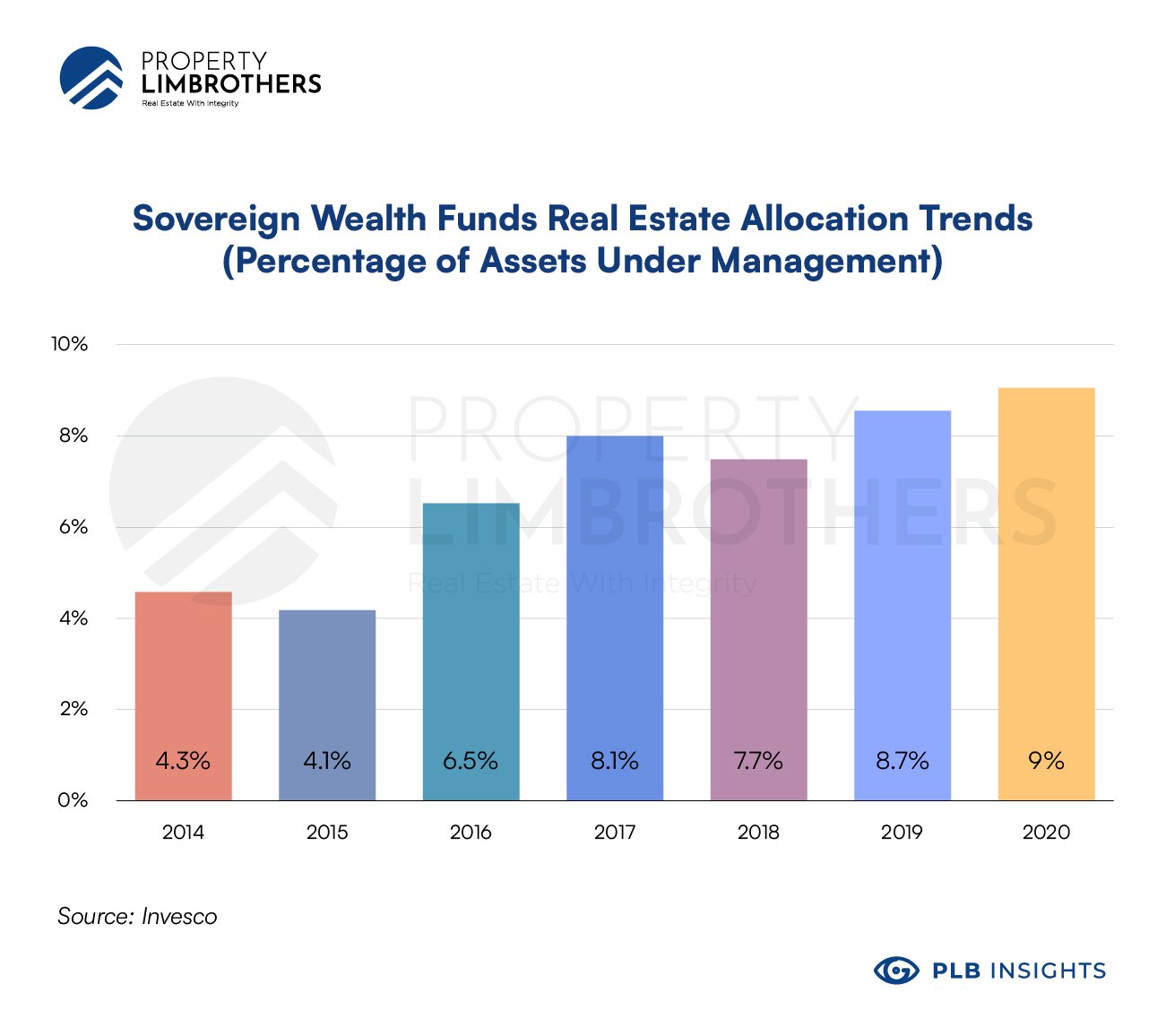

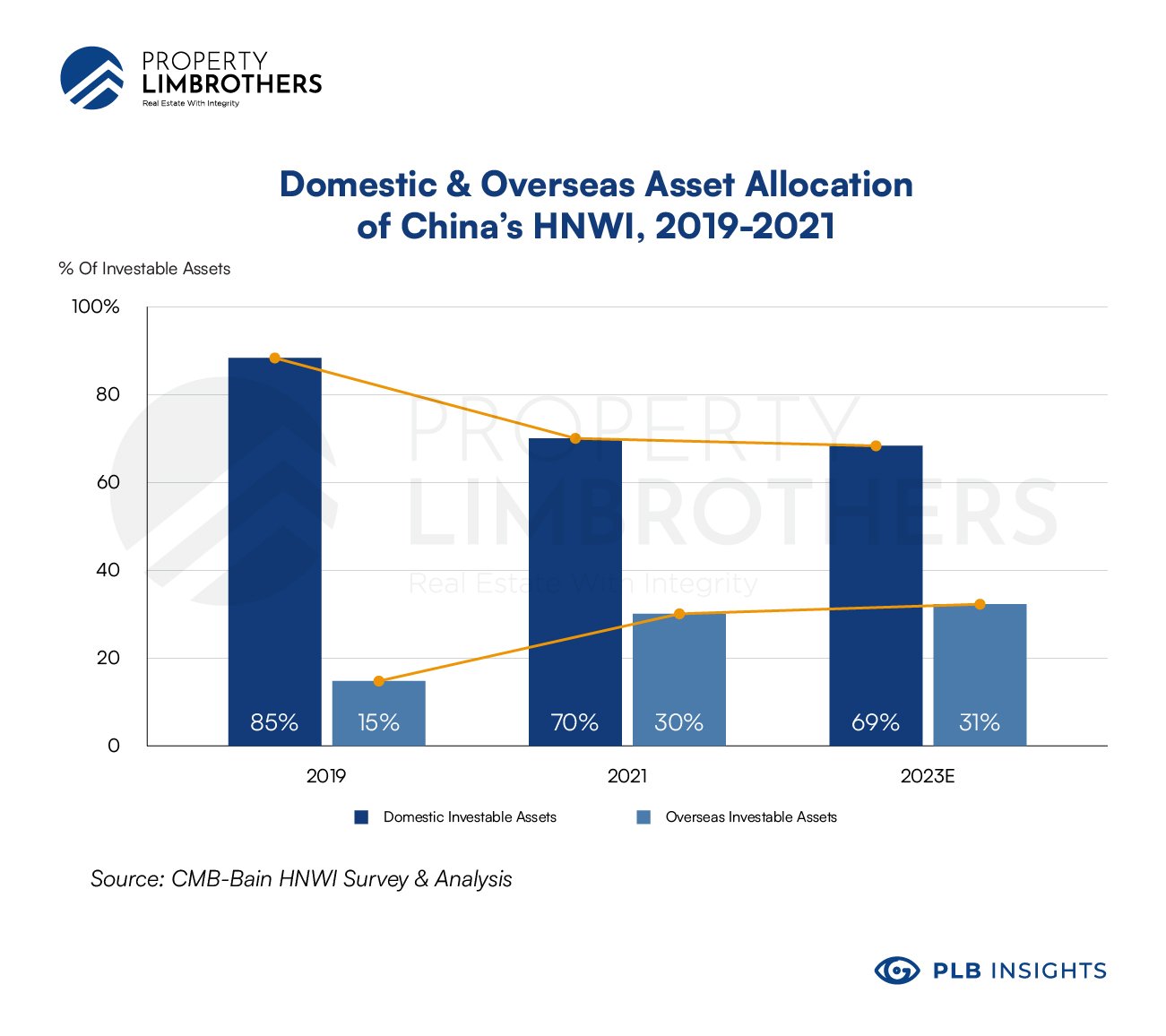

Singapore being a top 3 choice, according to the 2021 CMB–B&C survey, is going to set Singapore up to be in a great position to benefit from increased asset allocations to real estate by Chinese HNWI and Global Sovereign Wealth Funds. Chinese HNWIs have doubled their asset allocation from domestic to overseas (15% to 30%), the pandemic seems to have accelerated the transition to investment abroad. Sovereign Wealth Funds have a total estimated AUM of US$ 10.5 Trillion (Statista, 2021). We see a positive trend for their asset allocations into real estate.

Based on the information we have discussed thus far, Singapore is in an excellent position to benefit from global inflows of capital into its real estate market. Its outlook is still exceptionally bullish and resilient despite the global financial headwinds from rising interest rates, commodity prices, and geopolitical instability.

Market Sentiment in Singapore’s Property Market

The bullish case is supported by Morgan Stanley, along with our own research at PropertyLimBrothers. Morgan Stanley’s bullish case for Singaporean real estate will see prices double from 2018 to 2030. Strong GDP growth, investment outlook, foreign talent inflow, and controlled supply of land coupled signals strong fundamentals for growth over this decade. The market expects and prices in regular cooling measures, preventing demand from getting euphoric and speculative.

