The delicate matter of selecting a place with a huge chunk of your life savings is not a joke. Endless streams of online advice flood you with checklist after checklist. Just one mistake on a decision of this scale would send you back in time, financially. So here is another (hopefully original) checklist to make sure you got your bases covered.

Do you know what matters in your search?

#1 “Begin with the End in Mind”

This quote from one of my favourite authors, Stephen Covey, is a great place to start. As with most things, you should know why you are doing what you are doing. In this context, to begin with, the end in mind is to know your exit strategy. People may have different reasons for buying a new home. But for most people, this would not be your final property purchase. It is not unusual to hear people with two or three big property plays.

Image courtesy FinanceGuru

The first thing to search for in your new home is the next buyer. This may sound absurd since you may not know when or who you are selling to. But a property that would find itself short of buyers would ironically make your property purchase the “final” one. As much as the property should suit your tastes, it should not be so distinctive that no one else would desire it.

So, what would the next buyer look out for?

#2 Property Age & Tenure

Apart from the obvious (location, location, location), which you already know, we will dive into some potential blindspots when considering future buyers of your new home. The remaining tenure of your new home will be a key factor. The lower the tenure, the lesser you can loan from the bank. In turn, old properties will easily find themselves short of buyers unless it is a freehold property where tenure isn’t an issue.

In other words, you need sufficient tenure on your new home such that it remains affordable to future owners. The typical private property loan has a loan tenure of 30 years, with a 75% Loan-To-Valuation (LTV) and the buyer being 35 or younger. On the other hand, HDB loans have a tenure of 25 years. Loans that would see the buyer turn over 65 will have the LTV reduced to meet MAS requirements. Having sufficient remaining lease on your property allows your future buyers to sell to an audience that can take advantage of the full loan tenure.

