Finding a home that suits your entire family can be challenging, and it can be hard to know where to start. For most first-time home buyers purchasing a home is a huge decision, so you have to be confident in your decision. There are several essential things to consider when selecting a home for you and your family.

Buying the perfect home is a goal many Singaporean families share. To achieve this goal, you have to be patient and put in the time necessary to research what you need. Knowing what to look for in a house, such as size, location, and price, is essential.

You can use a property agent to help you search for the right home, and they can answer many of the questions you may have. Your property agent can also help you compare homes when you’ve narrowed down your search.

Before deciding to buy a home, you should make sure you’re ready for things that come with buying a home, like finding a purchasing agent, securing a home loan, maintenance, higher utility bills, renovations, and more.

Once you have a clear view of everything that goes into buying and owning a home, you can make more informed decisions. The more information you have, the more likely you are to purchase a home you can live in for years to come. Here are eight tips to help you find the right home for your family.

#1 Engage a Property Agent

Purchasing a home for your family is a huge milestone that takes careful research and consideration and can be a very time-consuming task. Lots of information online can help you buy a home yourself, but it can be confusing and take even more time.

Many people are doing it the DIY way to save money on paying commission fees to an agent. This can work; however, there’s also a good chance you will face difficulties completing the legal paperwork and pay more because of the lack of knowledge on the current market.

Using a property agent should be your first choice if you do not know the housing market, real estate, or handling property transactions. Running it yourself can cost you more than you would have paid for an agent if done wrong.

A property agent’s job is to match the buyer with the right house. They can help calculate prices and negotiate for the lowest possible price for you. With their knowledge of the housing market, they can also advise when to buy or sell a house.

Not only can they save you money from negotiating prices, but they can also save you time as well. Before you decide on a home, you will most likely view multiple, which already takes up so much time. A property agent can schedule viewings and shortlist properties that fit your specific needs.

Once you’ve figured out what house you want to buy, any legal paperwork is done through a conveyancing law firm.

A quick tip: When choosing a property agent, make sure they’re registered with the Council for Estate Agencies (CEA). This ensures you have a qualified licensed property agent helping you.

#2 Create a Budget

Before you start shopping for homes, you need to have a solid budget in place, so you know how much you’re able to spend on the house and how much you’ll expect to spend on things like furnishings or renovations.

You should start by making sure you know what your finances look like right now and for the foreseeable future. Once you know that, you can do an affordability check to get a rough idea of what you can afford.

The home price is only one cost you’ll have to consider while purchasing a home. These are some essentials you can expect to pay for when buying and owning a home, or doing renovations:

Upfront Costs

The amount you can expect to pay upfront varies depending on the loan amount, downpayment amount, and fees. Typically you can expect your down payment to be 25% of the loan amount you’re taking out. You will also need to pay for legal fees and stamp duties, as well as commission fees if you use a property agent, unless you’re buying privately, then your agent will be co-broking with the seller’s agent.

Recurring Payments

After you pay upfront costs, you now own a home! This means you also have regular payments you’ll need to make. This includes the mortgage payment, home insurance, utility bills, property taxes, and insurance for your mortgage or HBD Home Protection Scheme.