This puts the aggregate property market at approximately 6% Compound Annual Growth Rate (CAGR). Despite the COVID-19 pandemic, the bull case still stands with caveats to a decline in commercial real estate rentals. Nonetheless, we expect reasonable capital gains based on the healthy growth rates in price in spite of the pandemic and macroeconomic headwinds.

In PropertyLimBrothers, we have focused our attention on the Luxury Property Market in Singapore as one of the best segments to invest in. We define this segment as premium condominiums, landed property, and good class bungalows (GCBs) typically found in District 9, 10, 11 with price per square ft (PSF) of SG$3000-6000 and above. These properties are usually freehold, with a quantum of SG$5-20 million and up. These properties will be found in areas like (District 9:) Orchard Road, River Valley, Cairnhill, (District 10:) Tanglin Road, Farrer, Holland, Bukit Timah, Ardmore, (District 11:) Thomson, Watten Estate, Novena, and Newton.

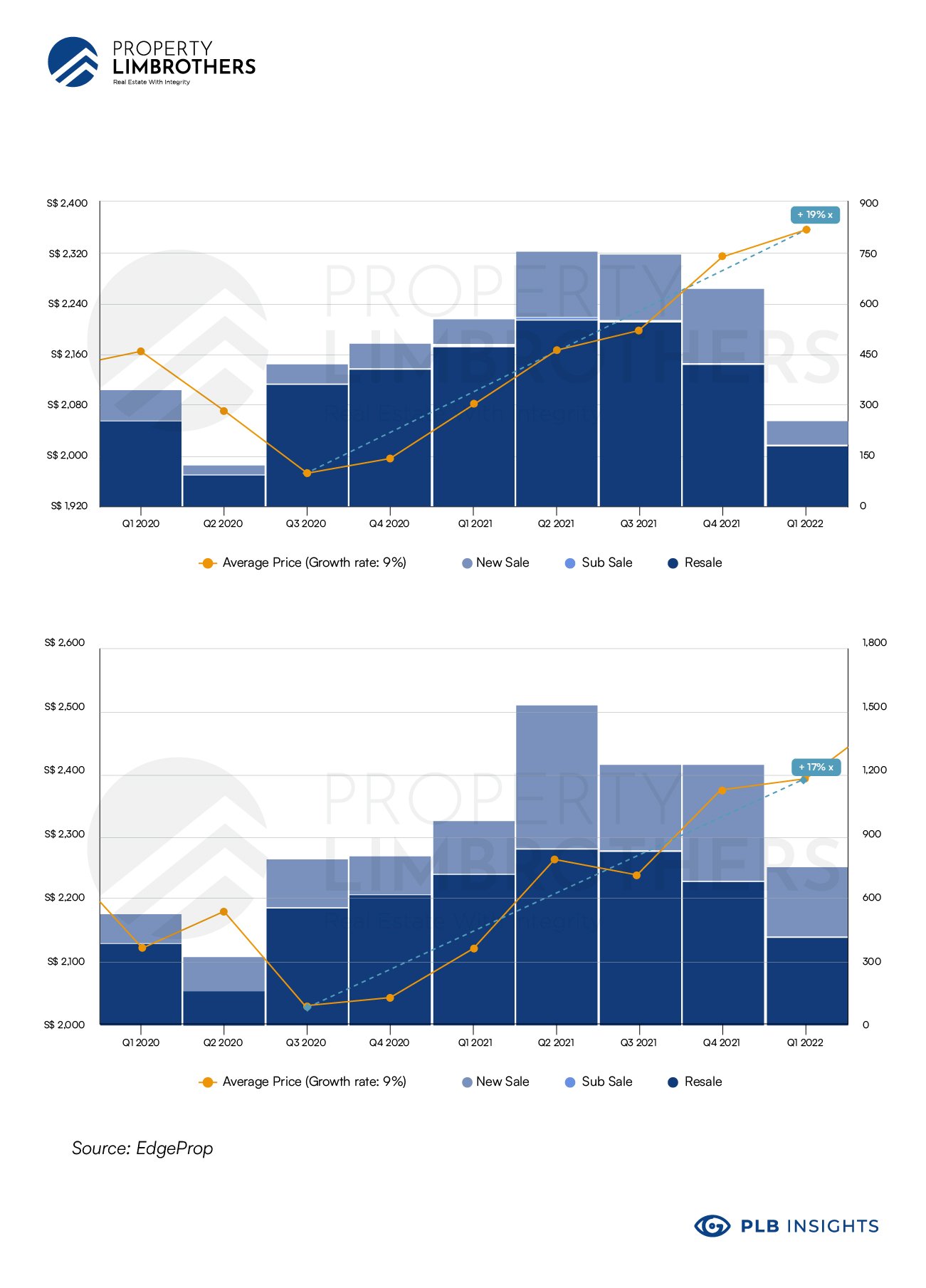

Looking at the general price trend for private condominiums and landed properties in District 9, 10, 11, the luxury property market has made a great recovery. From the past 2 years we see a simple average annual growth rate of 5.5%. However, when we look at the recovery momentum from Q3 2020 to present, prices have grown a tremendous amount at 17% over the past 7 quarters.

In contrast, Singapore’s aggregate performance for the entire property market is a strong 21% over the past two years. We see the luxury market perform a lot more consistently with a healthier upwards trend. Strong macroeconomic fundamentals support this move, with a trend of HNW migrants coming into Singapore for both residential and commercial purposes.

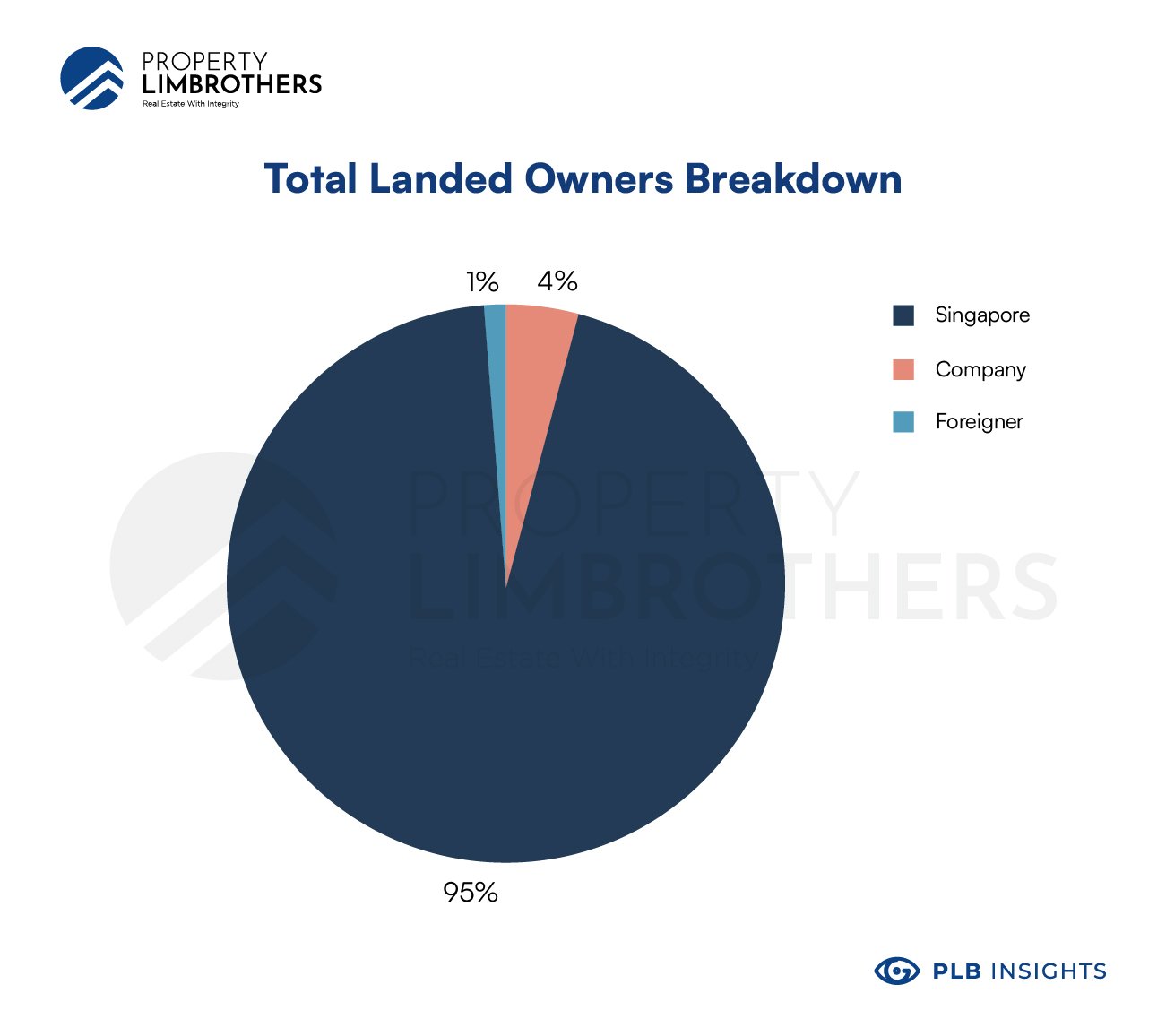

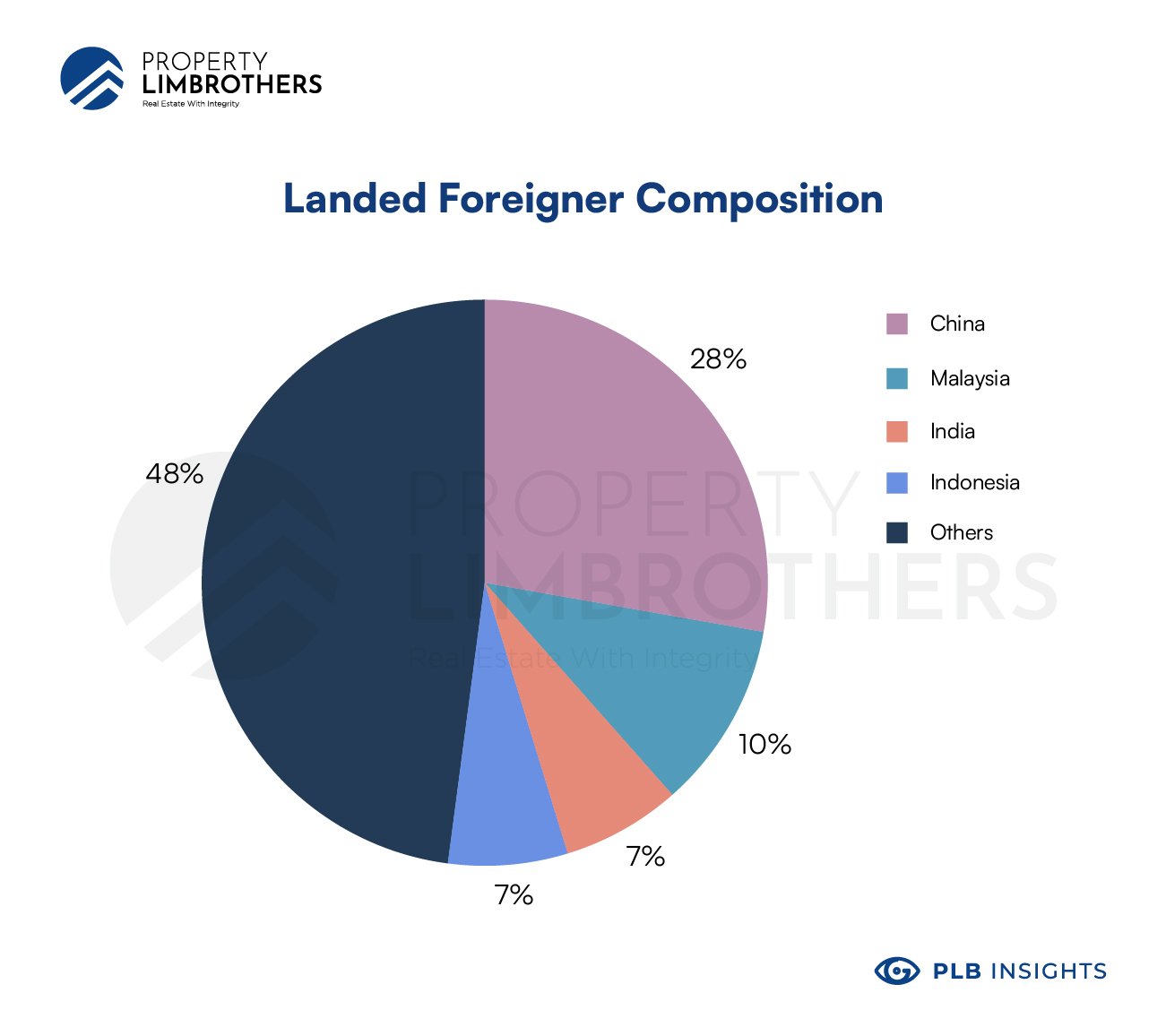

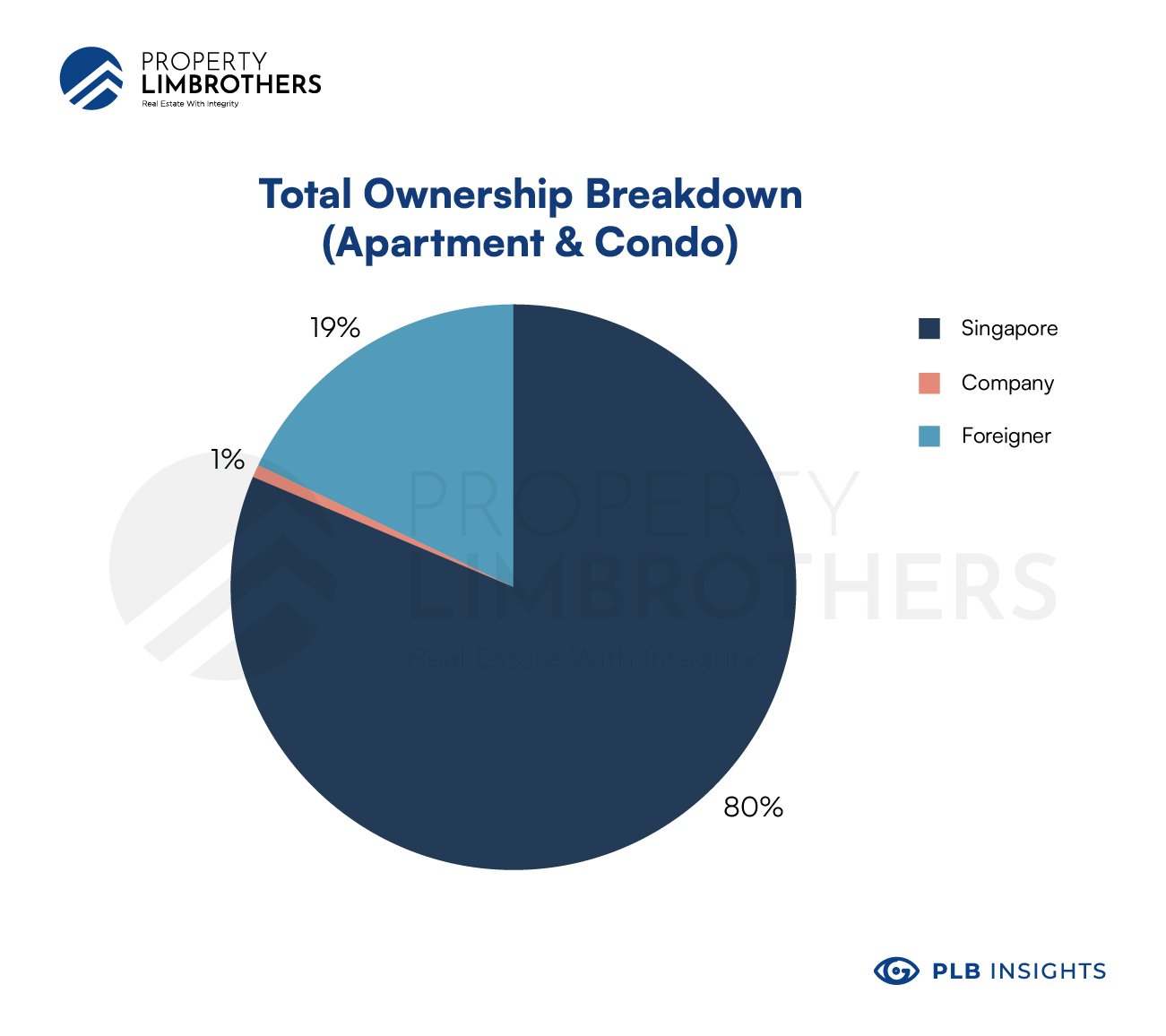

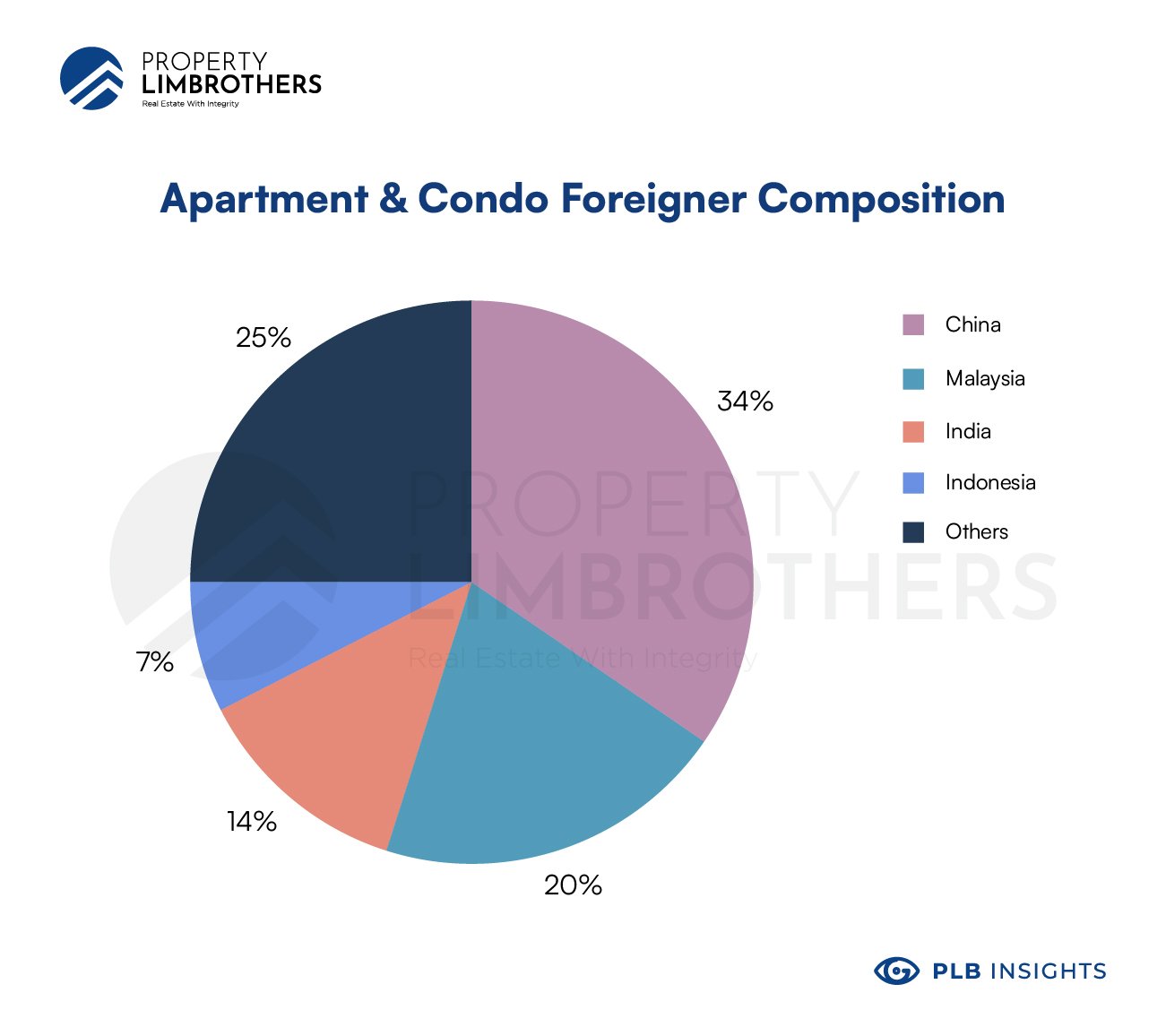

We now compare the breakdowns of foreign investment into the landed and apartment-condo segments. We see that foreign interest in landed property (1%) is much lower than in apartments & condos (19%). Part of the reason might be government rules requiring foreigners to obtain approval from the government prior to being able to purchase landed properties. We also see that foreign ownership is more diverse for landed property (48%) than for apartments & condos (25%). A key demographic we wish to highlight is also the presence of Chinese investors in the landed properties (28%) as opposed to apartments & condos (34%). This might be due to the strict LDAU approval criteria by the SLA to buy Landed properties in Mainland Singapore.

Over the course of the decade, we expect to see this landed property segment experience seeing more foreign interest with Chinese investors leading the charge. This is provided that the government policy does not become more adverse to foreign capital.

