2021 proved to be a banner year for both the Good Class Bungalow (GCB) and luxury condominium market segments, even when it has been a year full of uncertainty in Singapore’s market outlook. With property transaction prices and volume hitting record highs in 2021, both market segments have had robust performances heading into 2022.

Fast forward to the third quarter of 2022, market momentum has considerably slowed. As the U.S. Fed signals further interest rate hikes within the near future to stamp out inflation, this has pushed borrowing costs to the highest levels since pre-covid times, along with fears of recession looming ahead. Nonetheless, Singapore’s real estate market outlook remains positive for the remaining of 2022, with the average transacted unit price based on land area for GCBs continuing to trend upwards from $1,685 psf in 2021 to $1,967 psf in May 2022, based on data retrieved from PropNex Research and URA Realis.

Zooming into the luxury condominium market, the tremendously exclusive penthouses that sit at the very top of the pyramid of luxury living (literally so) are known as super penthouses. This asset class has matched the unfathomable prices that the GCB asset class commands. For the avid reader, this then begs the question – Which is the superior asset class in Singapore?

What are GCBs?

GCBs are the pinnacle of real estate in Singapore, and two specific sets of criteria distinguish this bracket of landed homes: the Locational and Parameter Criteria. Essentially, only detached homes located within the 39 GCB Areas in Singapore are considered GCBs. These detached homes must also adhere to the land plot size, width, depth, height and site coverage parameters, all of which you may find in detail here.

GCBs are Rare, but Super Penthouses are Rarer

In 2021 alone, a total of 88 GCB transactions were recorded with a total transaction value of S$2.55B. There are only about 2,800 GCB land plots in Singapore, with most being freehold in tenure.

In comparison, only six super penthouse transactions took place between 2006 and Q1 2019, and four more recorded between 2020 to Nov 2021, making up a total of only ten super penthouse transactions within the past 16 years. This includes the sole super penthouse unit located on the 48th level of the highly coveted Canninghill Piers, a luxury condominium that will be part of an integrated development along River Valley Road, expected to be completed in 2025. Super penthouses are mostly 99-year projects, and while there is no specified number of super penthouses in Singapore, this asset class is undoubtedly few and far between because technically, there can only be one super penthouse per tower. With its immense size, panoramic views, and avant-garde fittings and furniture, the rarity of super penthouses means that they are often suitable investments. Even if the residential market plunges, super penthouses will likely hold their value because owners and developers possess the holding power and can lease them out for high rental prices until demand returns.

For GCB and Super Penthouse Buyers, Money is Not a Concern

Looking at the current GCB market landscape, GCB purchasers are principally made up of a growing Singaporean ultra-rich population and newly-minted rich businesses and entrepreneurship that have burgeoned with the rapid acceleration of technology and globalisation.

Likewise, super penthouse buyers in Singapore are predominantly sought by foreign Ultra-High-Net-Worth-Individuals (UHNWIs) and wealthy families. However, the regulatory nature of Singapore’s real estate market means that even the wealthiest of foreign UHNWIs are not able to acquire a GCB property as they are non-Singapore Citizens.

Like private residential landed homes, only Singaporeans or Singapore entities can purchase and own GCBs. However, some exceptions are given to Singapore Permanent Residents, only with approval from the Land Dealings Approval Unit (LDAU) under the Singapore Land Authority (SLA). Under the Global Investor Programme (GIP), there is a path for eligible global investors or businesses to attain permanent residency if they drive substantial growth and contributions into Singapore’s economy.

On the other hand, foreign investors and UHNWIs predominantly make up the bulk of super penthouse purchases as there are no such restrictions when purchasing non-landed private residential developments.

Some of the most notable super penthouse transactions between 2006 to Q1 2019 include the super penthouse unit in Sculptura Ardmore, which was bought for S$60M by the Co-Founder of Facebook, Eduardo Saverin, and the one in Le Nouvel Ardmore purchased by the Co-Founder of Alibaba, Sun Tongyu, for $51M.

Because there is a tangible scarcity of supply for these two classes of properties in Singapore, keen investors and purchasers would view the future potential of these properties more confidently in anticipation of future growth. To these affluent groups of buyers, money is not a concern as they have an optimistic view of the potential upsides, and therefore they generally react more positively towards the prices of these properties. Thus, it is tough to rationalise the sky-high quantum prices associated with GCBs and super penthouses because both types of properties have very distinctive attributes that make them particularly sought-after.

Therefore, GCBs can naturally preserve their exclusivity and rarity due to strict ownership and supply regulations. Unsurprisingly, this has positive spillover effects into the super penthouse market as foreign investors who want to invest in a rare asset like GCBs but are unable to will then go for the next best alternative, super penthouses. These buyers will be more concerned with seeking for the highly coveted super penthouses in terms of location, size, views, luxury finishes, privileges and more.