Furnishing Costs

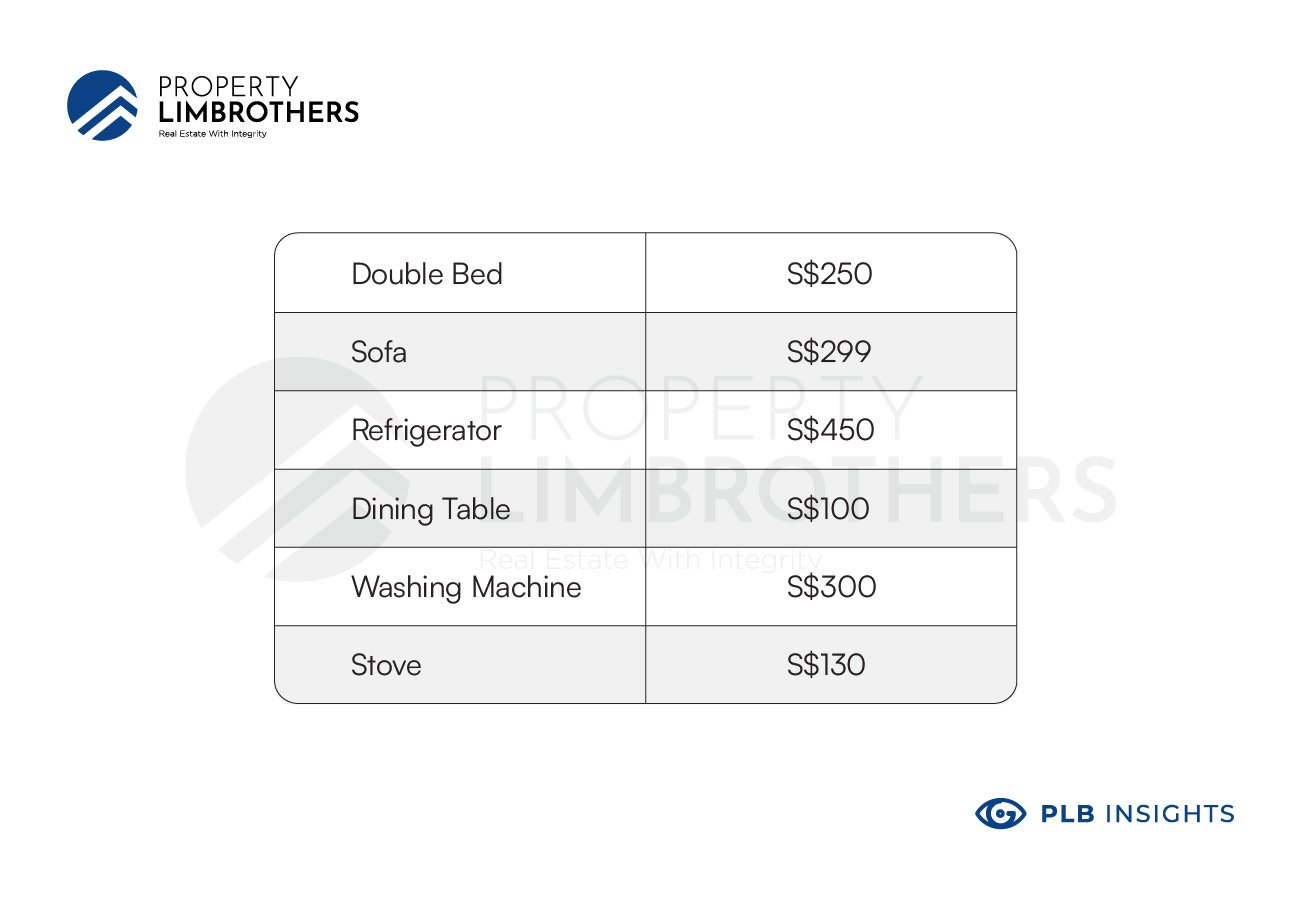

Furnishing your home can be a much more significant expense than you’d expect. On average, this is what you can expect to pay on the cheaper end for basic essential furnishings in Singapore:

Maintenance Costs

The cost of maintenance can vary depending on the size of the home. Maintenance costs include getting the plumbing fixed, pest control, replacing parts of the house when they become old or break.

Home maintenance can sometimes be unexpected, but to handle the costs when needed, it’s essential to put money aside when buying a home for future maintenance needs.

There are also quarterly Maintenance Fees that are payable if you choose to reside in a private property like a Condominium or an Apartment. These maintenance fees help to ensure that the property does not tumble into an unlivable state, for aesthetics and functional purposes.

Renovation Costs

Home renovations cost thousands of dollars so you should plan accordingly. The cost of renovations varies depending on the property size, type of work needed, materials, and who you hire. You can expect to pay around S$40,000 for light to moderate renovation work and closer to S$150,000 for extensive renovation work.

#3 Finding the Right Location

Finding the ideal location for your new home is one of the most important things to consider when purchasing a home. There are quite a few things to keep in mind when finding the correct location.

Before you start looking, you should know what area you would prefer to live in. This can be suburban areas or metropolitan areas near MRT stations.

You may want the quiet peace that suburban areas provide, and the low costs. However, these areas tend to be farther from amenities you may want to have close to you. Living in the city means you’ll have faster access to facilities and amenities near you, though units in the city tend to cost more.

It’s best to pick an area that suits your needs. If you have children, maybe it would be ideal to live near a school. Perhaps you would rather live near shops or places of worship. If you’re working with a property agent, be sure to tell them what type of locations you would find ideal so they can give you the best options.

#4 Figure Out the Size and Layout You Need

When looking for a home, always consider the layout and size. Do you have a small family or a large one? Does your family prefer a more open layout or a more private one?

Don’t forget about outdoor spaces like balconies or patios. Will you require a study or a home office? With more jobs becoming remote, many people now need at-home office spaces.