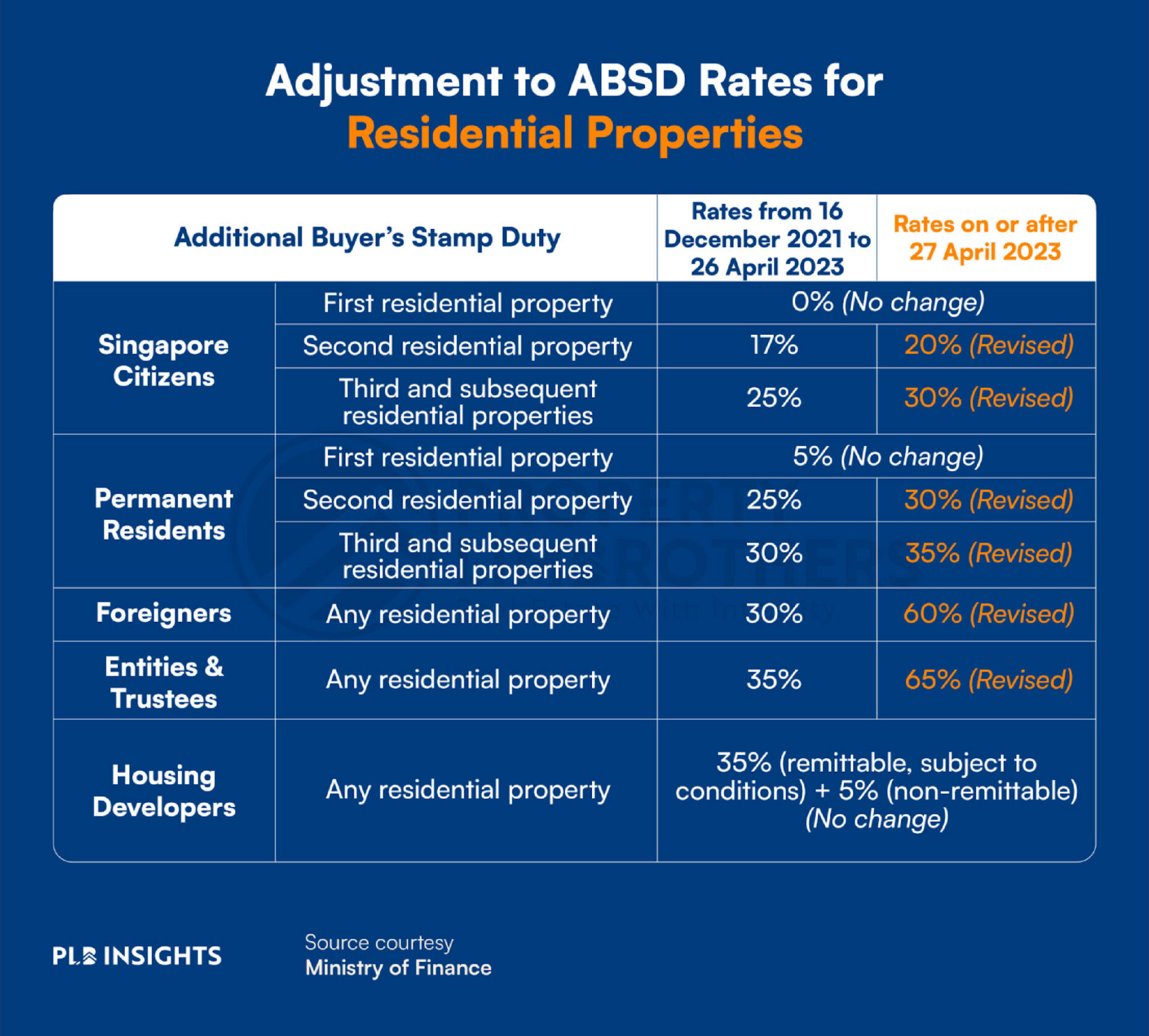

At this juncture, we would like to remind you of the likely impact of the latest 27 Apr 2023 ABSD changes for foreigners and developers on the luxury market. ABSD for foreigners buying residential properties has doubled from 30% to 60% since 2021. Developers are also hit by a 30% increase in ABSD (from 35% to 65%). This will likely price out many investors looking to invest in Singapore, creating a selection effect on wealthier foreign investors. By extension, this could drive up foreigner demand for luxury properties in Singapore. Foreign investors who are priced out of the residential property market could go to commercial property as an ABSD-free option.

The low foreigner interest in Singapore’s Landed property scene might be due to LDAU approval required for purchase. Nonetheless, the current foreigner ownership at 1% is a modestly low level and can see potential rise in the coming years depending on URA policy.

Closing Thoughts

Singapore is a good prospect as an investment destination for luxury properties. It tops the leaderboards for investment, development and rental metrics. Strong policy factors back up the strengths of this choice. Looking at how capital is flowing from Chinese HNWI and sovereign wealth funds, the real estate market as a whole might see more capital (foreign or local) flowing in. This will propel the real estate market to new heights, despite global macro headwinds.

Whether you’re a local or foreign investor, we’re here to help you. If you like our content and wish to discuss more about how it relates to your portfolio and investment needs, feel free to reach out to us here for consultation.

Disclaimer: The information provided in this article is accurate as of the date of publication and is based on the rules and regulations concerning stamp duty rates and taxes in effect at the time. While we strive to update our past articles diligently, please be aware that tax laws and regulations can change frequently, and it is essential to verify the most current rules and guidelines from the relevant government authorities or consult with a qualified professional for the latest updates and accurate advice.