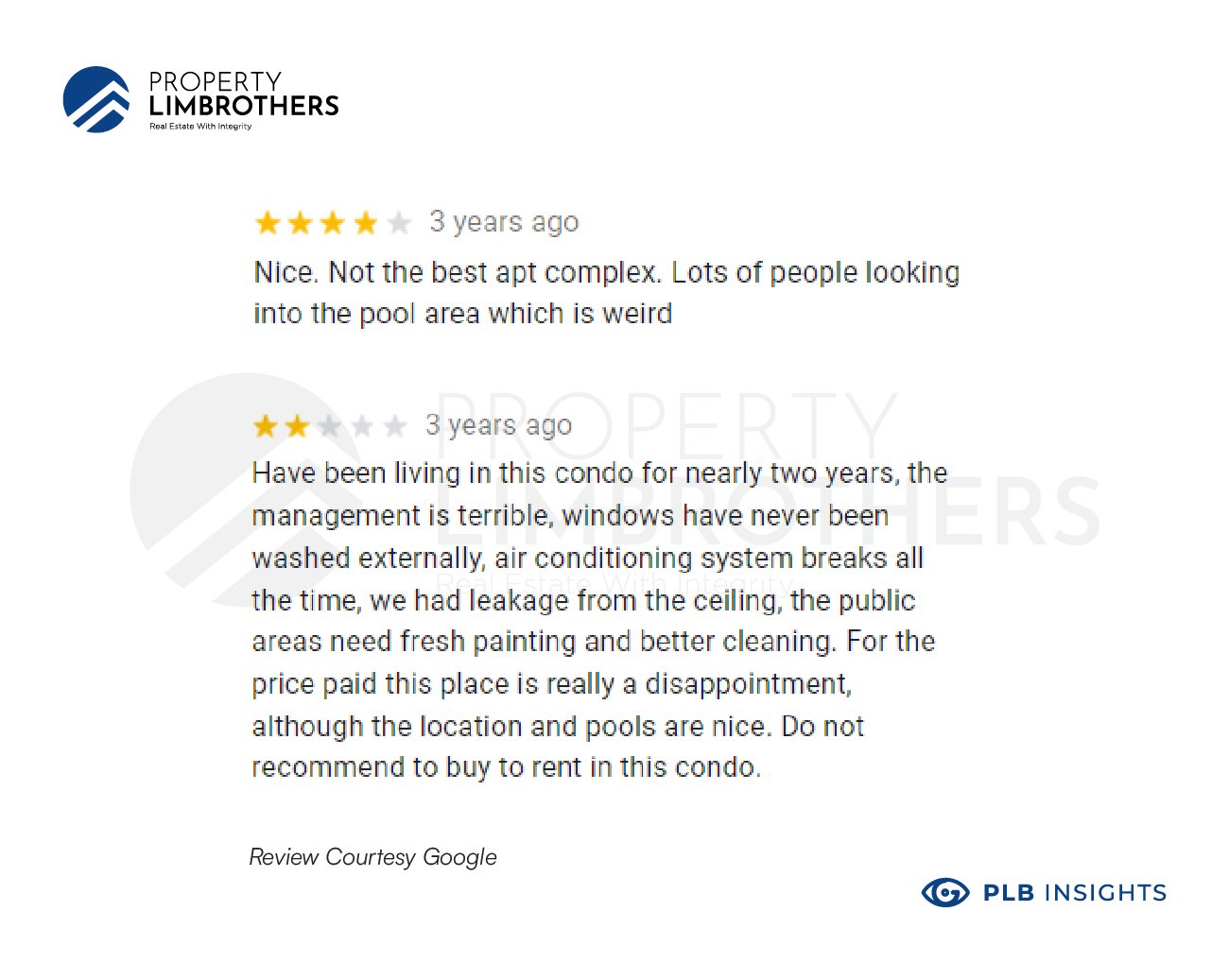

#3 Resident Experiences

Resident experience is underrated and is often drowned out by all the price, volume, regulations, and predictions. Someone should be (ideally) staying in that property: the owner or the tenant. Part-research, part-entertainment, you should pay attention to reviews given by users on platforms such as Google Maps and other property listing websites.

Note that it is mostly nothing exciting for the positive reviews or unrelated complaints. Take these positive reviews with a cup of salt. What we are looking out for here are the bad reviews. This gives us an idea of any red flags to be aware of. Reading these reviews will give you a better understanding of whether the property is what you imagined it to be. It is a good exercise to prevent disappointment or rude surprises. You will occasionally catch some amusing trivia.

#4 Potential for Appreciation

Now it is time to talk about the more obvious things. Location, quantum and PSF aside, some other factors affect a property’s potential for appreciation. The last thing you want is to buy at the peak with prices plateauing or, worse, dropping (yes, it is possible).

Here are some indicators that might help:

-

Relative launch price

-

Current price trends

Capital appreciation for properties is a game of slicing the pie. A higher launch price relative to nearby comparable properties means that the developers have a larger slice of the pie. The potential for appreciation would be limited.

Contrary to popular belief and hype, property prices are not guaranteed to climb. Current price trends do not guarantee a continuous upward trend. Properties with a heated demand might have a lower potential for appreciation. This would be more likely when demand is speculative and/or when the current property has appreciated more than their peers. Buying at this stage gives the sellers a larger slice of the pie. That said, you may be considering undervalued properties trending downwards. While it is true that the potential for appreciation is higher, be careful of the factors that might be pushing the price downwards. The prices of undervalued properties might not necessarily recover. We cover this phenomenon in our previous article on ECs.