Foreign Investors are Attracted to Invest in Singapore’s Properties Due to its Stable Economy

Of the 11 of the world’s super penthouses on the market in 2019, 6 are situated here in Singapore. With the majority located in Singapore, each super penthouse transaction here is a mark of confidence in Singapore’s economy and signals a new wave of wealthy investors and family offices who fancy making Singapore their next home. This is testament to how stable and resilient Singapore’s economy is against others much larger in size and market capital due to its strategic geographical location, modern infrastructure and a strong pro-business governance. With 8 super penthouses on sale in 2022, Singapore remains one of the top investment destinations for global investors.

Foreign Investors Buy Singapore Properties Based on their Lifestyle Needs

When purchasing properties in Singapore, foreign UHNWIs and families look towards properties that cater to their lifestyles. For instance, should foreign investors still prefer to own a landed home in Singapore, there is only one alternative: the 99-year leasehold landed homes in Sentosa Cove, which foreigners are allowed to buy. On the contrary, some foreign investors are already owning several landed properties in other parts of the world. Coming to Singapore, they would prefer to enjoy the high-rise life here. So, these buyers will naturally look towards super penthouses as they offer a similar luxury of space as a landed home, with the bonus of stunning cityscape views that landed homes do not offer, hence getting the best of both worlds.

GCBs: The Epitome of Exclusivity and Serenity

GCBs and super penthouses enjoy the best intangible attributes: complete privacy, exclusivity, rarity and prestige, albeit in different forms.

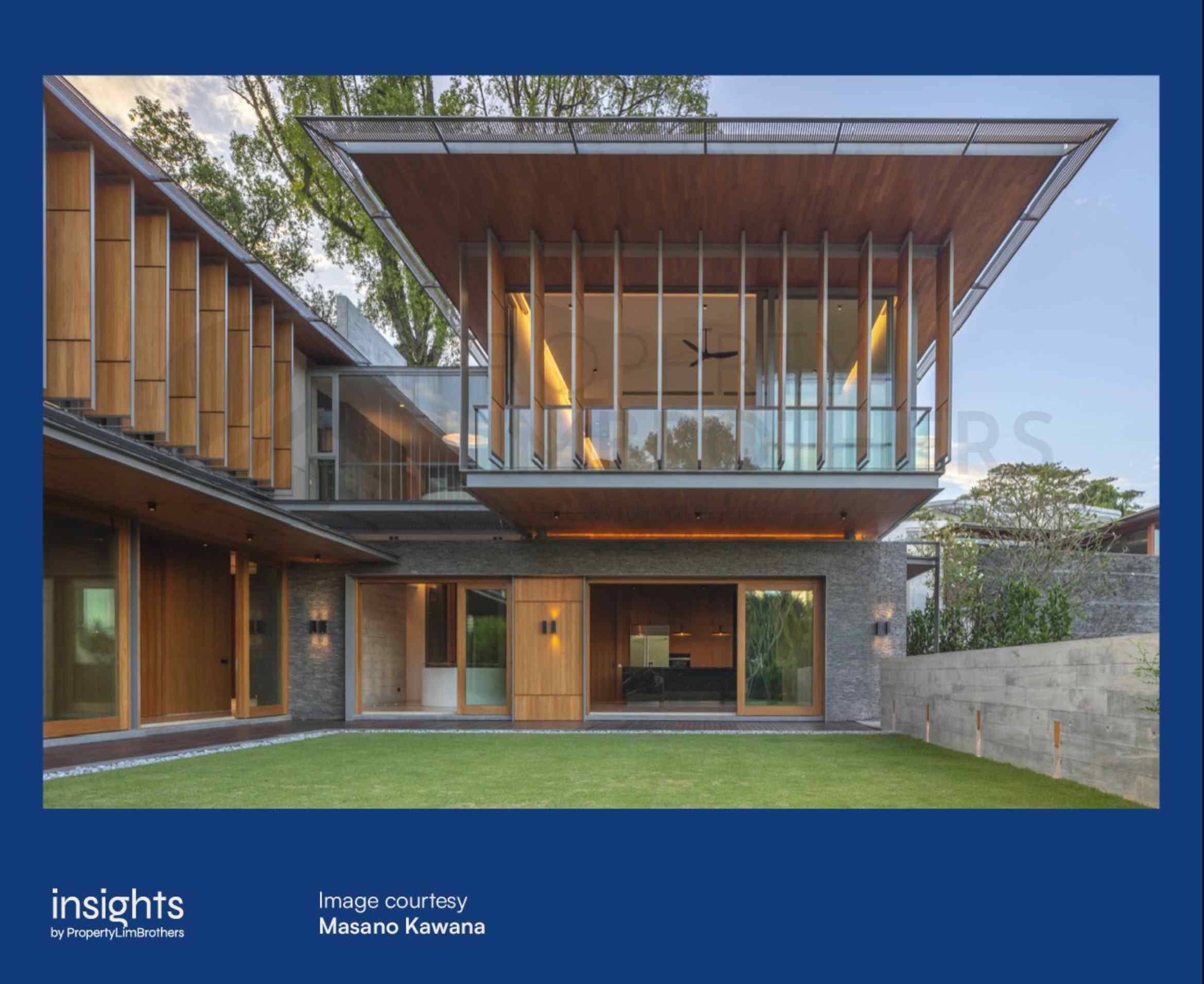

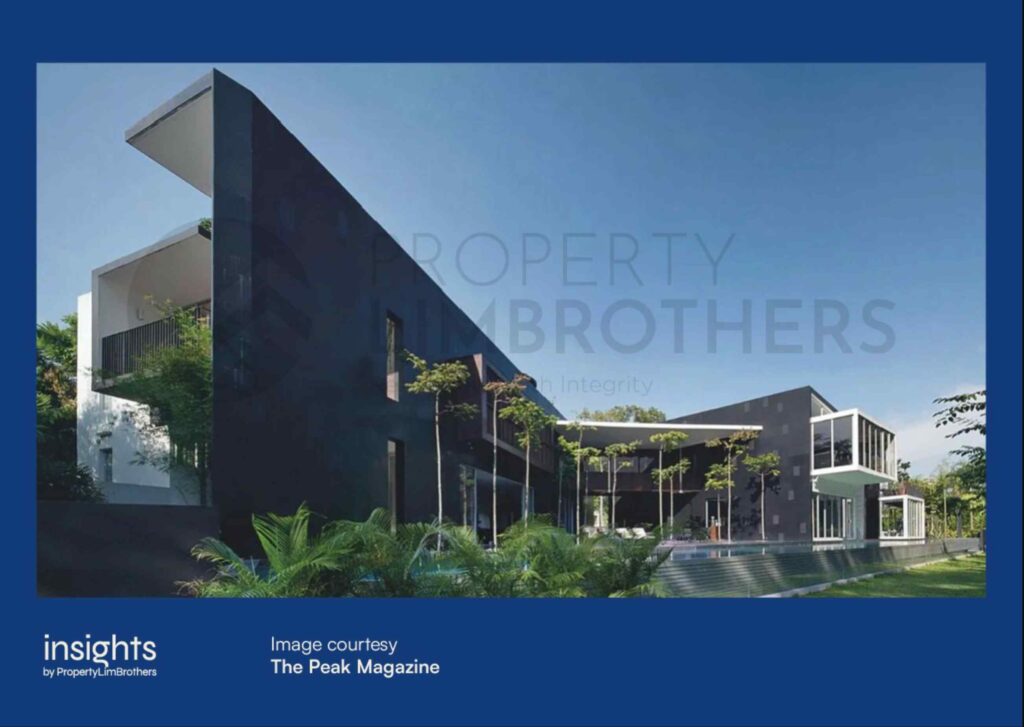

For GCBs, the novelty factor comes from their inherent attributes. Nestled within GCB Areas tucked away from the hustle and bustle, GCB owners are blessed with the surrounding peace and tranquillity. These nationally gazetted GCB Areas are generally situated only within the prime residential districts of 10 and 11, and the landed estates of Districts 20, 21 and 23, all within Singapore’s Prime Hexagon. The address of the GCB is also eminently paramount because the address’s name defines the GCB’s prestige. GCB Areas like Nassim, Queen Astrid Park and Cluny Hill are home to the most prestigious GCBs in Singapore.

Another inherent attribute contributing to a GCB’s novelty factor is the luxury of land space. Even though there are strict parameter guidelines to adhere to, GCB owners can design and build their dream homes tailored specifically to their tastes and preferences, thus fostering originality and character in each GCB’s architecture. Furthermore, as GCBs sit on larger land plots, there are naturally fewer neighbours within the GCB enclave. This implies less traffic and footfall within the enclave as the neighbours are likely to be the only ones commuting past, which forms the sense of exclusivity and privacy.

Super Penthouses: Space with a View

Super penthouses get to enjoy these intangible attributes contrastingly and their locations are not pale in any comparison. Located in prime city centre addresses, these penthouses offer space with a view. With the luxury of space and size, plus the ability to enjoy spectacular views from a high vantage point overlooking the visible horizon, this is one thing GCBs will not be able to offer.

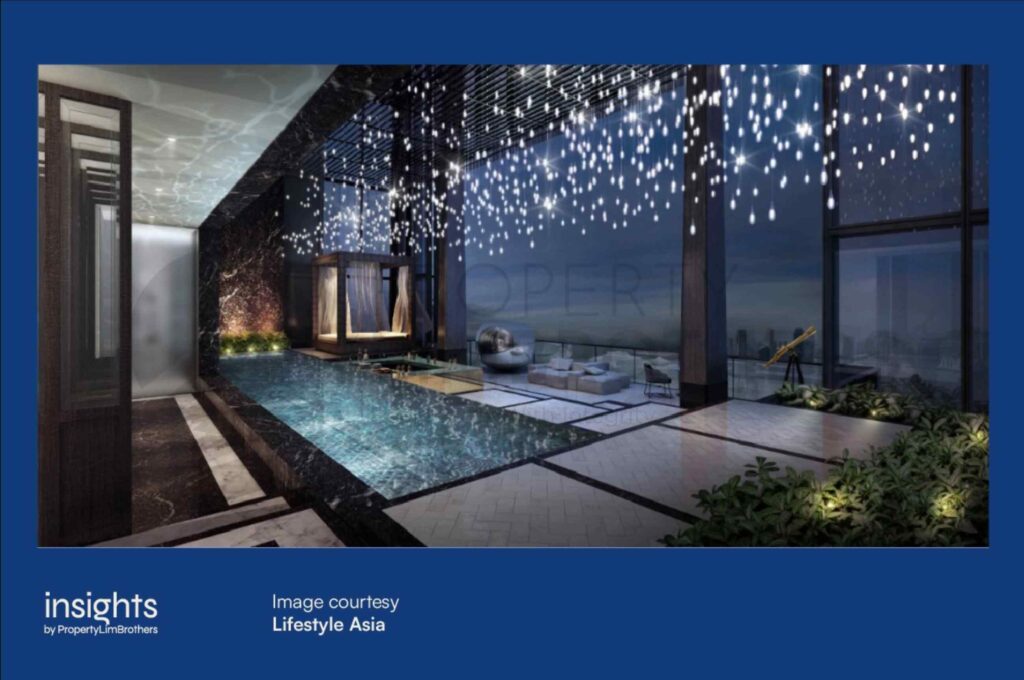

The most crucial attribute buyers look for in a super penthouse is size. These buyers desire to own a space that complements their luxurious lifestyle and matches the distinct type of luxury living they aspire to have. For this reason, developers customarily furnish super penthouses with top-notch appliances, quality finishes, lofty ceilings, private amenities such as a rooftop pool, direct lift access and many more. On top of that, owners also enjoy more intangible benefits such as privileges, offerings, luxury goods and concierge services.

For instance, the 11,130 sqft duplex super penthouse atop the Concourse Skyline on the 39th and 40th floors has a full suite of privileges and concierge services. Fully outfitted with customised fixtures, appliances, and exclusive pieces by international designers, this penthouse enjoys almost 360-degree views of the Singapore skyline, including the Marina Bay area. In addition, there is a private massage and wellness room with a masseuse available on demand from Six Senses Hotels Resorts Spas and personal tailoring services by The Bespoke Club, which offers handmade suits and gowns. The extravagance would be the privilege of ownership of a rare 1.01-carat blue diamond from World of Diamonds stated to be valued at S$3.02M, and this further entitles the owner to 40 hours of aircraft charter, valued at $500K, in a Global 6,000 business jet courtesy of Singapore Air Charter.

Moreover, for many UHNWIs and their families, work and life are closely intertwined. So, the need to have entertainment and family spaces supersedes all other requirements because they look at these properties not just as an investment, but as a home to live in. Not only do super penthouse owners get to revel in the luxury of space and best-in-class furnishings that GCBs similarly offer, but they also get to relish the stunning views of the city skyline, à la a “bungalow in the sky”.

Cream of the Crop Bungalows vs Bungalows in the Sky

Ultimately, both GCBs and super penthouses are in a class of their own. With the UHNWI population in Singapore expected to grow from 4,206 in 2021 to reach around 6,000 by 2026, per Knight Frank, sustained demand for GCBs and super penthouses is expected.

With the changing lifestyles in today’s modern landscape, people are constantly travelling for work and pleasure. The attractiveness of super penthouses seems to be more appealing as this asset class requires little upkeep and maintenance services compared to GCBs.

However, in a land-scarce state like Singapore, where GCB land plots are freehold land in prime locations and are inherently limited in supply, GCBs remain the most prized asset and are overall more sought-after than super penthouses.

If you’re on the lookout for luxury homes or looking to sell off your luxury home, feel free to get in touch with the PropertyLimBrothers team, and we will always be happy to help. In the meantime, take care, and keep a lookout for our next article!