When viewing home, be sure to keep in mind wasted space. Wasted space in the layout is things like long corridors or irregular-shaped rooms that might leave odd corners that are hard to furnish.

If you decide you don’t need any outside space, then a balcony or patio may just be wasted space. Having a house with large amounts of wasted space means the cost per square foot (PSF) is higher.

Quick Tip: When viewing homes consider the placement of windows and how much afternoon sun there will be inside the house. You can schedule house viewings between 3-4 pm to get a good idea of what it may look like.

#5 Take Into Account the Condition and Maintenance

While viewing houses, you should ask questions about the age and condition of the house. Property agents are not under a legal duty to disclose any defects with the quality of the property. This means you should get the property adequately inspected before you decide to buy the house.

Even if you don’t have the property checked, a seller will typically try to pass the inspection duty onto the buyer. They do this by adding an “as is, where is” clause.

These clauses state that the seller has made no promise the property is fit for the buyers to use. It also says the buyer has had the property inspected or is responsible for inspections and accepts it in the current condition.

#6 Evaluate and Compare Homes

Before you start viewing homes, you can narrow your search by looking at available homes online and ruling out ones that don’t fit your needs. This will save you from viewing houses you aren’t interested in.

If you already have a location in mind, you can narrow your search to that area. Knowing the specifics of the type of property you’re looking for can help shorten your list of options.

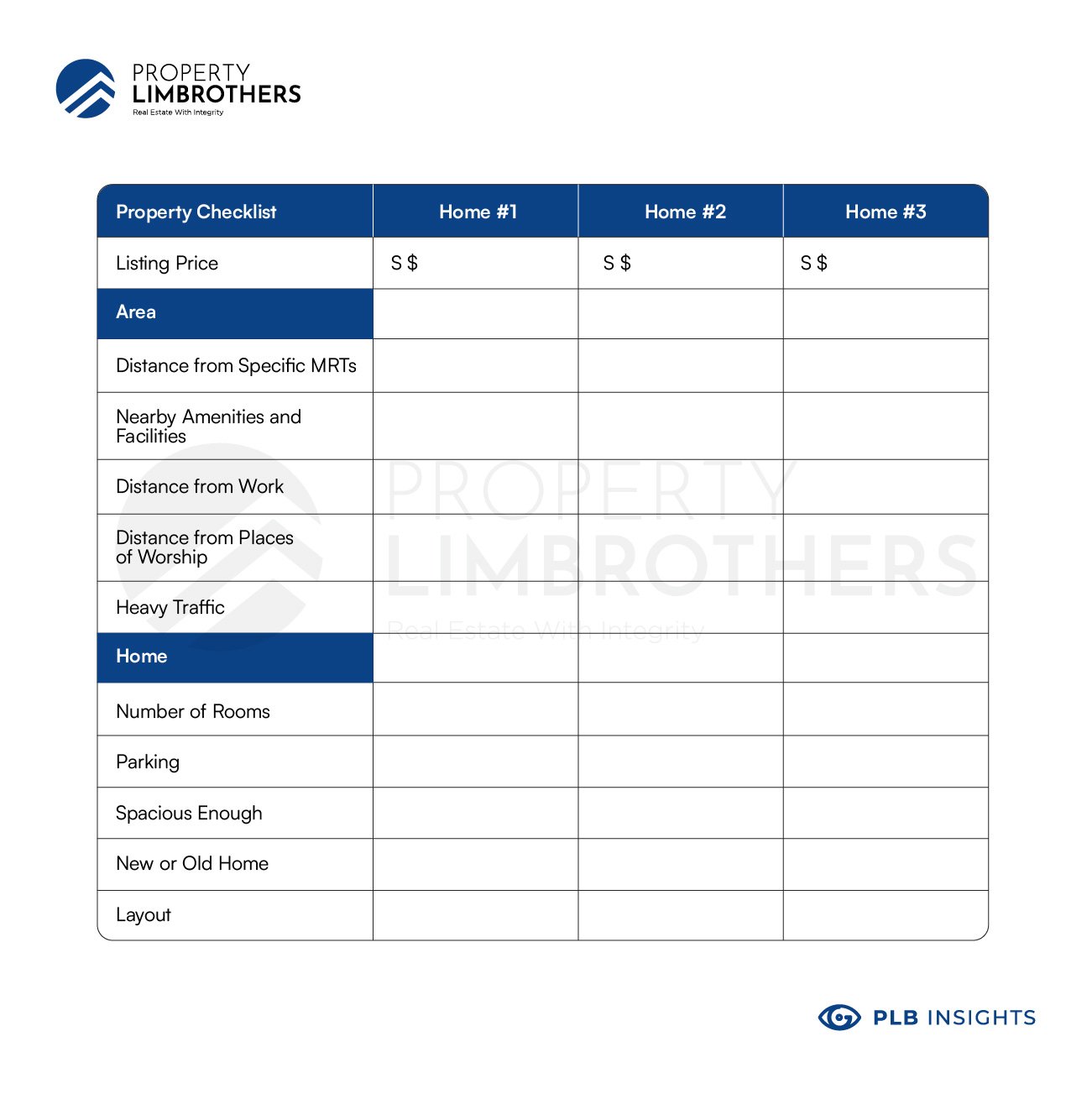

You can create a table of what you’re looking for in a home and go through each house to decide which ones are a better fit. Here’s a checklist of what to look for when comparing homes. You can use this list and modify it to fit your needs.

This list contains general information. Still, you should be as specific as you need to make sure you’re picking the best home for your family.

#7 Look Out for Hidden Costs

When searching for a home, most people don’t consider all the hidden costs and fees that come with buying it. You will have to pay for things like –

-

Property agent commission – If you’re using a real estate agent, you can expect to be paying nothing to 1% of the purchase price depending on the services engaged.

-

Legal Costs – To process the papers to buy your home, you must hire a lawyer. If you’re buying a private property, you can expect to pay between S$2,500 – S$3,200 in legal fees. If you’re making an HBD purchase, you can expect to pay between S$600 – S$900. More information on HDB Legal Fees here.

-

Buyer’s Stamp Duty – If this is your first time purchasing a home, you’ll have to pay the buyer’s stamp duty. This is a tax for buying or selling property. This is what you’ll be paying –

1% on the first S$180,000

2% on the next S$180,000

3% on the S$640,000

4% on any remaining amount

More information on Stamp Duties here

-

Valuation Fees – Most people need to take out a home loan when buying a home. When applying for a home loan, the bank will evaluate your assets and give you a loan based on that.

You can be charged fees by the bank after they’ve done the valuation. Depending on the property type you’re buying, this can cost you between S$350 to S$500.

-

Administrative Fees – If you’re buying an HBD flat, you’ll need to complete applications and paperwork. This can cost between S$40 to S$80, depending on the size of the flat.

-

Home Loan Interest – Different banks have different rates for mortgage loans. The easiest way to find the most competitive rates is to engage a Mortgage Broker who will help you compare the rates across the prominent banks.

When going through your finances to see what you can afford, be sure to add interest to your monthly mortgage payment. If you miscalculate and are late on repayments, you might lose your home.

#8 Secure a Home Loan

Now that you’re ready to purchase a home. You can start securing a home loan. The type of loan you get depends on your property type. If you’re buying a HDB flat and taking a HDB Housing Loan, you can borrow up to 85% of the property value.

If you’re going to take out a bank loan, you can borrow up to 75% of the property value. These are the maximum amounts allotted and might be lower depending on your situation.

When securing a home loan, you need first to make sure you’re eligible. To meet the eligibility requirements for a bank loan, you need to provide proof of income. This is typically six months of payslips or CPF contributions. Eligibility requirements for HBD loans are –

-

At least one co-borrower must be a Singapore citizen.

-

You can only take out two HBD loans in a lifetime, so if you already have one, this will be your last, and if you already have two, you need to use a bank loan.

-

Your monthly income cannot exceed –

S$14,000 for families.

S$21,000 for extended families.

S$7,000 for singles.

-

You cannot own another property.

-

The remaining lease for that property must last until the youngest buyer is 95 years old.

-

A credit score that is no worse than BB.

Closing Thoughts

In conclusion, buying a home is a massive step in anyone’s life and should be done with extreme care. Be sure to do extensive research and ask for help when you need it. Knowing what you need from home, having a budget, finding a location, and securing a loan can get you the right home for your family in no time.

Should you need further advice on choosing the right home for your family, feel free to get in touch with the PropertyLimBrothers team, and we will always be happy to help.

If you have enjoyed this piece, we think you might also be interested in checking out our past article, 6 Criteria You Want To Look Out For When Viewing Or Buying Property In Singapore, to take a step towards choosing the right home for your family.

P.S. This article is written in conjunction with our #InvestorsSeries on Youtube. We drop nuggets of wisdom for you to learn more about Singapore’s property market! From frequently asked questions to market analysis, we will take you through them all with the PropertyLimBrothers team.