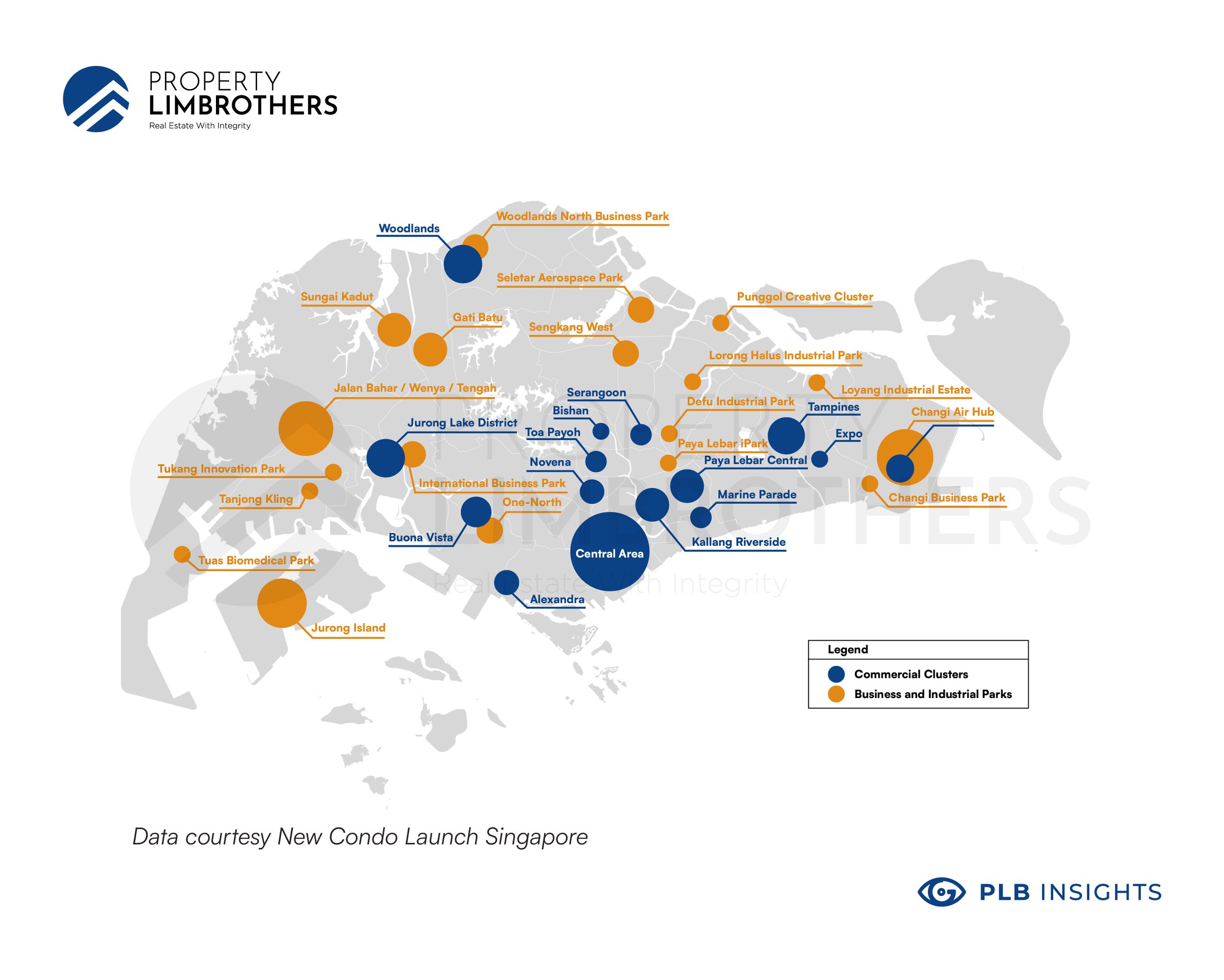

#5 URA Master Plans

Last but not least, you should look out for URA Master Plans that might affect the future of your new home. You should pay attention to any future additions of amenities, MRT stations, or a designation as a commercial or transportation hub. Note that Master Plans are planned after all. They are not promises nor guarantees of those developments. Nonetheless, should the Master Plans materialise and your new home benefits from it, you will be able to enjoy some appreciation in the price of your property.

Benefitting from URA Master Plans is a long-term play. If this drives a key part of your decision, you should be aware that you are in it for the long run. This could mean an investment horizon of one to two decades, perhaps even longer if there are delays in the Master Plans. Nevertheless, URA gives us Singaporeans a great heads-up decade in advance. This is a privilege and a rarity. These plans can be taken as general indicators of the government’s plans for the region in the future.

Closing Thoughts

This article highlights some of the blindspots buyers might have by focusing on their exit strategy. Apart from the obvious advice, people looking for their new homes should consider the next buyer and pay attention to the factors that will affect the future value of their new home. That being said, your considerations should be more careful. It is not easy to make a well-informed decision on this big purchase. But fret not. We are here to help you.

Here are some other tips that may help you out in your property journey: